Breakfast occasions were big business for retailers in 2021, with at home consumption remaining above pre-pandemic levels. However, many traditional breakfast categories saw mixed sales results.

In a new report, Winning Breakfast, Generation by Generation, data analytics firm IRI outlines strategies to bolster category growth in the year ahead.

One key focus is identifying and catering to the shifting consumption behaviors of different age groups.

“What appears to be trending in breakfast is online convenience, variety, and versatility,” said Sally Lyons Wyatt, IRI EVP and Practice Leader, in a recent webinar. “Over 52% of consumers aren’t necessarily looking at … a full sit-down breakfast — 31% describe it as a mini or small breakfast while 21% describe it as morning snack.”

Furthermore, 4 in 10 people often skip breakfast, with the largest majority (56%) being Gen Z and Younger Millennials, followed by 43% of Older Millennials, and 41% of Gen Xers.

Purchase Dynamics

Dollar sales for the total breakfast category were up 4% year over year, according to IRI 2021 data for the week ending December 26. However, unit sales dropped 1.1%, reflecting the impacts of inflation coupled with supply chain and demand constraints

The same challenges deflated trends across the majority of top 10 breakfast categories, with unit sales from refrigerated eggs and breakfast meats to fresh fruits, yogurt, and coffee lagging 2020.

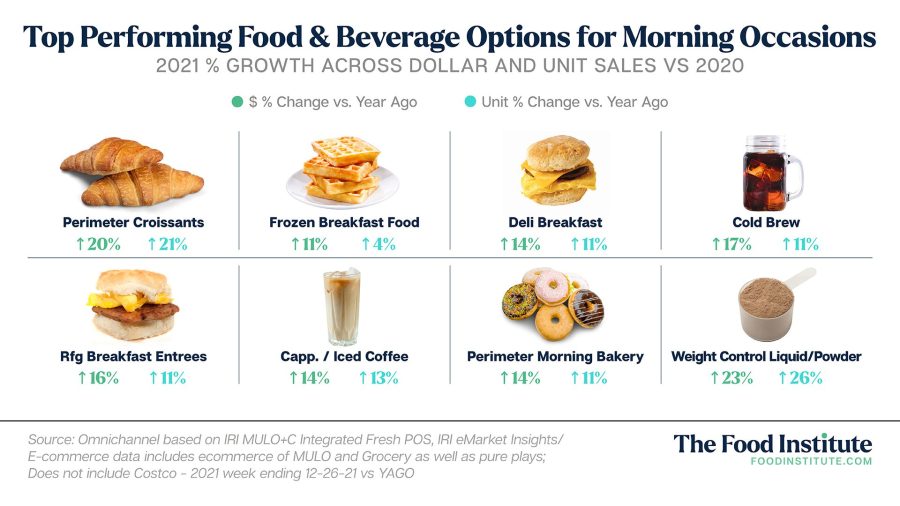

However, frozen breakfast foods and nutritional powders — along several outlying categories which appeal to on-the-go convenience —experienced noteworthy growth across both dollar and unit sales.

As Wyatt notes, the versatility of baked goods has turned the category into a fan favorite largely due to social media, in which consumers explore flavors and creative uses, like sandwich creation.

Furthermore, several of the same strong performers from 2021— including cold brew, weight controls, croissants, and deli sandwiches — appeared among the top ten products in a five-year CAGR analysis, along with ingredients like pancake and waffle mix.

Along with confirming demand for these categories over the course of time, the analysis, again, “points towards that need for variety and versatility that we’re seeing consumers gravitating towards,” said Wyatt.

Growth Pockets

Health considerations are back in focus following the comfort and indulgence trends triggered by the pandemic, and breakfast is no exception.

According to the IRI report:

- 67% of consumers prioritize healthiness for morning foods and beverage choices

- 51% looked for morning food/beverages that offer specific nutritional benefits like vitamins and minerals

- 30% look for immunity benefits when they’re trying to decide which products to buy for consumption in the morning

Wyatt points to health indicators as a potential opportunity to boost sales across traditional breakfast categories. “If you’re not calling out the benefits of your products you need to be doing so, and if you are…be sure to do so in an omnimedia-channels perspective,” she added

Flavor trends are another growth pocket in the breakfast universe, such as:

- Fruit and Fruit Blends

- Chocolate and Combinations

- Caramel

- Marshmallow

- Peanut Butter

Other suggested areas for sales activation include:

- Winning the weekend through unique experiences both in-store and online

- Balancing price, value and premiumization to drive penetration and incremental revenue

- Serving sustainability, especially through packaging

- Recharging benefit-based innovation with balanced assortment and focus on wellness attributes

- Engaging generations individually by recognizing different behaviors and offering personalized solutions

While ongoing mobility remains a key factor in accurately identifying what appeals to different generations, “at the end of the day, if you deliver on taste, easy to make, and nutrition, you’re probably going to be fine,” Wyatt concluded.