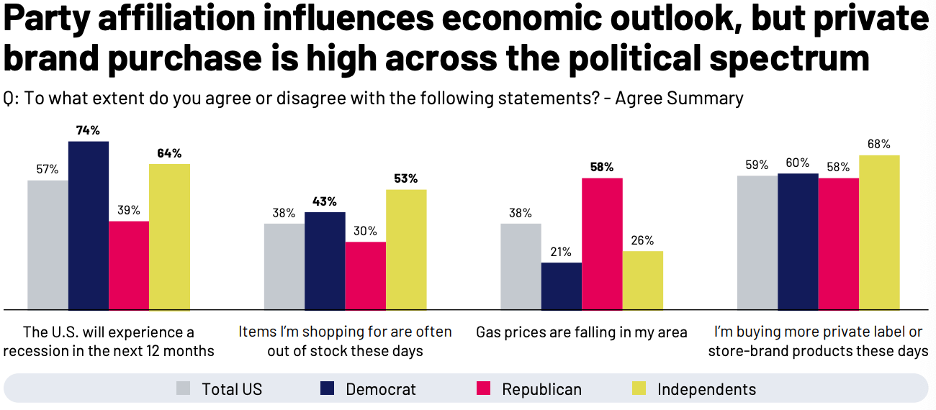

Ask an American today about the health of the economy, and, depending on their political alignment, the answer may vary. Recent data suggests that the perception of the country’s financial health is deeply contextual.

Kris Hull, EVP of consumer products at Ipsos, evaluated this topic during a conversation at Groceryshop 2025. He explained how the current state of the country is playing a key role in purchasing decisions.

“Americans are nuanced. Political perceptions and party affiliations are affecting how they perceive the economic realities and what is responsible for them,” said Hull.

Where 74% of democrats believe a recession is imminent, only 39% of republicans agree. These perspectives, in turn, impact purchasing decisions. In today’s market, however, one thing is clear: value is table stakes.

Consumers are increasing their private label purchases despite also enjoying their name-brand products. The majority of independents, democrats, and republicans agree that they’ve increased their private label category consumption.

“Less than half of people believe that the quality gap between [brand names] and private labels is enough to justify the price for us. So, there is some erosion,” said Hull.

What’s more, of the 78% of consumers that are feeling higher prices in their grocery bills, 77% of democrats feel that government policies, such as tariffs, are to blame, while only 37% of republicans feel the same, according to the Ipsos study. Conversely, 31% of republicans feel it’s due to individual businesses recouping their previous losses, compared to only 7% of democrats who feel the same.

Hull also offered advice on how to engage with this new consumer: listen to how Americans are responding to market dynamics, learn about meaningful ways to engage with these nuances, and respond with authenticity and empathy for the cash-strapped, worried consumer.

The New Reality: Value First, Always

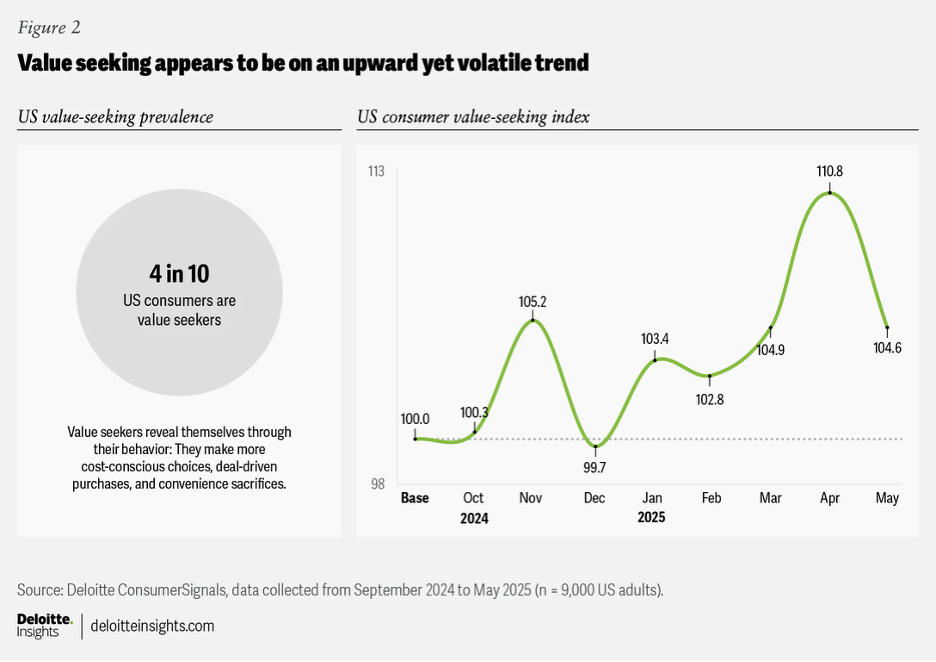

Today, 40% of Americans call themselves “value seekers” who tend to respond to deals and cost-saving measures. Overall, however, value-seeking is up from the beginning of the year.

Moreover, Deloitte noted that consumers indicated they will purchase deeper into a grocery category when they’re considered a “more-value-for-the-price” brand. But value doesn’t just mean price. In fact, the report found that 10 – 40% of consumers’ value propositions arise from factors other than price, demonstrating how complex the shopper journey has become.

Moreover, Deloitte noted that consumers indicated they will purchase deeper into a grocery category when they’re considered a “more-value-for-the-price” brand. But value doesn’t just mean price. In fact, the report found that 10 – 40% of consumers’ value propositions arise from factors other than price, demonstrating how complex the shopper journey has become.

This phenomenon supersedes political affiliation and socioeconomic status.

“The usual segregations of age, demographics, and financial well-being are not the real correlators. It’s actually where you are in your life stage that matters,” Danny Edsall, principal and global grocery leader at Deloitte, said in a conversation about the value-obsessed shopper at Groceryshop.

He outlined a few shopper types demonstrating this divide.

The first is the financially insecure middle-aged shopper who value-seeks on everyday necessities, prioritizing store brands and cheaper alternatives at retail, and better deals at foodservice. Then, there’s the retiree with conservative spending habits who is attracted to deals but exhibits more financial security. Finally, there is the young family, who either value-seeks across everyday necessities or, if more well off, ignores sole value propositions unless swayed by a good deal, like the retiree.

Knowing this, the F&B industry can make informed decisions about its market demographic(s) by tailoring messaging and price competition to its ideal consumer base.

The Considered Shopper

For consumers across income levels, convenience and value are intrinsically linked. This provides a lens to view how consumers understand “value” in today’s market.

The enduring success of third-party grocery and foodservice delivery services is a testament to this relationship. In September, online grocery sales increased 31% year over year, fueled by larger average order values and accelerated monthly active users.

Today’s economy has created a “considered shopper who has money to spend but is staying very careful and value-focused,” said Oliver Chen, managing director of retail at TD Cowen, during a separate conversation at Groceryshop.

He noted that this consumer subgroup still loves the physical store but also demands convenience. This means these shoppers will channel shift to find the key to feeling they’re getting a good value, without having to go too out of their way.

Martie co-founder Louise Fritjofsson noted that high-income consumers make up 60% of their customer base. She operates a grocery delivery website that offers deep discounts for specialty food products nearing their best-by or expiration dates. These users are “considered shoppers” because they still desire that premium aspect of the assortment and the convenience of online delivery while also stretching their dollar further.

This considered shopper is also likely to be swayed by an affordable premium offering through traditional channels or legacy brands. This is motivating what Mindy Shaltry, head of omnichannel marketing and activation for Mondelez, calls a “barbell effect” in snacking, wherein outsized growth is concentrated around low and premium product assortments.

The considered shopper is looking for the convenience and value of a premium snacking experience. In practice, this may look like a shopper purchasing a specialty CPG gelato product rather than going out to an ice cream shop.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.