The most beloved quick-service restaurant may give you pause – for one, it’s not a QSR in the traditional sense, but convenience chains’ growing market position has made them a formidable competitor. Enter Buc-ee’s, the Texas-based convenience chain with a cult-like following.

The business was named the top U.S. QSR in the Retailer Preference Index QSR Edition by dunnhumby, which looked at 58 U.S. QSRs and considered insights from 10,500 U.S. consumers.

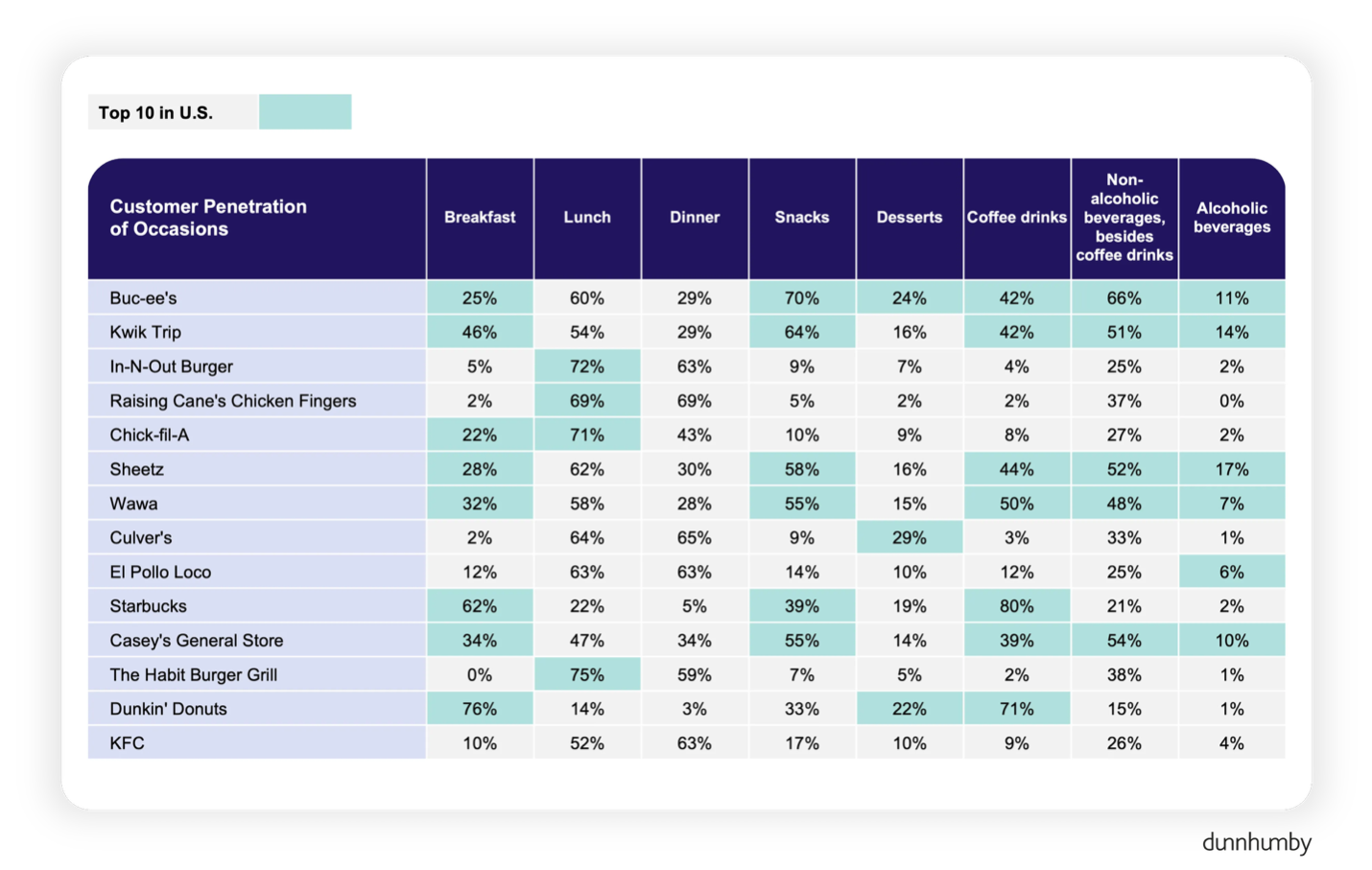

Here’s a look at the top chains in the first quartile.

The report expanded the definition of QSR beyond the traditional fast-food restaurant to include businesses that offer quick, convenient meal solutions, which allows café chains such as Starbucks to go toe-to-toe with convenience stores including Wawa.

“We are clearly seeing that a majority of consumers now see convenience stores as legitimate, and sometimes preferable, quick-service meal destinations,” said Matt O’Grady, dunnhumby president of the Americas, in a statement.

“For traditional QSRs, this shift underscores the importance of understanding what today’s customers truly want and taking strategic steps to deliver on those expectations. The brands that recognize this evolving landscape and focus on the right areas will be best positioned to meet customer needs in an increasingly competitive market.”

Translation: legacy businesses take note. Competition has become much more nuanced.

The RPI considers six pillars to determine success: quality experiences and products, visibility, convenience and speed, affordability, product variety, and seamless experience. Each of the top performers excel in multiple areas.

Where the Leaders Win

Despite headwinds hitting the general QSR segment and creating market stagnation, the top 14 brands are accelerating their growth faster than any other industry subgroup. Over the past five years, for example, foot traffic increased by 5.9% year-over-year for the top performers, compared to 2.5% in the third quartile, and 0.2% for those in the bottom.

This movement signals that strong customer value positions, i.e. those that hit multiple RPI pillars, are table stakes.

Let’s look at some of the key growth areas.

Daypart Dominance: Breakfast, Snacking

For these top-performing brands, breakfast has become a key to success. Breakfast solutions have a greater chance of meeting customers at a pivotal purchase point, more likely to be memorable because time pressures tend to be higher with morning traffic, school schedules, and work commutes.

Note that eight of the top ten breakfast QSRs are in the first quartile, with a surprising number of consumers choosing convenience chain solutions, such as Buc-ee’s, Kwik Trip, Sheetz, and Wawa, to satisfy their cravings. Conversely, lower-performing brands also see fewer breakfast shoppers.

Many of these same chains also excel at snacking occasions, demonstrating that winning in both areas can help keep consumers coming into the store.

Quality Above All: Now, Always

The top five brands all excel in one key aspect: high-quality products and experiences. Buc-ee’s ranks a shocking 98/100, while other notable leaders, such as In-N-Out, scored 90/100.

Macrotrends focused on personal health and well-being are likely motivating the emphasis that brands need to take to play in the space. More often, consumers want to feel good about the foods going into their bodies, even when searching for “fast food,” which has historically been perceived as unhealthy.

In addition to the product, the eating experience must also communicate quality. A clear example of this is In-N-Out’s open kitchen format, where consumers can see a clean kitchen cook high-quality meat in front of them, along with branding that advertises how naturally-derived its assortment is. Note that this experience doesn’t mean a price premium for the retailer, as an entire meal can still be purchased for under $10.

As such, Dunnhumby noted this pillar as the single most important determinant for the RPI.

Putting the Quick in QSR

In addition to offering top-quality food for the budget, QSRs still must be convenient and speedy.

In addition to quick turnaround times, some considerations for this metric include fast and accurate delivery, and ease and diversity of ordering methods (both in-store and on the app).

The top performers in this category include Kwik Trip (an honor befitting its name), Casey’s General Store, and Dunkin’. Note that, despite losing out to its main competitor, Starbucks, Dunkin’ is perceived as a much quicker and convenient beverage solution. This likely helps it carve out its market niche.

For the rest, the fact that convenience chains are taking these customers from QSRs should concern the traditional segment and motivate operators to better communicate convenience and introduce operational efficiencies.

Food for Thought Leadership

This Episode is Sponsored by: Performance Foodservice

How important is it as a food distributor to build a brand for foodservice – especially since consumers may never see or recognize it? Mike Seidel, vice president of procurement at Performance Foodservice Corporate, shares how the company views the development of its existing foodservice brands, including Roma and Contigo, and how they helped in the creation of its most recent Mediterranean concept Zebec.