Egg prices were volatile in 2023 due to highly pathogenic avian influenza (HPAI). Not much has changed as the calendar has flipped into 2024.

“The U.S. egg market has been extremely volatile since quarter four of 2023,” said Eggs Unlimited global trade strategist Brian Moscogiuri in an e-mail to The Food Institute. “Prices hit the highest levels we’ve ever seen for the month of February, forcing retailers to raise shelf prices and distributors to reduce inventory positions more recently.”

Moscogiuri noted this supply dynamic allowed supplies to recover and spot prices to fall sharply as February ended, which was opportune with an early Easter holiday on deck for 2024.

Wells Fargo Agri-Food Institute sector manager Kevin Bergquist confirmed this dynamic, saying the current egg market remained highly variable and unpredictable.

“Wholesale egg prices likely won’t skyrocket to nearly $5.50 per dozen like in late 2022, but if the last two weeks are any indication of the near-term future, we are definitely headed that way right now. The HPAI wild card is still very much in play,” he wrote in an e-mail to The Food Institute.

HPAI Continues to Impact the Egg Industry

Bergquist noted that the market never really settled from the 2022-23 HPAI outbreak despite some “normal” seasonal changes.

“Although the justification for the wild egg markets is rightly placed on the HPAI outbreak over the last two years, there is no reliable metric to predict the egg market. Some prognosticators point to 320 million egg layers as a threshold figure when the egg market will have enough of a dependable supply to restore ‘normal’ pricing patterns. The current USDA figure is 312 million layers as of January 2024,” he noted.

Both Bergquist and Moscogiuri pointed to a fall outbreak of HPAI as a major inflection point for the industry.

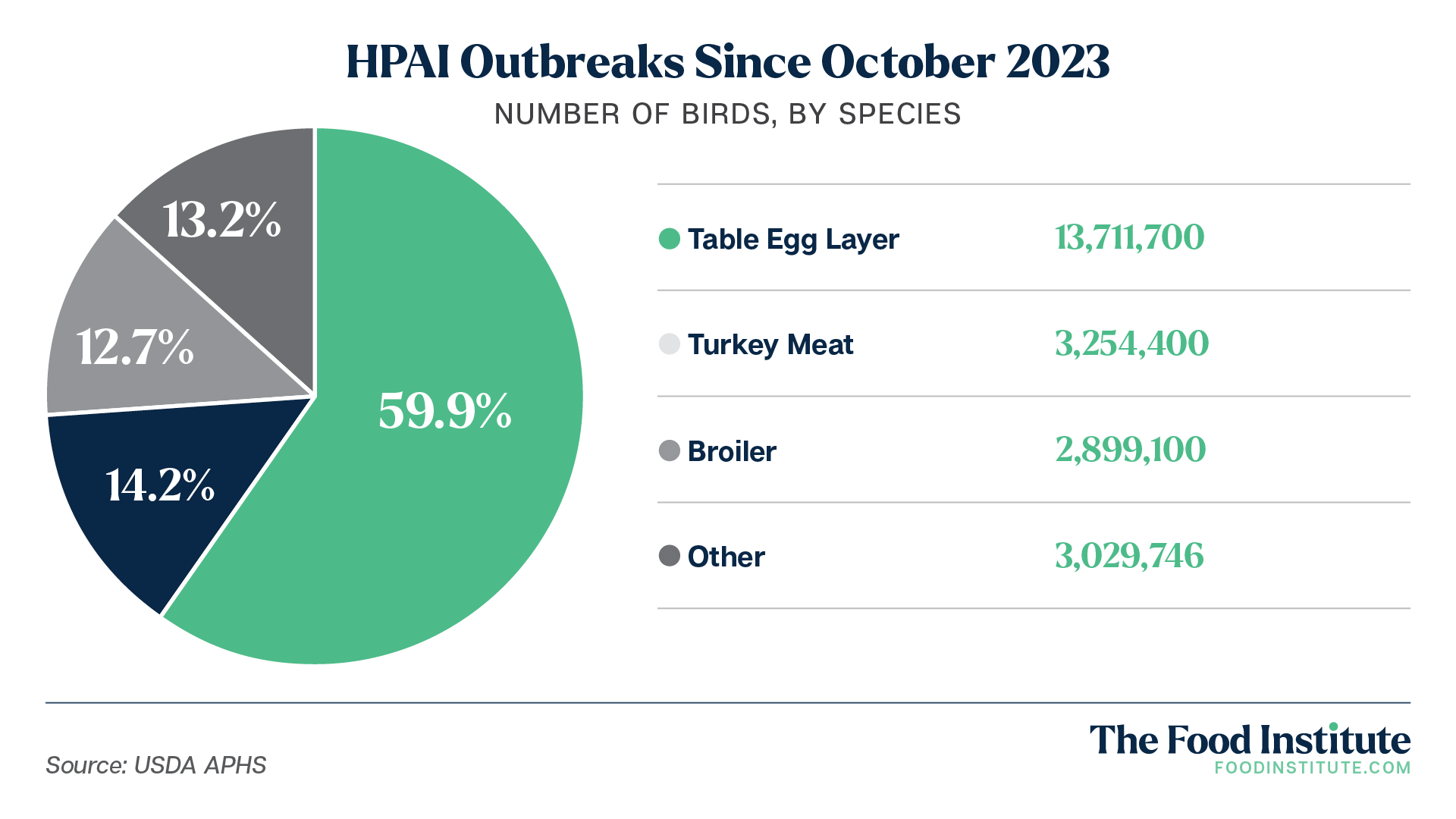

“Surprisingly, HPAI did not impact commercial egg production during the spring migration of 2023. Many believed that the cycle could be over, but the virus returned in November. Through early January, the industry lost about 14 million layers, and we have seen more than 50 million egg-laying hens affected in the last two years,” said Moscogiuri.

Cage-Free Initiatives Take Hold

Cage-free initiatives at both the state and corporate levels are impacting egg prices, too.

“Washington and Oregon also transitioned to cage-free standards to begin 2024, and we will see a continued rollout of cage-free initiatives at the state and corporate level over the next few years. Retailers also ran some unexpected and aggressive price points through the back half of January, bolstering the demand for shell eggs and driving weekly inventory levels to the lowest levels in over five years later in the month,” said Moscogiuri.

McDonald’s was one such corporation that fulfilled a promise to source cage-free eggs, a commitment it made in 2015. The company said it sourced almost 2 billion eggs in 2023; as of February 2024, it has sourced only cage-free eggs.

Future Prospects for the Egg Market

When it comes to the future of the egg market, “Expect the unexpected,” Bergquist noted, “Egg prices will likely remain highly variable for the near future.”

“Eggs have always been touted as a low-cost food protein when compared to alternative products like beef, pork, and poultry. Right now, however, egg prices are rising and prices for other proteins, namely poultry, are very affordable. Consumers may wish to seek out value-priced alternative goods when the opportunity presents itself,” he added.

Moscogiuri saw more volatility in the industry’s immediate future.

“The market is likely to remain volatile through Easter, but the holiday falls early this year. That means there is a long period between April and May when demand is typically slow. Seasonal slowdowns in demand could give the market an opportunity to normalize – something we saw during the summer of 2023. However, the risk of HPAI’s impact this spring remains very real and is something buyers and sellers will be playing close attention to.”