Anaheim, Calif. – The plant-based industry is much like a garden: it once flourished with vibrant growth but has since faced a dry spell, awaiting the right conditions to rebloom. At Natural Products Expo West, key industry stakeholders may have offered the industry the nutrients it needs.

Between 2018 and 2024 the plant-based foods industry grew from $4.5 billion to $8.1 billion in annual sales, supported by the 59% household penetration and 79% repeat rate observed throughout 2024, according to a session, titled “From Plants to Plates: Unpacking Consumer Spending & Sentiment in Plant-Based vs Animal-Based Categories,” which presented recent data created in partnership with the Plant Based Foods Association and Kroger’s data insights firm 84.51.

However, despite the perceived growth, the industry has struggled in recent years, facing headwinds, particularly from key “decreasers”—those who have dialed back their plant-based purchases.

To win back these consumers, decreasers cite lower pricing, better taste and texture, and wider availability of plant-based options on-shelf as key motivators to continue purchasing plant-based categories, explained PBFA head of marketplace Hannah Lopez.

The conversation, which also included 84.51 director of loyalty marketing consulting Maureen Heis and non-dairy creamer brand Nutpods CMO Patrick Coyle, looked at the state of the industry and advised plant-based manufacturers and grocers how to address key industry pain points.

“The plant-based food industry is keenly aware of consumer sentiment and continues to drive innovation throughout the industry,” added Lopez.

Already, measurable success has been achieved to mitigate these growing pains.

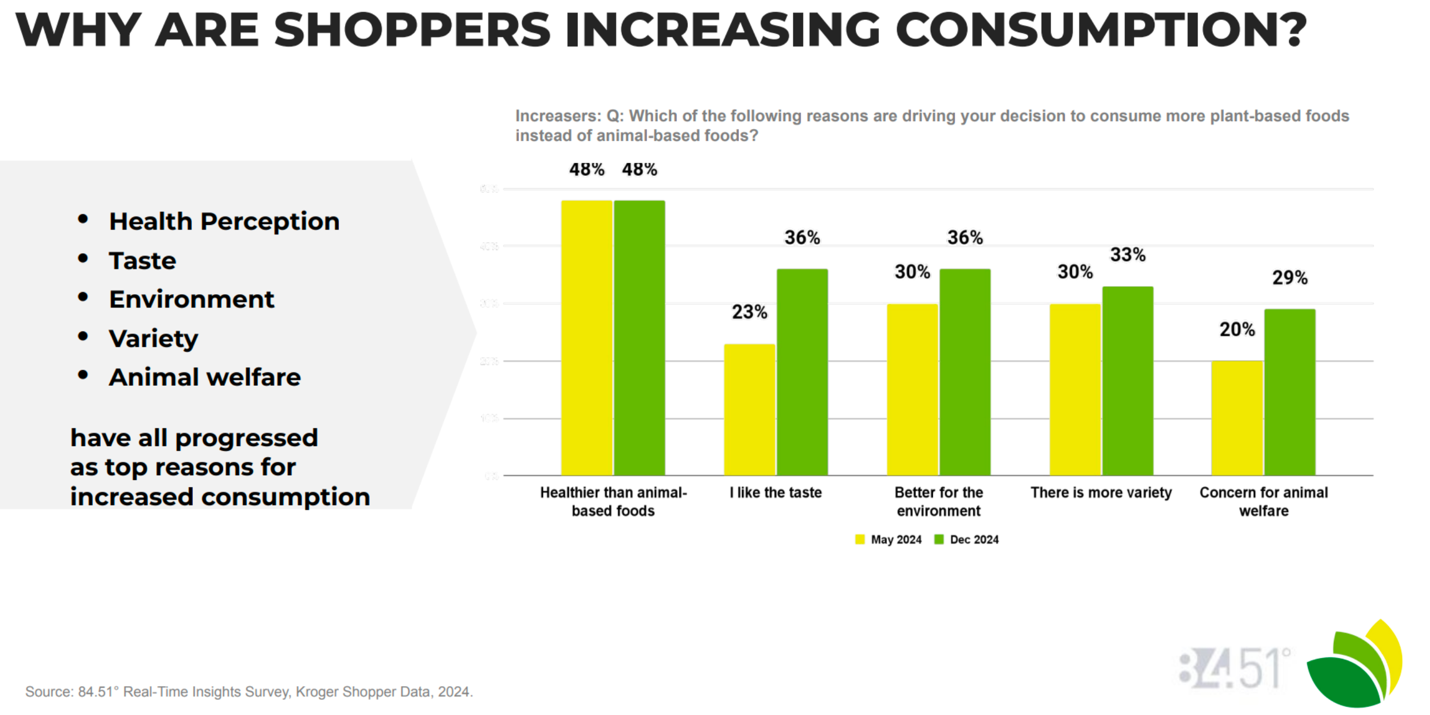

On the other end of the spectrum, for example, consumer “increasers” say they’re upping their plant-based consumption because of taste and variety.

The report polled consumers in May 2024 and December 2024, finding that those who increased purchases cited taste as the fast-growing motivator, increasing 13% to 36%, while variety increased by 3% over the same period to 33%.

Plant-Based Growth Indicators

The 2025 outlook for the plant-based sector looks optimistic, with both plant-based evangelists and skeptics increasing consumption across categories.

Across households, household consumption has increased by 34%, while 57% note they are maintaining their purchasing behavior. When asked why, health perception, taste, environmental impact, variety, and animal welfare reasons all grew between May 2024 and December 2024.

As a result, 91% of increasers and 96% of decreasers of plant-based foods claim to be increasing or maintaining consumption, according to the report. This indicates strong wins for the sector.

The key to tapping into this growth? a comprehensive strategy considering mechanization, pricing, and personalized promotions.

Capturing Growth With a Plant-Based Portfolio

Coyle noted that the sentiment data underscores the key to plant-based success—consumers care about the product before the mission.

“There’s a balance between value and values,” he said. “We must balance the heart with the head. In most cases, consumers won’t pay twice as much for a more sustainable product.”

Additionally, he recommended tempering the research with a comprehensive strategy. For example, consumers cite decreasing plant-based consumption because of fewer promotions on these products throughout 2024; however, from a brand perception standpoint, a product line shouldn’t always be on sale.

Instead, he recommends working with retailers to maximize the limited display space in stores. Designated plant-based sections could be a blight on a brand, as it does little to attract new consumers to the area, so facilitating any way to foster special moments with plant-based products can help inspire trial and repeat purchases.

Lopez agreed, adding that business leaders should consider the following:

- Provide transparency on nutritional benefits to educate them on the category.

- Offer promotions and variety (within reason) to assuage the category’s negative price and availability perceptions.

- Work with retailers to add shelf-talkers and signage to make it easier to find and prepare meals with plant-based products.

A tenet of the plant-based 2.0 movement, Coyle added that its brand benefited from eschewing flavor parity with its dairy-based analog. He said that the brand has invested significant R&D into optimizing taste and texture, however, the goal is to make it the best it can be, rather than an imitation of a dairy creamer.

“The reason you use coffee creamer is to make your coffee better. If it doesn’t, the customer won’t buy it,” he said.

The Food Institute Podcast

This Episode is Sponsored by: City National Bank

How are macro-economic factors and changing consumer preferences impacting the natural grocery sector? City National Bank’s Justin D’Affronte steps in as guest host as he speaks with Mother’s Market CEO Dorothy Carlow about inflation, tariffs, consumer preferences, and more.