The COVID-19 pandemic will continue to affect the manufacturing capabilities of food companies through the end of 2020, but automation, social distancing, and pivoting towards healthier products could provide avenues for future growth.

Meatpackers Face Duel Threat of Plant-Based, Price Fixing

Meatpacking plants were among the worst hit when it came to COVID-19 infections due to the nature of the facilities. Workers often work in close proximity to each other, and the cold temperatures present in the facilities likely increased exposures.

CDC reported July 7 in an early release of its Morbidity and Mortality Weekly Report that 16,233 cases had been identified in 239 meatpacking facilities across 23 states in April and May. The agency reported 86 COVID-19 related deaths, representing 0.5% of those identified.

Though opportunities exist for meatpacking plants through exports and an existing U.S. customer-base, plant-based meat substitutes continue to gain traction, with Impossible Foods and Beyond Meat expanding their availability through retailers and new foodservice partnerships.

Novameat developed and debuted a 3D-printed, plantbased steak, which will put more pressure on the U.S. meat industry as plant-based products move beyond analogues to ground beef and burgers.

While a viable plant-based chicken product has not reached the same popularity, there is growing interest in the space and it will likely develop further before the end of the year.

Additionally, the meat and poultry industries are facing antitrust probes regarding pricing. The Justice Department sent civil investigate demands to Tyson Foods Inc., JBS SA, Cargill Inc., and National Beef Inc. in early June to investigate allegations the companies conspired to fix prices.

Criminal charges were filed against four current and former Pilgrim’s Pride Corp. executives regarding price fixing in the same time period.

The investigation was ongoing, according to the Department of Justice. With these developments in mind, it will likely be difficult for poultry or meat companies to increase prices during the pandemic, even if the market justifies such a move.

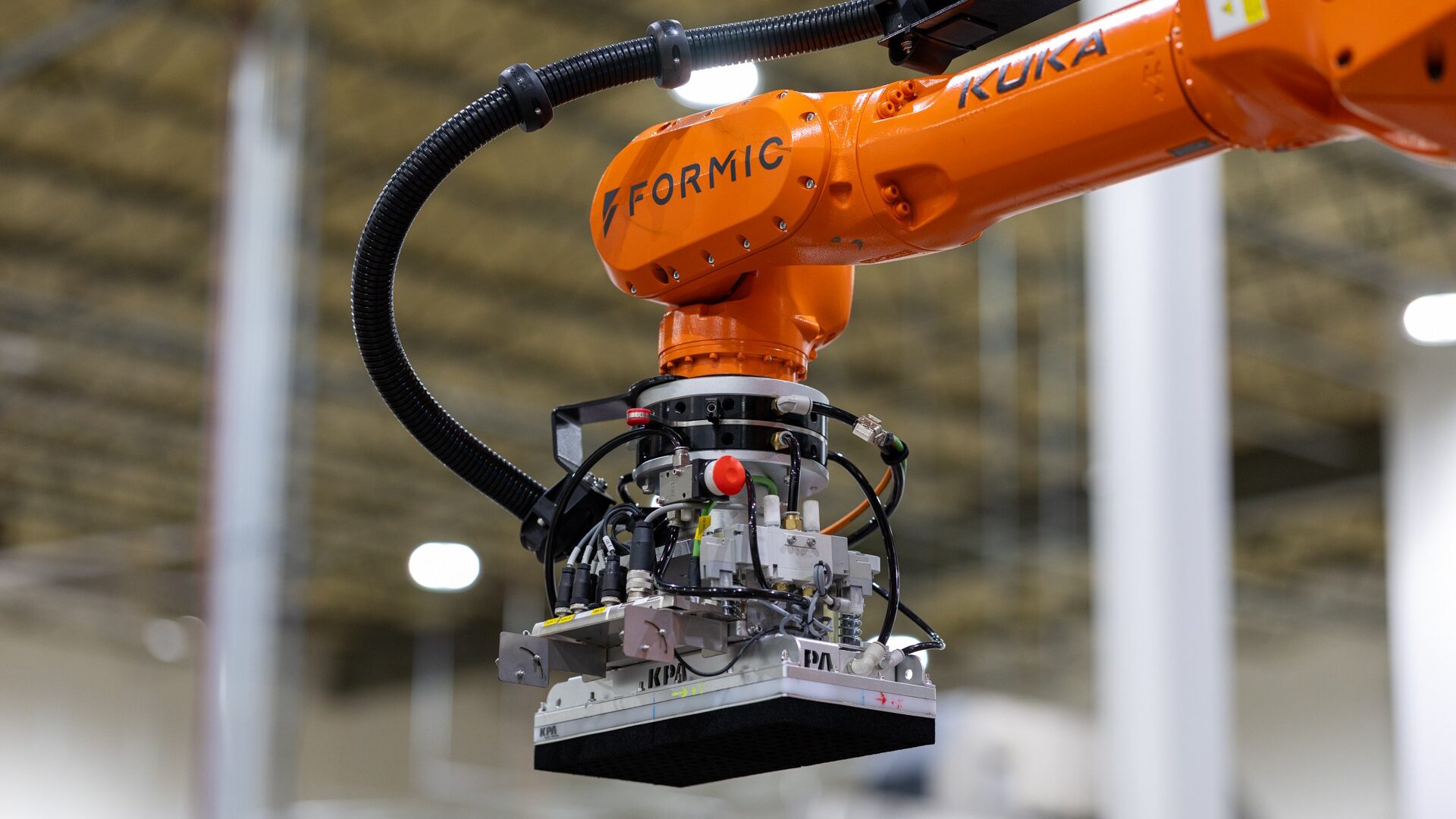

A Pivot to Automation

One way for the meat sector to respond could be through automation. The pandemic has accelerated meatpackers’ exploration of the use of robots on processing lines, reported the Wall Street Journal (July 9).

Although the industry has been relatively slow to automation due to the variable size and shape of carcasses, COVID-19 health concerns in closely-packed plants and the U.S. labor shortage may spur change in adopting factory robots. Meatpacking plants typically employ 3.2 workers per 1,000-sq. ft. of manufacturing space, three times the national average.

Not all in the industry thought the turn to automation would occur so quickly, with Mark Lauritsen, an international vice president of the United Food and Commercial Workers International Union, arguing human labor was still cheaper and more adept at skilled jobs in meatpacking plants when compared to automated labor.

While speaking with The Food Institute Podcast, Mark Moore, president of CMC Design-Build, said interest in automation was often high before the pandemic but concerns regarding ROI often led to those plans being abandoned. However, he believed some manufacturers would turn to automation technology due to the pandemic and fears of future public health crises.

Vertical farms are one such avenue for growth, with Moore saying the market remained strong. Willo, which bills itself as using “state-of-the-art indoor vertical farming technology to bring agriculture into the 21st century” launched a direct-toconsumer vertical farming delivery program in San Jose, CA.

The company uses custom-curated artificial intelligence and automation technologies to grow crops at indoor vertical farms and features a home-delivery component which allows it to contend with most social-distancing mandates without much interruption to business.

Produce Companies Contend with Harvesting Headwinds

While not as affected early in the COVID-19 pandemic as meatpacking plants, fruit and vegetable processing operations are contending with the disease as new crop activities for 2020 begin.

Apple and cherry orchards in Washington state’s Yakima Valley are among the farmers facing production slowdowns related to social distancing and other preventative measures. Production issues like those in Washington state are facing will likely apply to any specialty crops that rely upon human workers for harvest and could push down supply. Fresh market and processing market buyers could face increased competition with lowered oversupply, which is expected to push prices up.

Speaking with The Food Institute Podcast, juice industry veteran and independent consultant Carol Plisga noted consumers were already turning to juice products with health claims and benefits before the pandemic, and this trend accelerated as people searched for ways to stay in better shape. She also noted blends of fruit and vegetable juice products were gaining in popularity as it provided a way to reduce the sugar load of a beverage.

These trends will likely continue through the close of 2020, and fruit and vegetable product makers are in a prime position to capitalize on these claims, considering fruits and vegetables contain vitamins, nutrients, and other beneficial health properties ripe for marketing. During the week ending June 28, frozen fruit and vegetable dollar sales were up 22% compared to same week in the prior year, according to an analysis of IRI Worldwide data by 210 Analytics. Shelfstable fruit and vegetable sales were up 15.1% during the period, and fresh sales were up 5.8%.

These increases showcase that demand for fruits and vegetables are up across the board in the retail sphere, regardless of subcategory.

CPG Could Benefit from Expanded Variety

Consumer packaged goods (CPG) companies are in a unique position during the pandemic as their products are inherently shelf stable. While benefitting from pandemic pantry loading early in the pandemic, overloaded consumers may be turning to their own stores in the coming months. That said, if a second wave of the virus returns in force, the companies are already in position to capitalize as consumers look to reload their stockpiles. At the onset of the coronavirus pandemic, CPG companies like Kraft Heinz and J. M. Smucker Co. said they would cut down on the variety of products they made available to market in an effort to ensure a steady supply.

While the practice seemed plausible on the surface, companies could benefit from restoring their full product lines or expanding them, according to IRI Worldwide.

IRI indicated consumers were turning to smaller companies that produce similar items to fill the hole left by production contraction activities at the beginning of the pandemic. Those smaller brands made up 22.4% of total CPG sales following May 17, compared to 21% March 23.

With about one-third of Americans saying they plan to continue cooking at home more after pandemic restrictions lift, according to a survey conducted by Bloomberg News and Morning Consult, CPG companies will have plenty of opportunities to market to these customers in the next six months and even further down the line.