Over the past few years, chicken has emerged as the protein of choice among U.S. consumers thanks to its versatility: a grilled chicken breast can meet health-focused needs just as easily as fried chicken satisfies shoppers looking for comfort food.

But will chicken remain the top animal protein for U.S. consumers in 2026? Let’s examine the key factors at play.

Animal Protein Availability in 2026

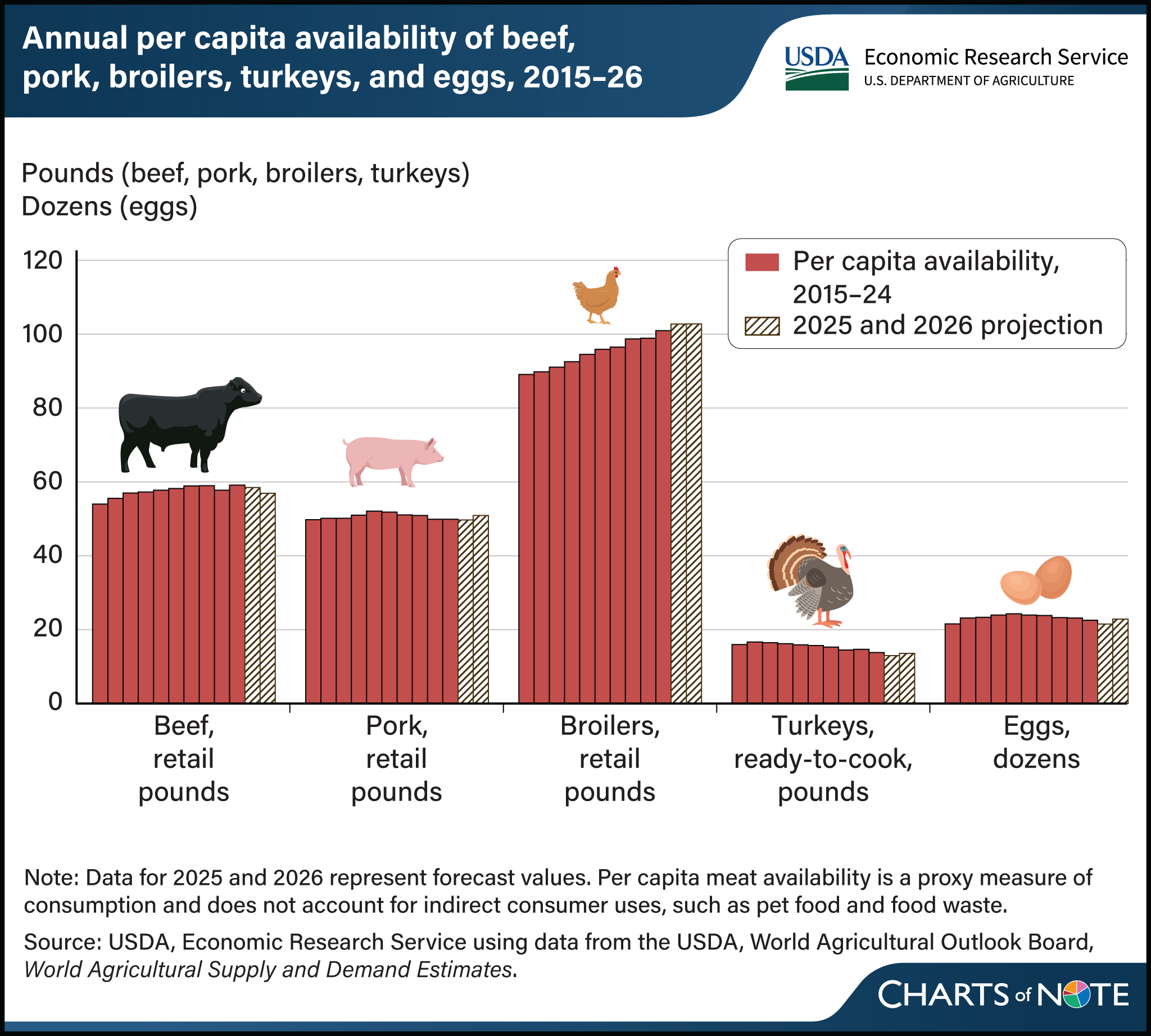

According to USDA projections, chicken is likely to remain the dominant animal protein in the U.S. – at least in terms of per capita availability. The agency expects chicken availability to reach 102.8 pounds per person in 2026, while per capita beef availability is projected to decline to 56.9 pounds.

Pork availability could rise to 50.9 pounds per person in 2026, up slightly from 49.9 pounds in 2024. Turkey availability is projected to fall to 13.6 pounds per person in 2026.

Meanwhile, per-capita availability of table eggs is expected to jump to 22.9 dozen per person in 2026, up from the projected 21.5 dozen in 2025.

According to the National Oceanic and Atmospheric Administration, per capita availability of seafood was 19.7 lbs. per person in 2022, the most recent data available.

It’s worth noting that African swine fever (recently detected in Spain) and the ongoing threat of highly pathogenic avian influenza could disrupt production, trade flows, and pricing across animal proteins in 2026.

Chicken and Beef Lead Key Supermarket Sales Metrics

At retail, fresh chicken purchases were up 4% year-over-year in volume in October, compared to a 2% increase for fresh beef, according to Anne-Marie Roerink of 210 Analytics.

Citing Circana data, Roerink noted that turkey (+1.7%) also posted a volume increase. However, fresh lamb (-17.8%), fresh pork (-1.2%), and veal (-4.6%) all saw volume declines.

On a dollar basis, fresh beef outperformed fresh chicken; fresh beef sales rose 10.7% year-over-year to $4.3 billion, compared to a 7.1% increase for fresh chicken to $2 billion.

Chicken Likely to Remain Popular at Foodservice

On the foodservice side, chicken is likely to remain popular, as it can meet consumer needs for value, health, and flexibility.

With consumers continuing to prioritize value, chicken tends to benefit because it supports a wide range of price points, applications, and cuisines, including snacks wraps, bowls, sandwiches, tenders, and salads.

Additionally, it does so without forcing operators into premium pricing. Circana’s 2025-26 outlook emphasizes slow growth and shifting priorities tied to consumer value-seeking behaviors – an environment that generally favors lower-cost, highly adaptable proteins like chicken.

Beans and Legumes Could Have a Moment, Too

While chicken seems likely to continue its dominance, protein growth isn’t limited to animal products. Beans and legumes check multiple consumer boxes: high protein, high fiber, lower cost, and “natural” positioning – all attributes that can resonate across health, value, and ingredient-conscious shoppers.

In 2025, Grubhub reported a 135% increase in grocery-store bean and legume orders, totaling more than 1.5 tons delivered nationwide. The platform also pointed to strong momentum for dense bean salads, especially among consumers focused on health and wellness and gut health. Los Angeles led the nation in bean orders.

The Verdict: Chicken Keeps Its Crown

Don’t count chicken out: most indicators suggest it will remain the most popular animal protein in 2026.

That said, rising consumer interest in protein overall could lift multiple categories – especially eggs and pork – depending on pricing, supply conditions, and animal-disease impacts.

Food for Thought Leadership

In this episode of Food for Thought Leadership, Food Institute VP of content and client relationships Chris Campbell sits down with Barry Thomas, senior thought leader at Kantar, to unpack the rapid rise of agentic AI — a new class of AI systems that don’t just generate information but take action on behalf of the user.