Americans love their coffee. For many, a daily coffee run on the way to work, or as a little treat throughout the day, is imperative. The top chains delivering “craveability” are giving consumers unique flavor experiences and high-quality coffee for an attractive relative value.

The branded coffee shop market, currently worth $58.5 billion, grew by an astonishing 6.6% over the last 12 months; however, so too have coffee prices. Average 16-ounce latte prices have hit $5.19, which is leading to a pullback in chain growth plans and in same-store foot traffic.

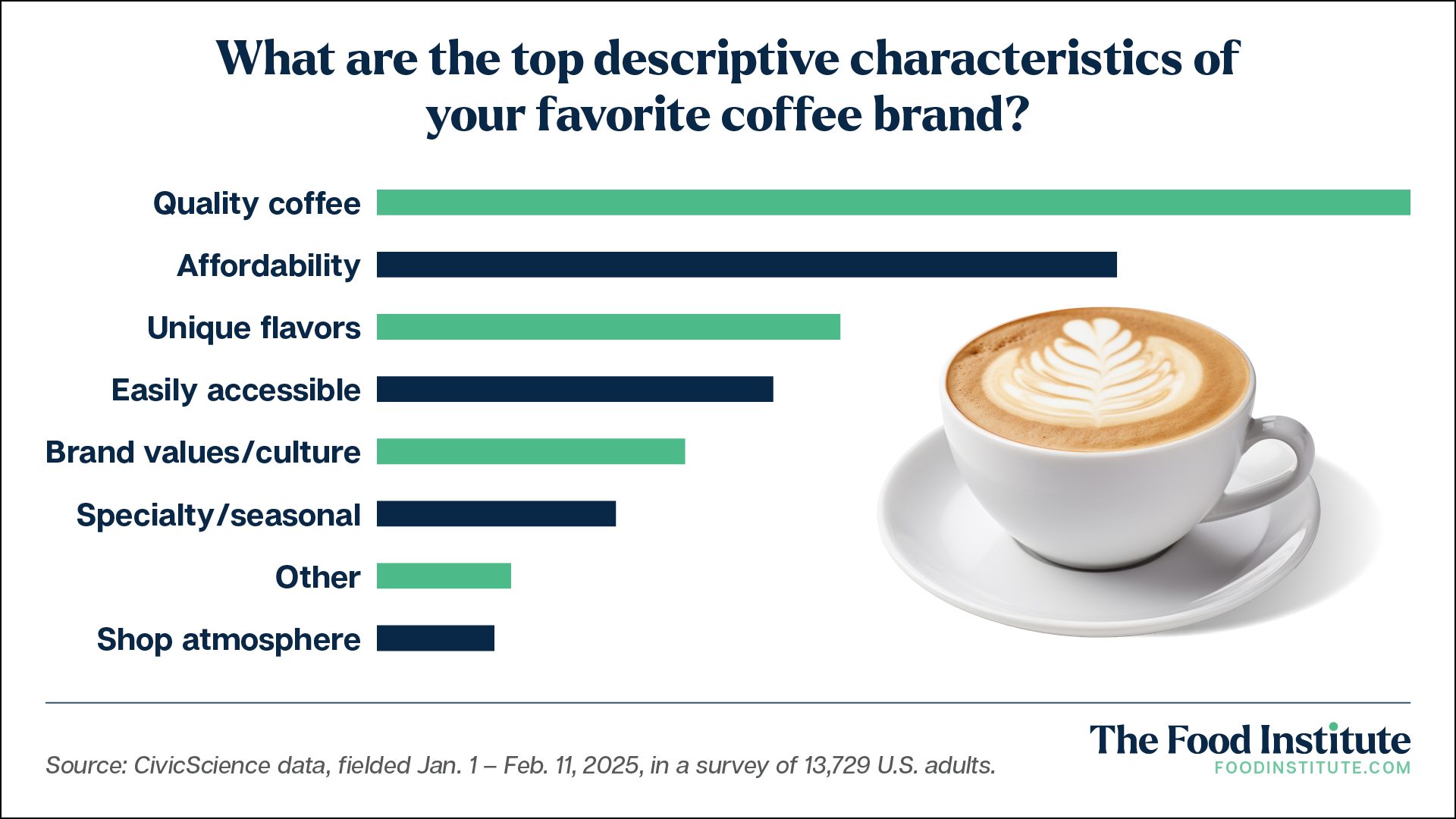

As a result, customer satisfaction in the chain is a clear indicator of a chain’s success. Leveraging consumer data from nearly 30,000 American adults sourced Jan. 1 – Oct. 6, The Food Institute determined the definitive ranking of the top national coffee chains, based on their craveability score.

Consumer sentiments toward the national chain were among the key factors considered in the ranking.

1. Peet’s

Dethroning Caribou coffee since the last time FI covered café chains’ craveability, Peet’s has delivered on top consumer need stakes with its coffee quality sourcing, roasting, and brewing, and rotating seasonal menu.

It has innovative caffeinated beverages, meals and treats, at a slightly lower price point than some other premium coffee chains on the list. Notably, Peet’s often comes out with on-trend items at a quicker pace than other chains. For example, their protein-added coffee line for foodservice debuted in January, roughly nine months before Starbucks.

Expect to see a line of cardamom-infused offerings coming to stores as well, such as the Cardamom Citrus Cold Brew Oat Latte and the Cardamom Citrus Mocha Frappé.

Overall, consumers are most satisfied with Peet’s beverage portfolio compared to others on the list, as the chain garnered the highest ratio of favorable views to dissenting opinions.

2. Caribou

In the year of the mid-sized coffee chain, industry giants of recent are eating into the precious market share of the national giants, and Caribou is a clear indication that this trend isn’t going anywhere.

Known for its unique and seasonal drinks, the smaller-sized chain excels in indulgent, flavors that play into larger industry trends. In this vein, the chain currently offers a line of Honeycrisp apple beverages that capitalize on consumer’s obsession with the apple variety, and this winter, they’re featuring innovations to a Spicy Mocha line as well as a Cranberry Dark Chocolate cold-press coffee that offers a dessert-like beverage experience.

Perhaps, too, the secret is in its obscurity. Despite having locations across 20 states, more than 40% of consumers didn’t know it even existed. The smaller footprint, however, affords the café the ability to more easily serve the needs of its local community, likely contributing to a higher overall preference.

3. Starbucks

Love it or hate it, Starbucks has left its mark on the U.S. and global market. It is known for its premium-priced beverages with a devoted following, helped popularize the current specialty coffee movement in retail, and even created the pumpkin spice latte.

In recent years, however, it has strayed from its brand promise; as a result, its foot-traffic has faltered. Current CEO Brian Niccol is trying to bring the chain back to its former glory with a “Back to Starbucks” approach that endeavors to offer a modern coffee experience while also maintaining its signature “coffeehouse” feel.

Nevertheless, it continues to be the most recognizable entry point for the general consumer into the specialty space, being among the first national chains to offer nitro cold brew beverages, and offering a level of customization and range to delight the most discerning consumer.

It’s worth mentioning, however, that, although consumers love the brands’ offerings, the largest percentage also looks at them unfavorably. Within the context of their selection, it’s likely because of the high price relative to the perceived value, as affordability ranks higher than other unique or specialty characteristics.

4. Dunkin’

Years into a rebrand, Dunkin’ has worked hard to shake the “doughnut-first” image of its past. Now, it boasts a selection of specialty beverages and pop-culture collaborations that excite its consumer base while also offering attractive deals to incentivize experimentation.

This summer, the chain worked with pop singer Sabrina Carpenter on a lineup of themed beverages hot and cold beverages. On Oct. 16, the brand also partnered with actress Salma Hayek on a marketing campaign with Kahlúa, suggesting the importance of partnerships in the brand’s go-to-market strategy.

They’re taking notes from major QSRs and fast-casual chains that have launched similar collaborations, and the plan is paying off. In March of this year, a report found that, while Starbucks visits were down 1.6% year-over-year, Dunkin’ only dropped 0.6%. Before that, however, Dunkin’ struggled to secure visit growth.

5. McCafé

Since relaunching in 2017, McCafé has gained recognition through its affordable accessibility into premium beverages, including latte and frappe espresso-based drinks, and indulgent coffee-based treats.

McCafé has the scale, value, and its companion assortment of McDonald’s breakfast purchases to sweeten the deal; however, it lacks in the innovation space, not offering as much availability for on-trend flavors or formats. On the other hand, it has clearly distanced itself from the traditional convenience store or “fast-food” coffee with the bare minimum quality commitments (100% arabica beans) and a premium spin.

Surprisingly enough, consumers view the chain nearly as favorably as Peet’s and Starbucks, but with a larger unsatisfied customer base as its foil. This is likely the result of expectation setting – walking into a McCafé offers less of a “coffeehouse feel” than some others on the list. Still, their selection entices many.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.