Impossible Foods is cutting foodservice distributor prices for the second time in a year as part of its push to better compete with traditional ground beef.

The maker of soy-based meat alternatives is dropping prices by an average of 15% in the U.S. as demand for plant-based products continues to rise. Alternative meat sales were up 61% in December from a year ago, year, while overall meat saw an increase of 17%, according to data from Nielsen.

Impossible Foods products are currently available in the U.S., Canada, Hong Kong, Macau, and Singapore, and there is plenty of room for the global expansion. For example, the number of vegans in the UK increased by 419,000 (62%) over the past 12 months alone, according to a survey by finder.com.

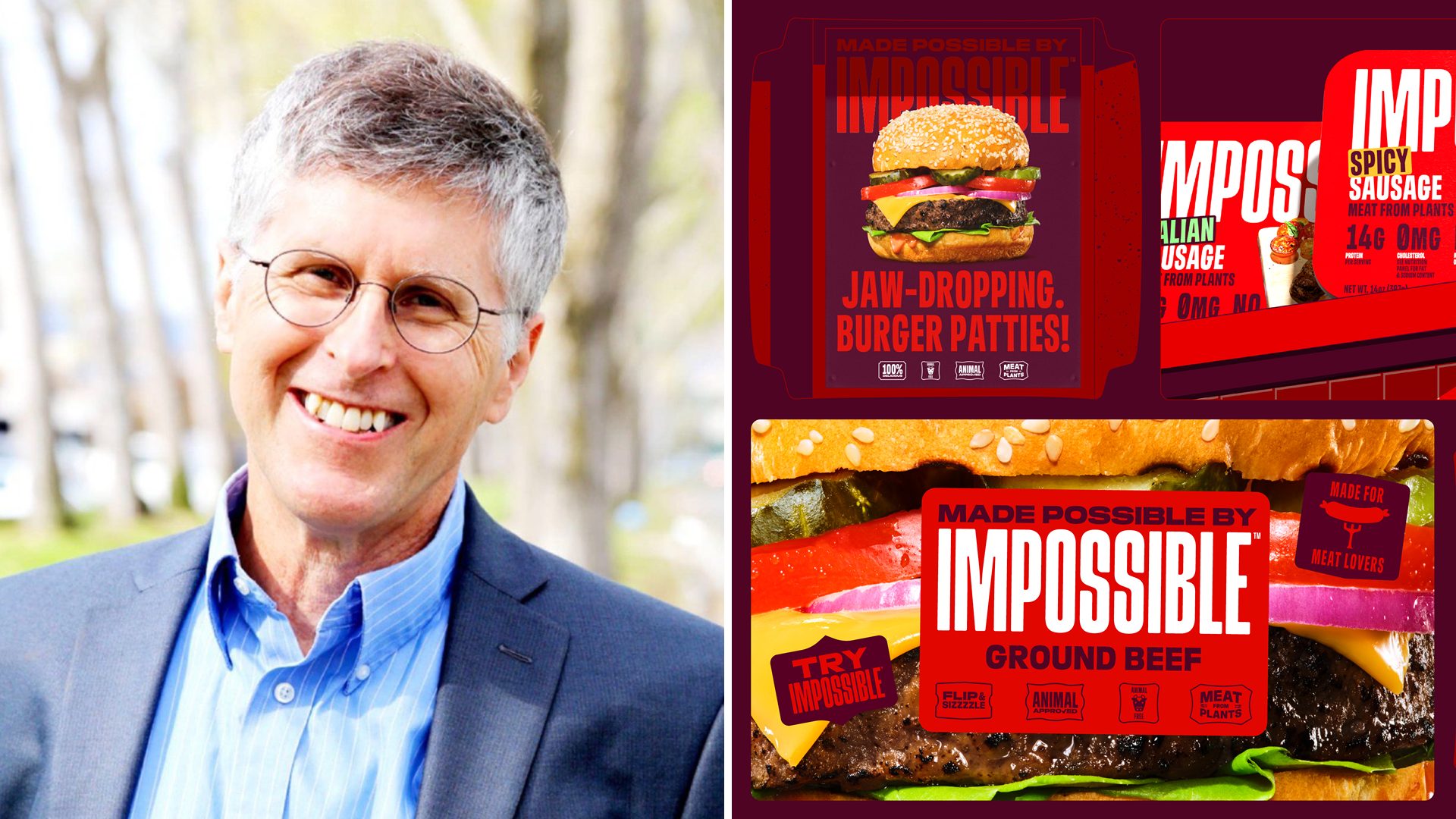

The new price cuts make Impossible Foods’ meat less expensive than premium, grass-fed, organic beef for the first time, company spokesperson Rachel Konrad told New York Post. “We experienced skyrocketing growth in 2020, which allowed us to go into high production and to cut our per unit costs,” Konrad said.

Konrad noted that the company is planning on more price cuts this year, but that distributors and restaurants will control whether or not consumers will see the lower prices.

While Impossible Foods products used to be hard to find, they are now available at major fast-food chains, such as Starbucks and Burger King, as well as 17,000 supermarkets.

If you would like to learn more about what’s to come in plant-based food, be sure to register for The Food Institute’s The Future of Plant-Based Foods webinar on Wed., Jan 27, at 2 p.m. EST. Co-presenters Darren Seifer of NPD and Alejandro Cola of Lazard will offer expert insight on the subject. Darren will explore the growing popularity of plant-based meat, dairy, and grain products, along with rising demand for next generation plant-based alternatives. Alejandro will examine M&A activity, internal investment in the space, and the market outlook.