Novel proteins including cultivated meat, mycelium, and dairy bioidenticals are advancing further into the market, and some state governments are pushing back. Do consumers want novel proteins?

Over the past five years, $4 billion has been invested to develop these novel ingredients. While commercial accessibility is still limited, many CPG companies and start-ups have launched their first products in the U.S.

Meanwhile, controversy surrounding the production of lab-derived animal proteins is thrusting these ingredients further into the food industry spotlight. This month, Florida became the first U.S. state to ban the sale of cultivated meat, and Alabama quickly followed suit. Several other states are currently reviewing similar legislation.

But how does the everyday consumer feel about novel proteins? Will they even try them, let alone buy them?

To glean insights, McKinsey & Company conducted a survey surrounding 12 ingredients classified by the following descriptors:

- Animal-free bioidenticals (dairy protein, collagen, and eggs): Biologically identical to animal proteins, made via precision fermentation

- Biomass (prebiotic, cultured, postbiotic, fermented, microbial, and gas-fed): Derived from microorganisms, typically new to human consumption

- Fungi (nutritional fungi, mycelium, and mycoprotein): Derived from organisms in the fungi kingdom

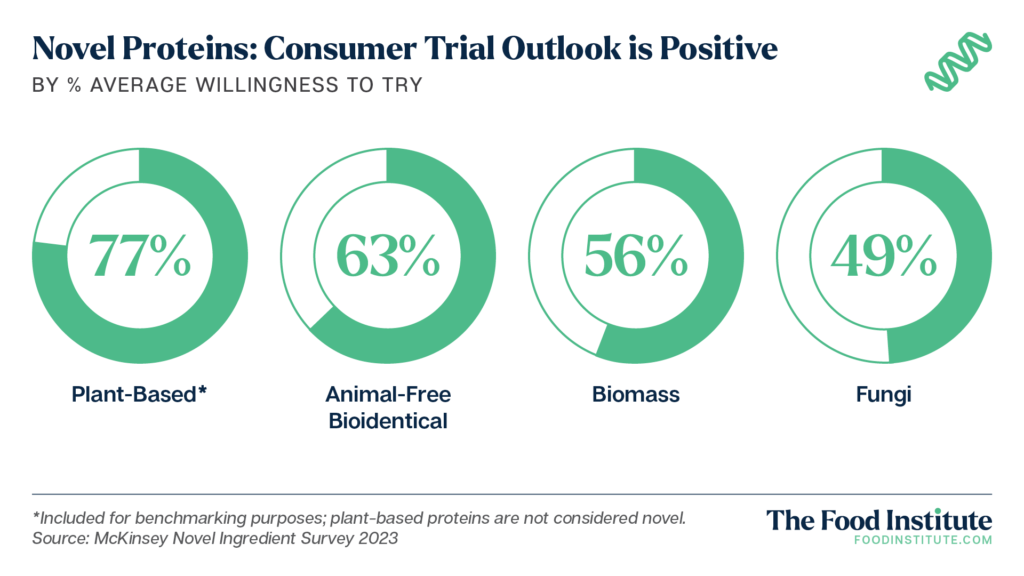

Plant-based proteins (almond, oat, chickpea, soy, pea, and barley) were included for benchmarking purposes only.

Majority of Respondents Open to Novel Protein Trial

Survey findings revealed that 56% of consumers were open to trying novel proteins across all three descriptors. Their sentiments were largely driven by the perception that such ingredients can improve upon traditional foods by being healthier, having the same or better flavor, and being sustainable.

On average, 28% of respondents would be more willing to try a novel ingredient if it made a product healthier, with Gen Z placing the highest degree of importance on health. For older generations, taste was a higher priority.

Among the 44% of respondents that were uninterested in trying any of the novel ingredients explored in this survey, lack of awareness or questions regarding how the product is made were the leading concerns, followed by taste, naturalness, and price.

Willingness to Pay More Varies by Product

Over half of respondents stated they would be open to pay more for products with conventional price points below $2 if they featured a novel ingredient.

This willingness varied, however, based on the product type and the channel.

For example, consumers were more willing to pay for beverages, snacks, and burgers compared with ice cream, egg sandwiches, and cookies. They were also more open to spending on retail and CPG concepts compared with foodservice.

Labeling Considerations

To further increase consumer adoption of novel ingredients, food and beverage producers can create categories and highlight specific product qualities on labels.

Familiar terminology and well-understood nutritional statements about potential health impacts such as “good or complete source of protein” appealed most to consumers, followed closely by statements that communicate environmental impact such as “sustainably produced.”

Vegetarian and vegan terminology and language about production methods (for example, “bioengineered” or “made with biotechnology”) are less likely to drive trial.

Other Takeaways to Encourage Trial

To increase consumer trial, manufacturers, brands, and foodservice operators can prioritize launching end products for breakfast, lunch, and snacks.

Less than half of consumers indicated awareness of novel ingredients, and “unsure of how these ingredients are made” was the largest barrier to trial. Stakeholders across the food industry may consider investing in consumer education as novel ingredients begin to come to market.

Consumers were more likely to try a product if recommended by a doctor, nutritionist, or other professional (44%) or by family and friends (27%).

FI’s May 2024 Industry Report takes a deep dive into the state of alternatives proteins and the recent controversy surrounding novel protein production in the U.S. This report is included in FI’s Corporate, Professional and E-member packages and is also available for individual purchase. Click here to download or learn more.

The Food Institute Podcast

Corn stocks, poultry flocks, and highly-pathogenic avian influenza – what does the U.S. agricultural system look like amid inflation and other headwinds? Wells Fargo Chief Agricultural Economist Dr. Michael Swanson discussed specialty crops, grain plantings, and what to expect in the growing year to come.