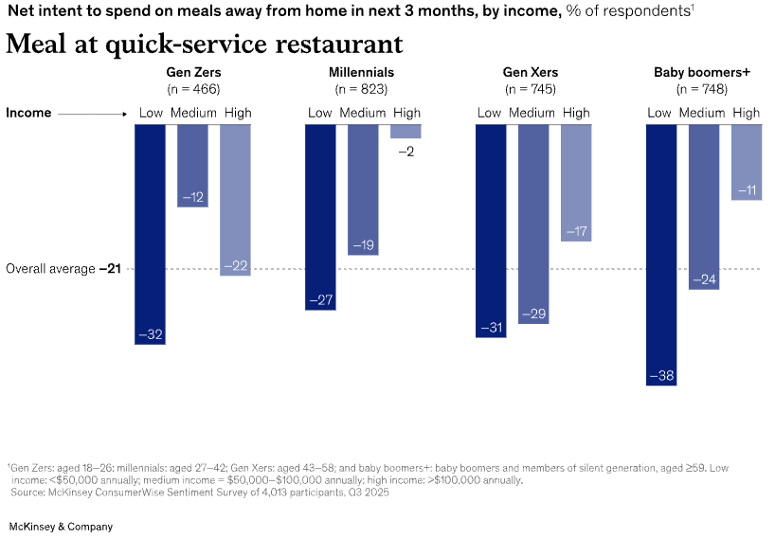

Consumers are shifting their way from quick-serve restaurants (QSRs), such as fast food and fast-casual businesses, in droves, with net intent to decrease spending by 21 points on average.

Research from McKinsey found what many in the food industry already know: the QSR value proposition is getting weaker, especially as consumers seek out healthier food. In fact, food quality is the top driver of a lower value proposition across the board.

The findings show that, although spending is expected to decline across the board, low-income shoppers exhibit the most fiscally conservative characteristics, especially among Gen Z and Baby Boomers. Moving up the income bracket, fiscal frugality begins to ease.

When evaluating historic QSR spending, the landscape looks bleaker for younger generations: while Gen Z and Millennials stepped down spending by 19 and 22 percentage points, respectively, both Baby Boomers and Gen X pulled back their spending by 11 percentage points each. As a result, businesses can either weather the storm until consumer spending loosens or they can dig into the emerging needs of today’s diners.

So, what is the modern shopper looking for? Exclusive CivicScience data fielded for FI suggests food quality and price remain the two largest factors. These drivers have held firm since mid-last year; however, now, an effective loyalty program and high-quality, speedy service are gaining ground.

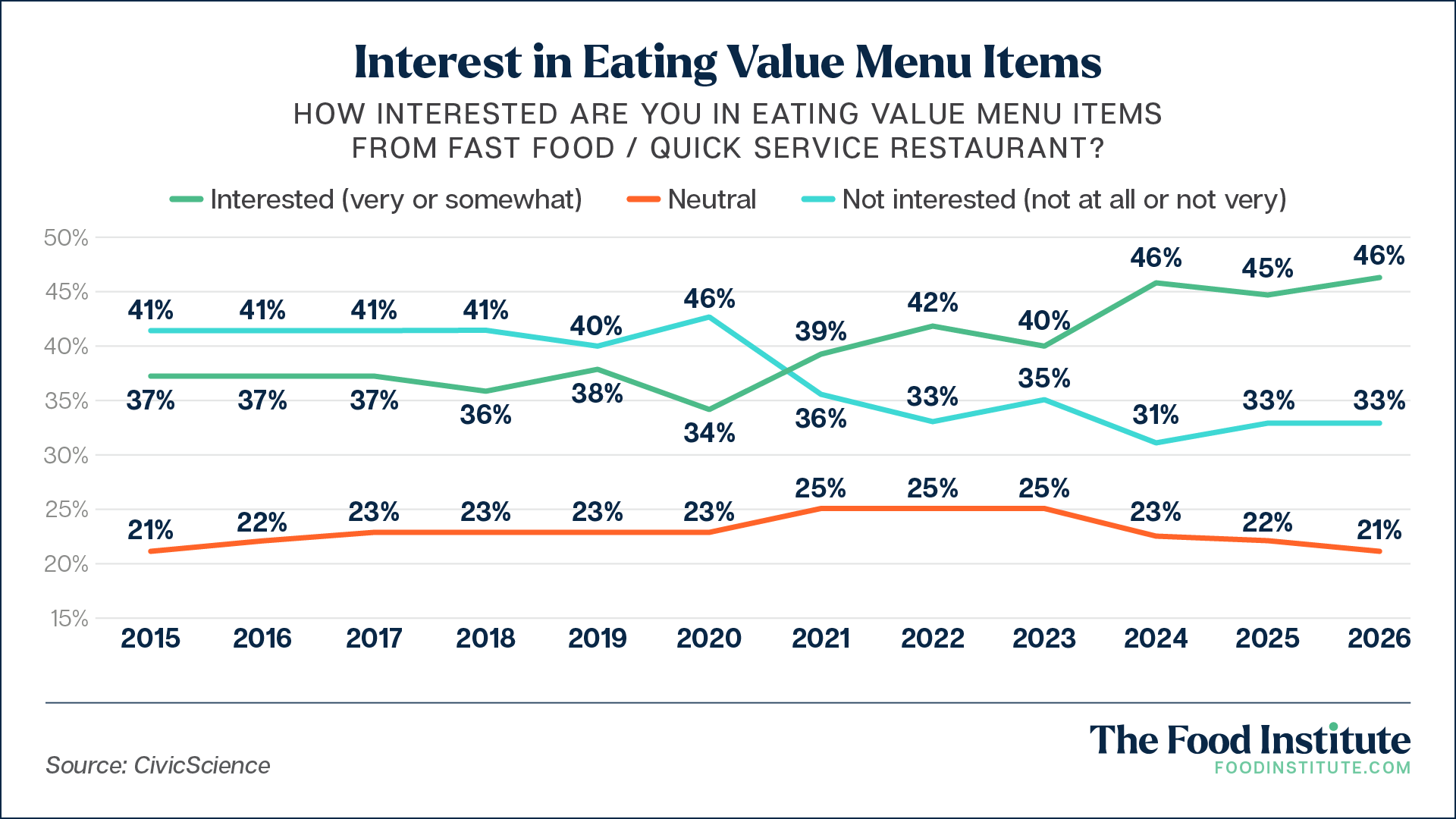

People want to get more without necessarily spending more on it, which is why interest in eating value menu options has returned to its 2024 peak, a local high compared to data that dates to 2015.

But today’s interpretation of “value” is a complex web of characteristics. Sure, value menus offer a price differentiator, but they also can provide compelling nutrition profiles (i.e., high-protein) or unique flavors or experiences (think Taco Bell’s Decades Menu).

The New Menu Precedent

CivicScience also found that “having it your way” is also transitioning into a compelling aspect of away-from-home dining, with “diverse menu options” beating “lower price” for general eating occasions (including full-service dining).

Healthy options also outranked service quality compared to Q4 2025.

Following is a list of consumer dining out values, ranked:

- Diverse Menu Options ↑

- Lower Price ↓

- Quality ingredients

- Healthy menu options ↑

- Higher level of service ↓

- Atmosphere

- Speed

QSRs have been busily catering to these emerging consumer needs. Businesses such as Shake Shack, Cava, Jack in the Box, and Subway all recently unveiled protein-packed additions to their lineup.

LTOs are also hot, adding to overall menu diversity and value menu offerings that secure stable foot traffic.

Recent McKinsey data corroborates CivicScience findings, particularly regarding the relationship between menu diversity and price. While purchase frequency is declining at burger QSRs, “ethnic” and regional, as well as Mexican establishments, continue to grow, even in this precarious environment.

In fact, McKinsey called Mexican restaurants a “bright spot” amongst the fast-food landscape, citing the fact that they are experiencing dual increases in purchase frequency and spending per unit while also experiencing a muted comparative unit per trip loss.

“This could be because Mexican LSRs are seen as better value for money, and the players that have done best in the past year have focused on offering greater convenience for diners and driving operational innovation,” read the report.

These innovations include drive-through dining, mobile order prioritization, and AI-driven tools to support back-of-house efficiencies. Not only are these establishments winning in those top need states (diversity, price), but they’re also hitting at least five of the seven top tenets to attract modern shoppers.

Food for Thought Leadership

In this episode, The Food Institute sits down with William Grand, founder and CEO of NutriFusion, to examine the growing health crisis tied to ultra-processed foods—and what it will take to fix it.