Recent investments in hybrid plant-based offerings have food and beverage stakeholders wondering about who the target consumer is, as it creates a new way for consumers to consider the social, moral, and environmental implications of their food sources.

Vegans and vegetarians are unlikely to compromise on their animal-free preferences in favor of these products, for example, causing brands in the space to look at omnivores and curious carnivores for support.

Some examples of these hybrid plant-based offerings include Applegate Farm’s Well Carved blended meat line that incorporates meat and vegetable pairings into the center-of-plate protein, Impossible Foods recent hinting of a 50/50 blended meat burger, and an initiative from Farm Dairy and PlanetDairy to create a blended cow-milk product that incorporates plant protein sources.

The Food Institute spoke with industry stakeholders about hybrid plant-based innovations in the market, uncovering a sentiment that leans toward cautious optimism. Many wax lyrical about the flexitarian appeal, where these products can serve as a marginal change to consumers endeavoring to lower their animal-based consumption without committing to the vegan label.

“Consumers are approaching food with more flexibility than ever, looking to balance small indulgences with healthier choices,” said Jenna Behrer, chief Growth Officer at frozen food brand Dr. Praeger’s, in a conversation with FI.

“Blended products are right in step with that shift.”

On the other hand, as with any novel food concept, particularly those with standout attributes that consumers may find attractive, brands need to make effective use of their marketing budgets while sculpting clear messaging for their target consumer base.

The hybrid cow milk debuted at Amsterdam’s World of Private Label International Show earlier this month, boasting value-added attributes such as a 20-30% reduction in emissions compared to dairy milk.

“We are targeting dairy lovers who are mindful about the environmental impact of traditional dairy,” said Jakob Skovgaard, co-founder and CEO of PlanetDairy, reported Green Queen.

Flexitarians May be the Key

On the marketing front, Impossible Foods is taking aim at flexitarians to drive the next stage of the brand’s growth. In an interview with The Wall Street Journal, CEO Peter McGuinness noted that the consumer subgroup could quadruple revenue for the brand in a short time period.

He added that these shoppers tend to have more discretionary income, shop Whole Foods, Costco, Target and Walmart, and skew to urban areas.

“To get this category going, I may do a hybrid burger that’s 50% beef,” said McGuinness.

But are these consumers as open to these marginal plant-based modifications as these leaders suggest?

Jack Ellis, senior associate of agriculture and food at Cleantech Group, told FI that, in a way, this consumer base has existed for a while.

“Meat products containing both animal and plant-based protein are nothing new. Things like sausage links or chicken nuggets and strips will often contain significant amounts of extenders and fillers made from soy, pea, and other proteins,” he said.

The difference comes down in the marketing, and these social attributes, which is where the topic becomes dicey: Tyson Foods, for example, debuted aptly marketed Raised & Rooted ‘blended’ product which was eventually discontinued. Today’s consumer, however, may be more willing to give these products another shot, as consumers seek out more protein-rich diets, and are gradually becoming more preoccupied with personal health and wellness as well as the environment.

Nevertheless, Ellis contends that these flexitarians may not respond well to the product base because they may prefer to take control of their decisions with opting for 100% plant-based cognates when deciding on their center-of-plate food sources.

“It isn’t clear that offering ‘blends’ will help consumer-facing alternative protein brands to substantially increase sales and market share,” said Ellis.

Behrer, however, is more optimistic. Dr. Praeger’s offers many products that fall into the “blended dairy” category including Pizza Stars and Broccoli Cheddar Cheesy bites which she contends offer a way for consumers to stop thinking of plant-based as an all-or-nothing decision.

“For retailers, these kinds of products meet consumers where they are by offering flexible, better-for-you options that feel familiar, satisfying, and easy to say yes to,” she said.

Novel hybrid plant-based offerings, such as the blended milk, however, tend to stray further from familiarity compared to Dr. Praeger’s assortment, but that doesn’t necessarily mean consumers aren’t willing to test them.

Hybrid Plant-Based Market Potential

Skovgaard notes that PlanetDairy’s blended dairy product is for consumers who prioritize sustainability, however, refuse to compromise on taste, nutrition, or price.

These aspects represent the budding category’s market potential: by incorporating the animal-based product, the sensory aspects can more readily be achieved without investing too heavily in R&D or having to use ingredients that can compromise a clean label.

For these products to work, they must succeed on flavor and texture while delivering on their promised attributes. Although the plant-based segment is getting better at offering flavor and texture parity compared to animal cognates, survey data shows it still labs behind.

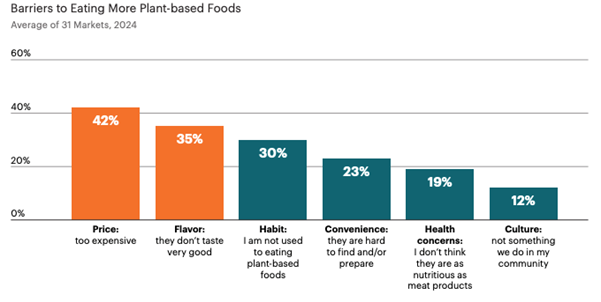

A recent report from Eat Foundation titled Grains of Truth 2024, for example, showed that flavor was among the top barriers for consumers to consider plant-based foods. Price was the top concern, which blended plant-based companies may be able to address by incorporating lower-priced meat and dairy products into the premium-priced specialty offering.

As for messaging, Jason Eastty, owner of the wellness center Healthspan Longevity, emphasized that consumers must not feel “tricked” into eating something they weren’t expecting by remaining transparent about its healthy qualities.

He noted how these offerings have the potential to fit into the growing “flexitarian” consumer base, but macronutrients, experience, and marketing angles will be the key to unlocking these consumers.

The Food Institute Podcast

Several economic headwinds indicate the consumer is being financially stretched, but we all need to eat – so what are consumers actually buying at the grocery store? Nik Modi of RBC returns to The Food Institute Podcast to discuss channel differentiation, consumer product selection, and other macro trends.