Earlier this summer, market research company Alpha-Diver and The Food Institute released the first ever Snack 50 report, the industry’s first measure of the psychological drivers of real-world consumer decision-making as it relates to snacking.

The firm has now created a deep dive into The Snack 50 findings, digging further into the insights regarding Gen Z’s snacking preferences. This young consumer edition of the report yields fresh insight that disrupts many assumptions and conventions upon which many marketers and retailers base their strategies and activations.

The complete report is available for download here.

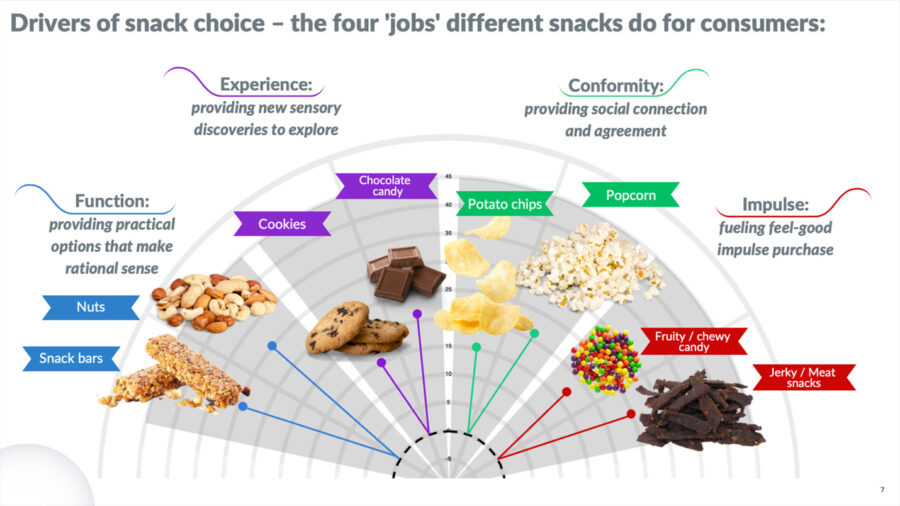

The chart above describes the four emotional jobs different types of snacks do for consumers, and the top snacks for each “job.” Looking at differences in preferences for snack “jobs” among Gen Z versus the overall population begins to reveal how this cohort differs and what it means for brands.

The report findings point to three macro differences young consumers express when it comes to what categories and brands they decide to buy.

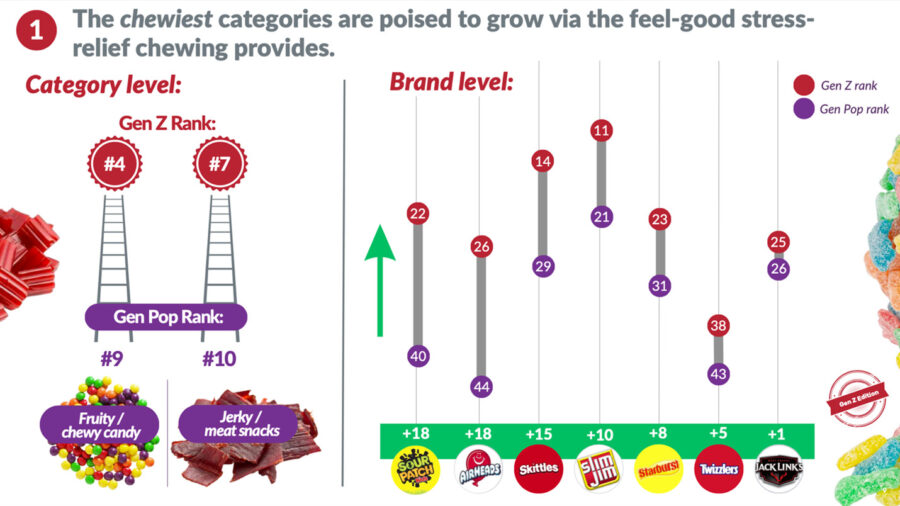

1. Young consumers choose the chews

Two categories enjoyed the most dramatic leaps in popularity among younger consumers: fruity / chewy candy and meat snacks. The corresponding brands within these categories jumped similarly in emotional importance, crucial to driving choice decisions out in the real, noisy marketplace.

Further, from a behavioral science standpoint, an interesting insight underlies these performance improvements. Specifically, these are the chewiest snacks included in the study.

It’s been widely reported that Gen Z and young consumers in general are experiencing potent levels of stress and anxiety. And in the world of psychology, it’s well documented that the physical act of chewing contributes to stress reduction. So, it’s no coincidence that “the chews” are appealing to younger consumers.

While a simple insight, this can be transformative in guiding innovation pipelines and corporate strategy (it’s unlikely any acquisition target criteria are currently framed around “chewiness”).

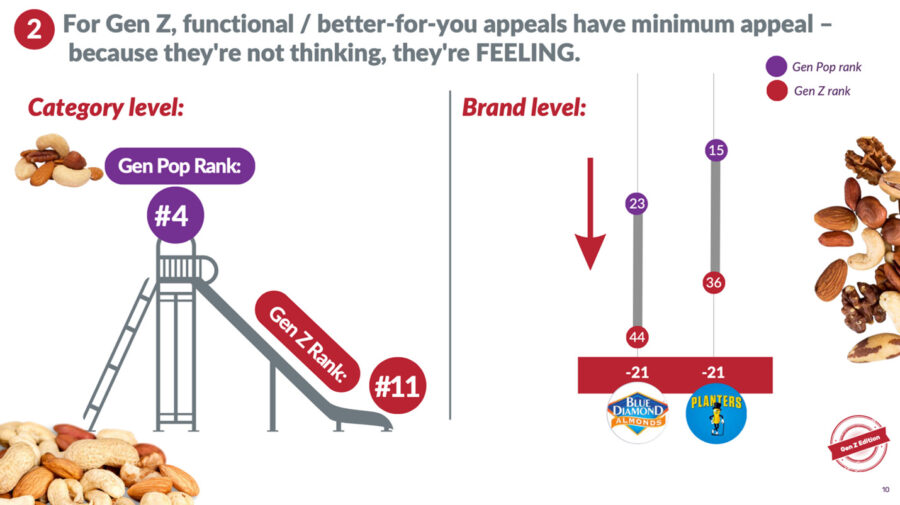

2. ‘Better-for-you’ appears worse for business

Consumers perceive that categories like nuts reside in the ‘functional’ space – meaning they make rational, practical sense. Typically, this is the domain of better-for-you, sensible options. So with so many headlines awash in the supposed importance of health and wellness for Gen Z, it’s surprising that snack nuts plummet in popularity among young consumers.

But why? Why don’t sensible snacks create the emotional voltage of their fun-forward (and generally less “healthy”) alternatives? Simply, because snacking decisions for Gen Z are very often about feeling better emotionally. The role of snacks is often to provide a mental escape via an interesting experience, or just some feel-good satisfaction that comes with salt, fat, and carbs.

So, it’s not that sensible options are irrelevant for young consumers, but marketers would be wise to adapt their understanding of this domain to address not only the better-for-you functionality, but also the “better-to-you” emotional experience.

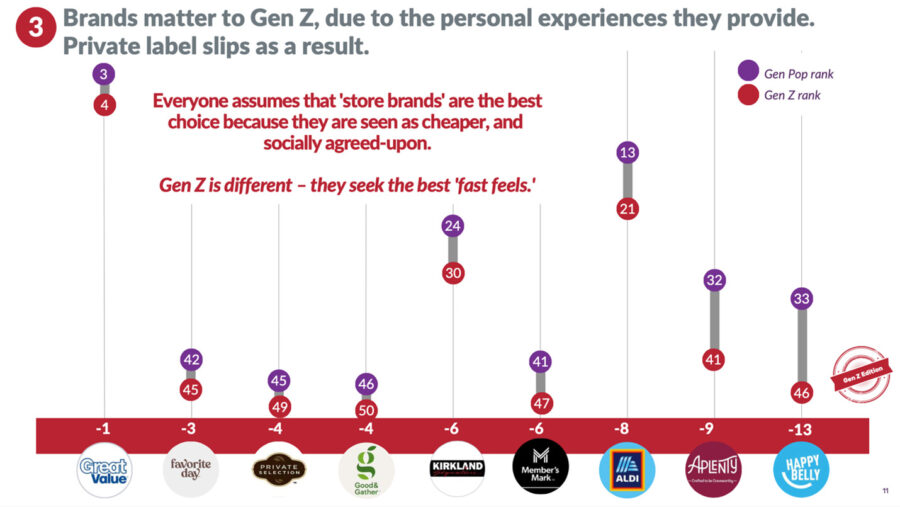

3. Brands matter

With ongoing economic uncertainty, student debt turmoil, and the ending of many government assistance programs, most marketers are understandably concerned about shoppers “trading down” to store brands.

However, the broader Snack 50 findings reveal that shoppers choose store brands due not merely to prices, but rather due to social norms and conformity to the opinions and agreement of others. In other words, they don’t choose Great Value at Walmart merely because they’ve compared the labels and it’s cheaper; they choose it because they perceive that other people like them agree it’s the best choice.

With Gen Z, however, the importance of social conformity drops considerably when it comes to snacking decisions. Decision-making by younger consumers is driven much more by individual experiences. As a result, the performance of store brands drops across the board.

So, when marketing to young consumers, experiences matter. Brands matter. And marketers have options beyond the price promotion race-to-the-bottom. (These data focus on Gen Zers 18+, as younger Gen Zers and Gen Alpha emerge these measures will continue to keep a finger on the pulse).

While the snacking decisions of Gen Z are often surprising, and counter to conventional assumptions, they are explainable. And the brand teams that heed these explanations, serving the core emotional needs of these consumers, will enjoy strong potential to drive big-time business results.

Hunter Thurman is president of Alpha-Diver, the market research & consulting firm that applies decision science to more deeply understand marketplace behavior. The firm’s neuroscientists and strategists work with leading brands, retailers and the Wall Street analyst community to explain consumer behavior in ways proven to help clients drive double-digit brand growth via activation.

Mary Mathes is Director of Data Insights for Alpha-Diver. She is an expert in revealing strategic, data-driven stories, who has honed a unique ability to distill crucial insights, place business challenges in context, and devise tangible solutions that let clients activate Alpha-Diver’s decision-science-driven understanding on another level.