Consumer demand for clean labels, convenience, and health continues to rise, and many plant-forward brands are tapping into this trifecta. Can limited ingredients boost plant-based snack sales?

According to Brightfield Group consumer wellness surveys, 5.3% of respondents claimed they adhered to a plant-based diet over the past year; 5.1% said they were vegetarian, and 3.1% were vegans.

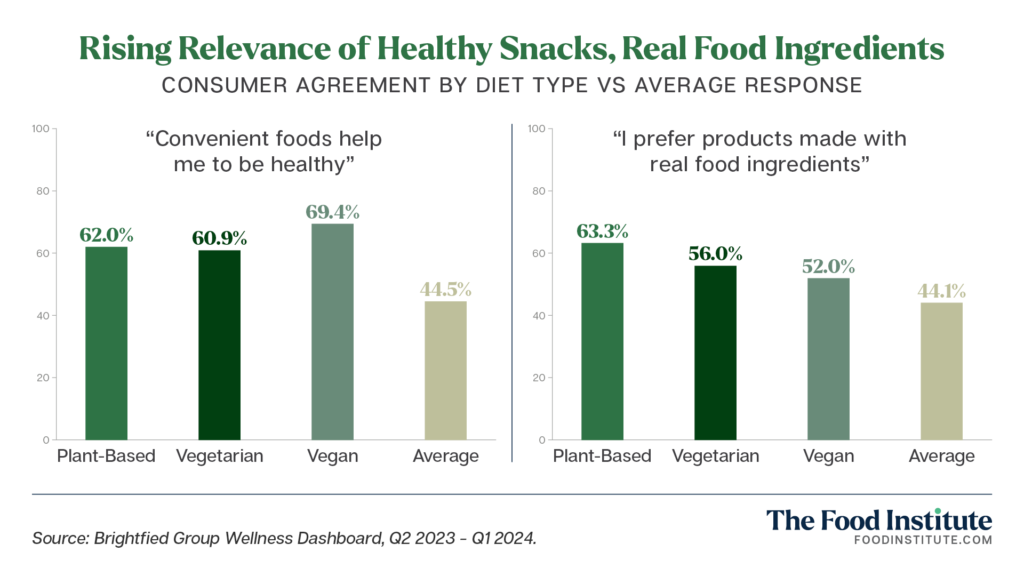

Among these cohorts, “made with real food ingredients” was the leading ingredient preference for plant-based and vegetarian dieters, while vegans prioritized “all natural” (60.3%) and “organic” (55.8%) claims.

Furthermore, “made with real food ingredients” was also the second-highest preference across all survey respondents, signaling broader interest for on-the-go, clean label snack options.

As FMI reports, the plant-based snack market value is projected to reach $76.2 billion by 2033, rising at a CAGR of 8.0% during the forecast period.

Plant-Based Snack Brands Going All In

Accordingly, several thriving companies in the plant-based snack industry now offer products with limited ingredients that are natural and minimally processed.

Confetti Snacks, for instance, upcycles imperfect or surplus vegetables and turns them into crunchy chips. The company’s ethos stems from founder Betty Lu’s personal experience of creating snacks from dried vegetables to eat during outdoor excursions.

“By adhering to a limited ingredient list, we align with this trend and provide consumers with the wholesome options they seek,” Lu told TFI. “Our approach emphasizes the rich natural properties of vegetables and mushrooms to craft nutritious, delicious snacks, reminiscent of homemade recipes.”

A limited ingredient list can also correlate with healthier, more natural products, says Julia Shapiro, VP of Brand and Content at ALOHA. The plant-based protein company produces shakes, powders, and bars, and is B Corp and Climate Neutral certified.

“By focusing on quality ingredients and avoiding unnecessary additives or fillers, we can offer products that are not only delicious but also nutritious,” Shapiro told TFI. “This is particularly important in the plant-based category, where consumers seek out products that align with their health and wellness goals.”

Between 2020 and 2023, ALOHA achieved nearly 500% growth while achieving significant profitability and positive cash flow. In April, SEMCAP Food & Nutrition invested $68 million of secondary capital in ALOHA to buy out early angel investors and take a significant minority stake in the company.

Family-friendly fruit pop producer Chloe’s was also founded on the value of limited, clean ingredients that can taste delicious while satiating sweet cravings. As CEO and co-founder Chloe Epstein notes, the company was the first frozen novelty to use just three ingredients: fruit, water, and cane sugar.

“It is possible to indulge without artificial, unnecessary ingredients,” Epstein told TFI. “Simplicity and transparency in ingredients foster trust in a brand, and by sticking to a limited ingredient list, our consumers remain loyal and enthusiastic about who we are and what we stand for.”

Transparency and simplicity are also paramount to the food philosophy at ALOHA.

“By keeping the ingredient list concise, we make it easier for consumers to understand what they’re putting into their bodies,” said Shapiro. “This transparency builds trust with our customers and fosters loyalty to our brand.”

How Critical are Healthy, Limited Ingredients?

As awareness around health and sustainability continues to grow, consumers are becoming savvier and more knowledgeable. This shift suggests that offering limited ingredients that are undeniably healthy will be essential for the future of the plant-based industry.

“With an increase in awareness of healthy living and eating comes an increase in demand for healthy options,” said Epstein. “The plant-based community wants to know that they are not forfeiting healthy, simple ingredients in exchange for plant-based options.”

“[Consumers] want plant-based options that not only taste good but also contribute to their overall well-being and that of the planet,” said Shapiro. “Catering to this demand will not only help ALOHA, and the category overall, but will have positive impact on public health and the environment.”

“By marketing these items as simple, clean, and better for you, the appeal to a wider audience expands,” Epstein added. “This strategy is essential for the growth of the category to capitalize on its niche plant-based market ideals along with wider market trends and opportunities.”

As the Brightfield consumer data reflects, limited ingredient lists and overall healthfulness transcends the plant-based category and reflects a broader shift in consumer preferences.

“Within the plant-based sector, this emphasis on health not only meets consumer expectations but also drives category growth by delivering on the promise of healthier alternatives,” said Lu. “As consumers become increasingly educated about the health implications of heavily processed foods, the demand for nutritious options rises across all food categories.”

The Food Institute Podcast

Funding sources are drying up and inflation is making it harder and harder for higher-priced food brands to compete – what’s an early-stage food company to do? Dr. James Richardson, owner of Premium Growth Solutions and author of Ramping Your Brand, joined The Food Institute Podcast to discuss what types of food companies are succeeding under current industry dynamics.