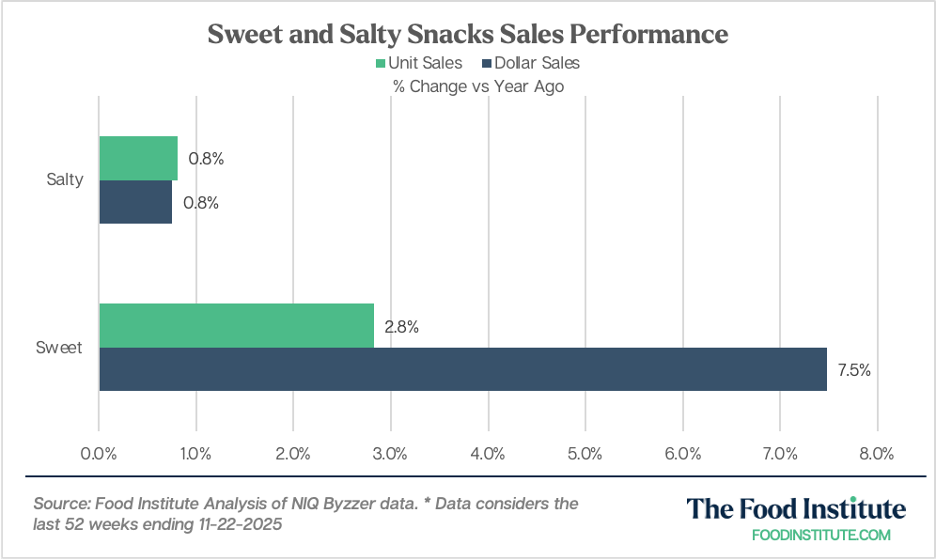

Snacking may be getting healthier, but American consumers are still looking forward to their between-meal indulgence to get through the day. In fact, all snacking categories are experiencing some element of sales growth, signaling sweet and salty snacks are not going anywhere.

Recent data from NielsenIQ’s Byzzer platform found that dollar sales for sweets, in particular, continue to post healthy gains across all retail channels.

The rise in snacking corresponds to an overall shift in eating habits wherein consumers are choosing smaller, more frequent moments to satisfy their appetite as part of their “on-the-go” lifestyle.

These moments provide an opportunity for food and beverage businesses that can deliver satiety or a “permissible indulgence” that can make an everyday moment feel special. Younger generations, including Gen Z, have made these moments a part of their day by creating a “little treat culture” through videos on TikTok and Instagram. These users show how specialty products offer self-care and escapism.

Snacking also serves a functional purpose, nourishing busy shoppers at crucial moments throughout the day, such as after a workout and between meals. Casual athletes, health-conscious shoppers, and GLP-1 drug users are among growing consumer bases that are tapping these key snacking moments by choosing nutrient-dense snacks.

Salty Snacks – Protein-Packed, Better-For-You

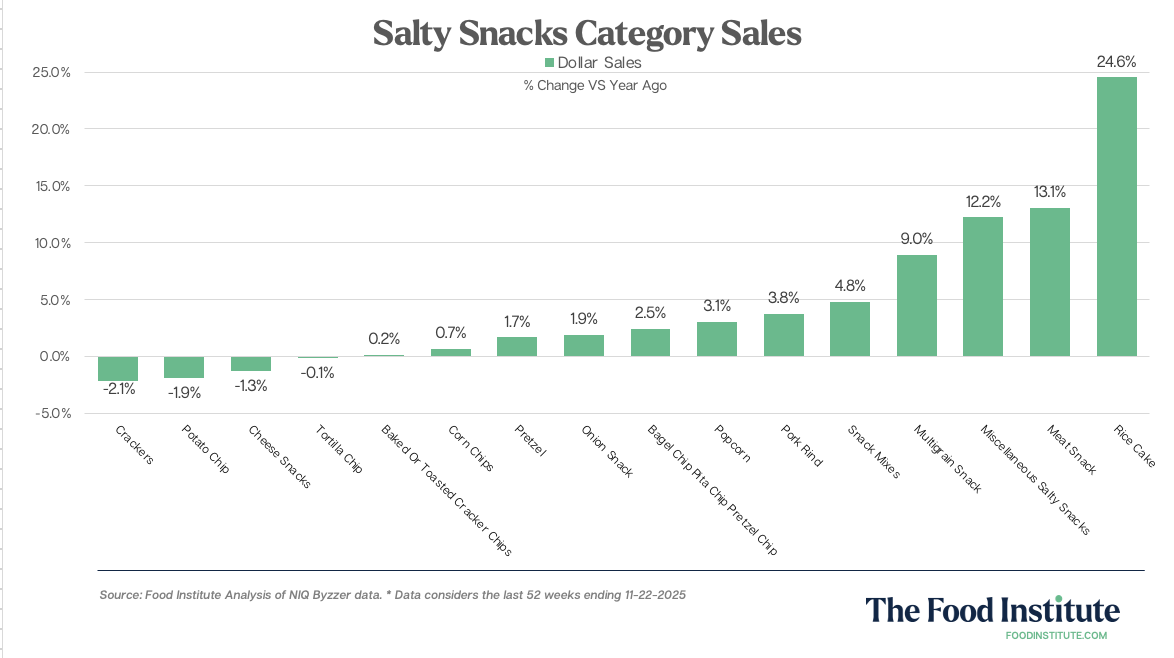

With these consumer motivators in mind, it makes sense why some of the largest gains in the salty snack category are coming from “healthier” categories, such as rice cakes (+24.6%), multigrain snacks (+9%), and popcorn (+3.1%).

Additionally, meat snacks experienced a 13.1% year-over-year dollar sales growth, likely due to the boom in the jerky category with healthier innovations from better-for-you market leaders, such as Chomps, Country Archer Provisions, and Tillamook Country Smoker.

On the other hand, traditional potato chips and tortilla chips saw a slight contraction, signaling that these legacy categories may benefit from innovative positioning or better-for-you value propositions.

Likely, these sales have been affected by concerns over ultra-processed foods and artificial dyes. In response, legacy CPGs are responding with innovations that are free from select problem ingredients. Doritos, for example, recently debuted Simply NKD – a reimagining of its flagship Nacho Cheese and Cool Ranch products made without dyes.

Sweet Snacks – Chocolate Madness, The Rise of ‘Afternoon Tea’

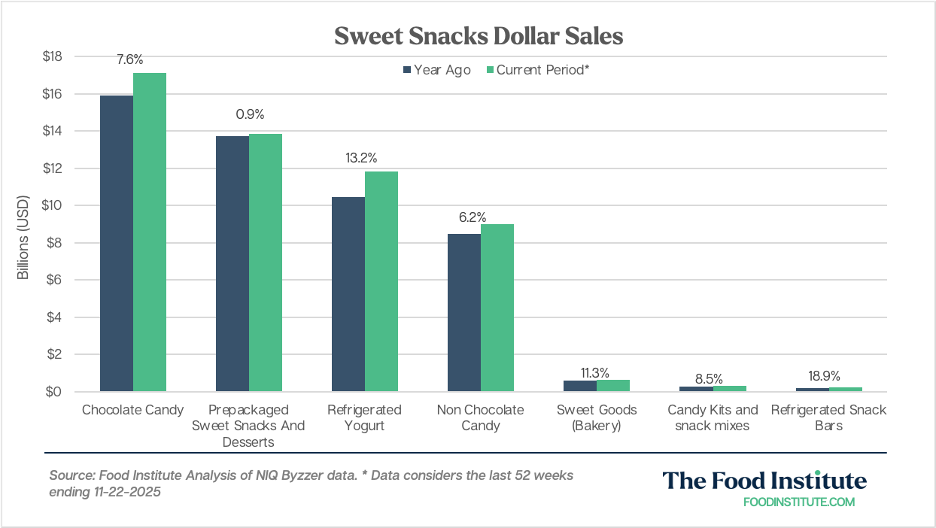

Chocolate candy continues to be a strong subcategory, posting 7.6% dollar sales growth year-over-year. Units, however, are not as impressive, having risen by less than a percent over the same period. This means that the dollar growth is likely the result of product prices increasing; however, it also shows that the vertical is elastic.

Little can get in the way of shoppers and their chocolate.

Non-chocolate candy is also posting healthy dollar sales growth (+6.2%), this time with unit movement that’s more aligned, at nearly 2%. Americans still have their sweet tooth, despite better-for-you trends, and candy and confectionery still have a place with the modern shopper.

That said, just as salty snacking favored health-forward positioning, once again, the market is kinder to better-for-you categories.

Refrigerated yogurt (+13.2%), for one, offers a permissible sweet snack that can double as a pre- or post-workout or meal replacement with its protein content. Similarly, the refrigerated snack bars market, which represents the smallest market position, is also the fastest-growing. The premium subcategory delivers on macronutrient goals in a snackable format, making it a compelling contender against less nutritionally dense indulgences.

Also motivating sweet snack sales is a macrotrend centered on “afternoon tea,” particularly among younger generations. This has been a boon for restaurants offering this experience and has motivated many to snack on finger pastries and baked goods alone or with friends.

Moreover, breakfast-time purchases of sweet treats offer a lower-cost option for indulgences compared to foodservice establishments that have had to increase prices to save margin at a time when input costs are rising.

These factors ladder up to an astonishing 11.3% growth in in-store bakery sweets. The 0.9% growth of the more mature prepackaged sweets is also likely supported by these new consumer need states.

Food for Thought Leadership

In this episode of Food for Thought Leadership, Food Institute VP of content and client relationships Chris Campbell sits down with Barry Thomas, senior thought leader at Kantar, to unpack the rapid rise of agentic AI — a new class of AI systems that don’t just generate information but take action on behalf of the user.