For those asking themselves, “How sweet is too sweet?” the answer is heavy soda. A regional beverage with dubious origin has TikTok, Instagram, and Reddit users excited by the intense sweetness and flavor amplification.

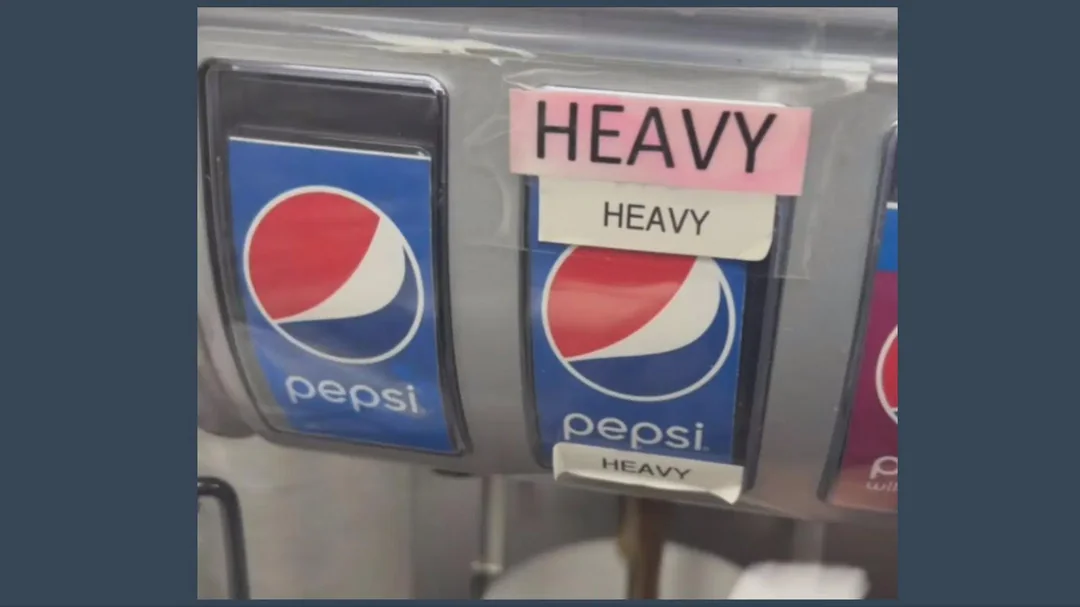

Heavy soda is a soda beverage available at certain beverage dispensers that use a higher ratio of soda syrup dissolved in carbonated water, resulting in a heavier, more viscous, and sweeter drink by volume.

Popular “heavy” beverages include classic soda fountain options, such as Pepsi, Coke, and Sprite.

However, spotting the modified beverage at retail is something of a shooting star, with many TikTok users accusing the beverage of belonging to myth. The reality, however, is that it exists, and its existence is resoundingly divisive.

Health concerns from medical professionals add to the debate, with Las Vegas orthodontist Dr. Jeremy Manuele telling Fox News the beverage can put consumers at higher risk for cavities, gum inflammation, heart disease, and more.

Source: Reddit

Anatomy aside, the latest resurgence is likely thanks to the growing dirty soda trend as well as TikTok virality—a single TikTok post from @kateboyerx2 amassed nearly 7 million views, and there are countless others following suit.

C-Barn, a Missouri-based convenience chain, has a long history of offering heavy sodas. Co-owner Ray Johnson confirmed a ratio of 3:1 (carbonated water to syrup) in its heavy soda recipe for at least eight years.

Joyce Meadows, C-Barn store manager, told Today that it is a crowd favorite at several locations.

“There are some key things that people say they just have to have, and heavy soda is one of them,” said Meadows. “They say when the ice melts, the flavor is still there.”

Regional Roots, National Appeal

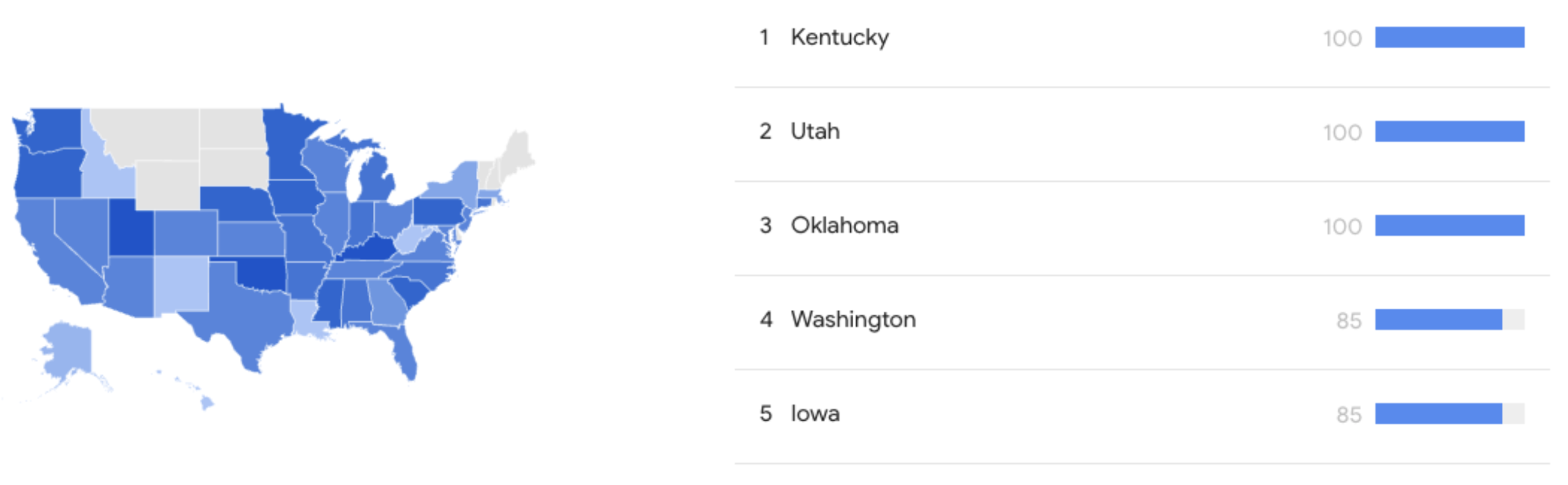

Although many trace the beverage’s origins to the Midwest (specifically, Montana), interest is countrywide.

In a Google Trends map tracking search term usage from the last 12 months ending Oct. 7, Kentucky, Utah, and Oklahoma are among the top areas where users are searching the term.

Consumer behavior shifts and current market conditions make this an opportune moment for convenience chains to hop on the trend.

Similar to dirty soda’s appeal, wherein additional flavorings are added to traditional sodas, heavy soda adds a touch of customization to the routine act of purchasing a beverage, plus its exclusivity, unique experience, and social media virality make it particularly enticing for younger consumers.

More importantly, the flavor intensity invokes a nostalgic appeal for many. One Reddit thread on the topic had users reminiscing on pizzerias, movie theaters, and QSRs that offered a similar-tasting item from their childhood.

At a time when consumers are looking for “moments of joy” in their day, heavy soda boasts an attractive value proposition.

“The extra syrup gives it extra flavor, and it feels like even more of a little treat,” said Manuele.

In last year’s Mondelez State of Snacking report, 76% of consumers look for a snack to boost their mood during the day, and 81% (a 9% increase from the year before) snack to find quiet moments to themselves. Apart from the functional purpose heavy soda affords, where all-day drinkers don’t have to worry about ice diluting flavor, these snackers are likely to enjoy the intensity of heavy soda.

Beverage Bomb—Intensity in the Zeitgeist

Consumers like to be wowed by the beverages they consume; however, the traditional soda industry has stagnated, according to research from data insights platform MenuData.

Heavy soda is easy for operators to include in their portfolio, as it doesn’t require any additional ingredients, and can help turn the needle in terms of foodservice beverage sales, a higher-margin area that can help offset rising foodservice labor and input costs.

Dirty soda may offer a case study into heavy soda’s market potential, as it is bucking the industry trend, growing at a rate of 42% year-over-year with an overall market penetration of 2%. These drinks also sit at a price premium compared to traditional soda, averaging $5.50.

CPG innovations such as Mountain Dew’s dirty soda also demonstrate shifting consumer interests toward saccharine indulgences. Hitting shelves in 2026, Dirty Mountain Dew Cream Soda Dew offers an indulgent taste that Pepsico’s U.S. beverage CMO Mark Kirkham claims takes the trend “to a whole new level.”

The craze has also taken to foodservice, with McDonald’s announcing a test of an enhanced soda portfolio earlier this summer.

In an era where consumers are becoming increasingly concerned with how food contributes to their personal health and wellbeing, and with functional sodas growing in popularity, unexpectedly, consumers are excited by sweet, indulgent products.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.