C-stores, in many respects, are surging. Convenience store chains largely enjoyed a stellar third quarter in 2024.

Placer.ai reported that overall visits to C-stores were up 58.6% during August compared to a January 2021 baseline. Additionally, visits were up 2.2% in August year-over-year.

Overall year-over-year visits to C-stores have been up every month since February 2024.

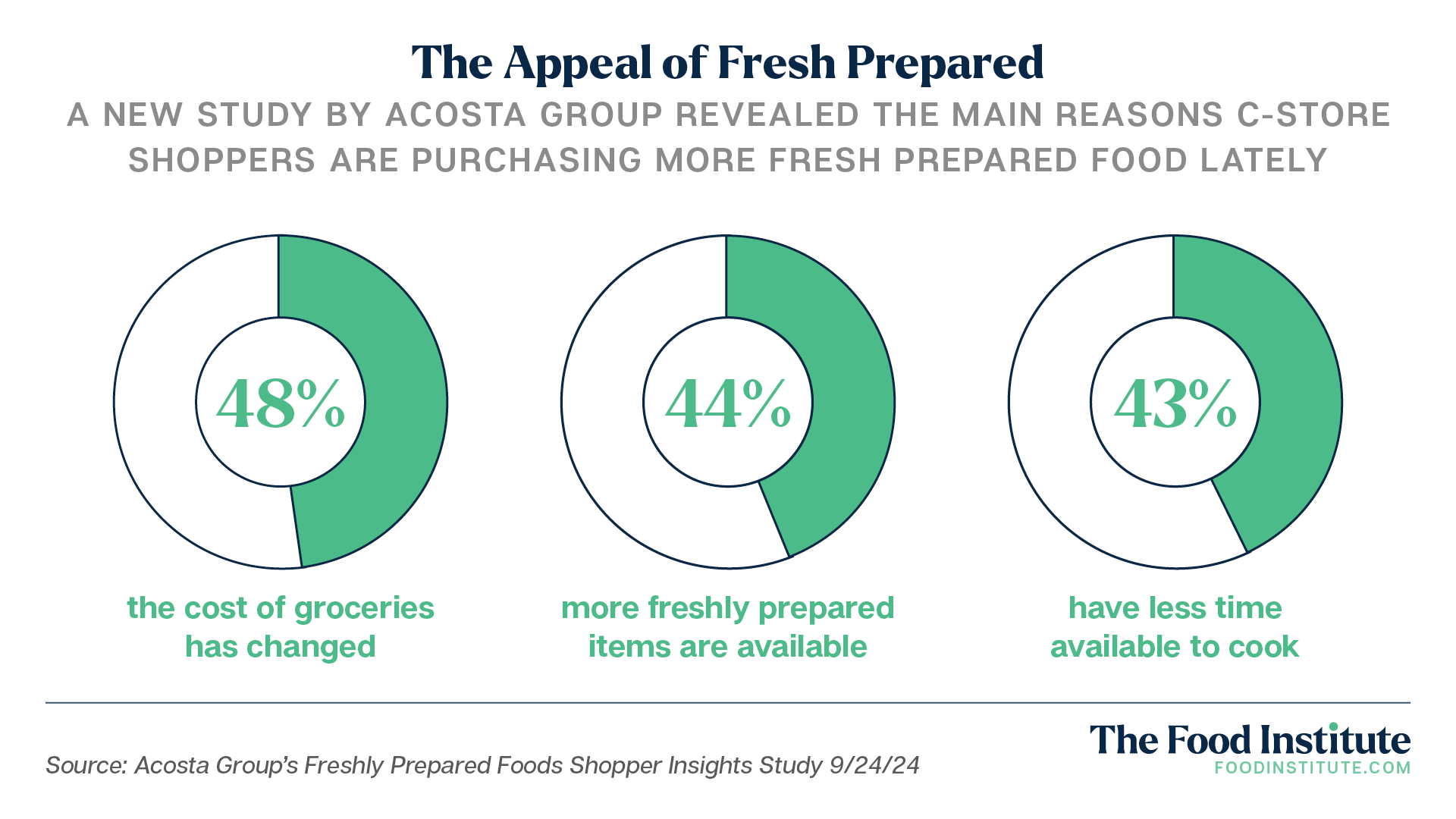

C-stores have undergone noteworthy shifts, embracing diverse offerings like fresh food and expanded dining options. These retail locations are increasingly viewed not only as places to fuel up, but also as affordable destinations for quick meals.

“It’s kind of an explosion in the convenience world, with prepared foods. And this hasn’t been something that’s just happened overnight,” D.J. White – senior VP of corporate distribution at CORE Foodservice, an Acosta Group agency – told The Food Institute. “Roller grills were kind of the first version of foodservice [at C-stores] and then it has evolved with pizza, and chicken, and now it’s evolving beyond that to a much higher degree.

“A protein bento box – you would never have seen that before in a convenience location.”

Convenience stores are the only channel to have grown in units per trip last year and number of trips.

“We’ve seen this over time when periods of inflation impact households,” said Doug Middlebrooks, senior VP, channel sales at Advantage Solutions. “More, smaller trips can take the place of larger stock-up trips in other channels, as people manage their household cash flow.”

This is likely a reflection of the trend that’s happening in grocery overall: a shift away from the “weekly stock-up” behavior to a more on-demand approach, with more frequent pickups and deliveries, said Jennifer Silverberg, CEO of SmartCommerce.

“This shift is getting consumers more used to smaller pack sizes, single-serve drinks, etcetera,” she added.

Regional Powerhouses Broaden Horizons

Regional C-store chains have developed loyal followings. In August, year-over-year visits were up 11.7% for Buc-cee’s, 7.6% at Sheetz, and 3.2% at Wawa, according to Placer.ai.

“These brands have become destinations in their own right,” Dr. Matt Hasan, CEO at aiRESULTS, told FI. “Buc-cee’s, for instance, is not just a store; it offers a unique shopping experience characterized by clean facilities, extensive snack options, and distinctive merchandise. (Plus), by providing EV charging, C-stores are positioning themselves at the intersection of convenience and sustainability.”

Successful recent stretches like those enjoyed by Wawa, Buc-cee’s, and Sheetz have helped inspire those brands to expand into new areas, broadening their reach.

Between January and August 2024, year-over-year visits to Wawa were mostly elevated, Placer.ai noted. Now, the chain is venturing into heavily populated Southern states like Florida, where its store count has grown significantly over the past few years.

Another chain with countless devotees, Buc-cee’s, is expanding beyond its Texas roots. The chain, known for its enormous stores, has already outpaced its strong 2023 performance this year, prompting it to open locations in Arkansas and North Carolina.

Dwell on it

By expanding into new areas, C-stores can tap into local visitation patterns. One metric that highlights local differences in consumer behavior is dwell time – the amount of time a customer spends inside a convenience store per visit.

During the first eight months of 2024, land-locked states like Wyoming, Montana, and North Dakota led the C-store category in dwell time, with average times per visit ranging between 21.2 and 28.2 minutes. The states with the longest dwell times also have some of the highest percentages of truck traffic on highways, Placer.ai found, suggesting that these longer stops are perhaps made by long-haul truckers looking for a hot meal or amenities like showers.

“What C-stores have really nailed is the science of what consumers need. They know the SKUs they need, the options they need, exactly what they need,” said Ellis Verdi, president of the DeVito/Verdi ad agency.

“Historically, there was always a high-price perception with C-stores. But today they’re much more competitive,” Verdi added. “Next to the gum or coffee that you came in for, there’s an appetizing roast beef sandwich or something else desirable.”

Business Lessons to Be Learned

A key differentiator between C-stores and other businesses is the flexibility these stores offer shoppers, with both foodservice and overall snacking occasions.

“The large variety of beverage options, for example, is something C-stores can leverage over traditional QSRs and other foodservice options,” Middlebrooks said.

“I think the convenience world is stealing share from other QSRs,” White said, “because they’re earning the trust of the consumer. … The convenience retailer is doing a great job of creating and driving customer loyalty.”

Grocers can also learn lessons from C-stores’ recent success.

“Grocery stores should think about how to make the quick stops easy and convenient,” Silverberg said. “Imagine I’m on the way home from work and realize I need to pick up milk; if I stop at the C-store I know I can be in and out in two minutes. But, at the grocery store, I have to park far away, go to the back of the store, then get in what may be a long line.

“The choice is easy – even if it costs an extra dollar, (the C-store) is worth it.”