In 1893, Caleb Bradham invented a digestive tonic to sell at his drugstore soda fountain in New Bern, North Carolina. “Brad’s Drink” would eventually become one of the top-selling carbonated soda brands in the world – Pepsi-Cola. In an era before modern OTC medicines, it was the apothecary tonic that Americans reached for to handle gas, constipation, and heartburn. The original ingredients in Pepsi-Cola included: sugar, water, caramel, lemon oil, kola nuts, nutmeg, and other additives. Its predecessor, Coca-Cola, had a similar digestive tonic origin. 19th-century soda was the ginger turmeric shot of its time.

The forgotten gut health origins of America’s top soda brands make Pepsi’s acquisition of gut health insurgent – Poppi – ironic indeed. Is Poppi both flavor and formulation nostalgia? Perhaps. But not intentionally.

High-growth “on-trend” brand acquisitions like this serve other strategic purposes inside public companies. And so do extensions of iconic brands on the tailwinds of emerging attributes such as “prebiotic.” What’s happening with prebiotic fiber has happened repeatedly since the 1990s. Low fat. Low carb. Natural. Organic. Probiotics. Low sugar. Stevia. Protein. It’s a veritable parade of niche attributes that have gone mainstream.

There is a strategic logic to these attribute-level extensions, even if they don’t pan out long-term.

Let’s explore.

PepsiCola’s Aging Beverage Portfolio is Prone to Leaks

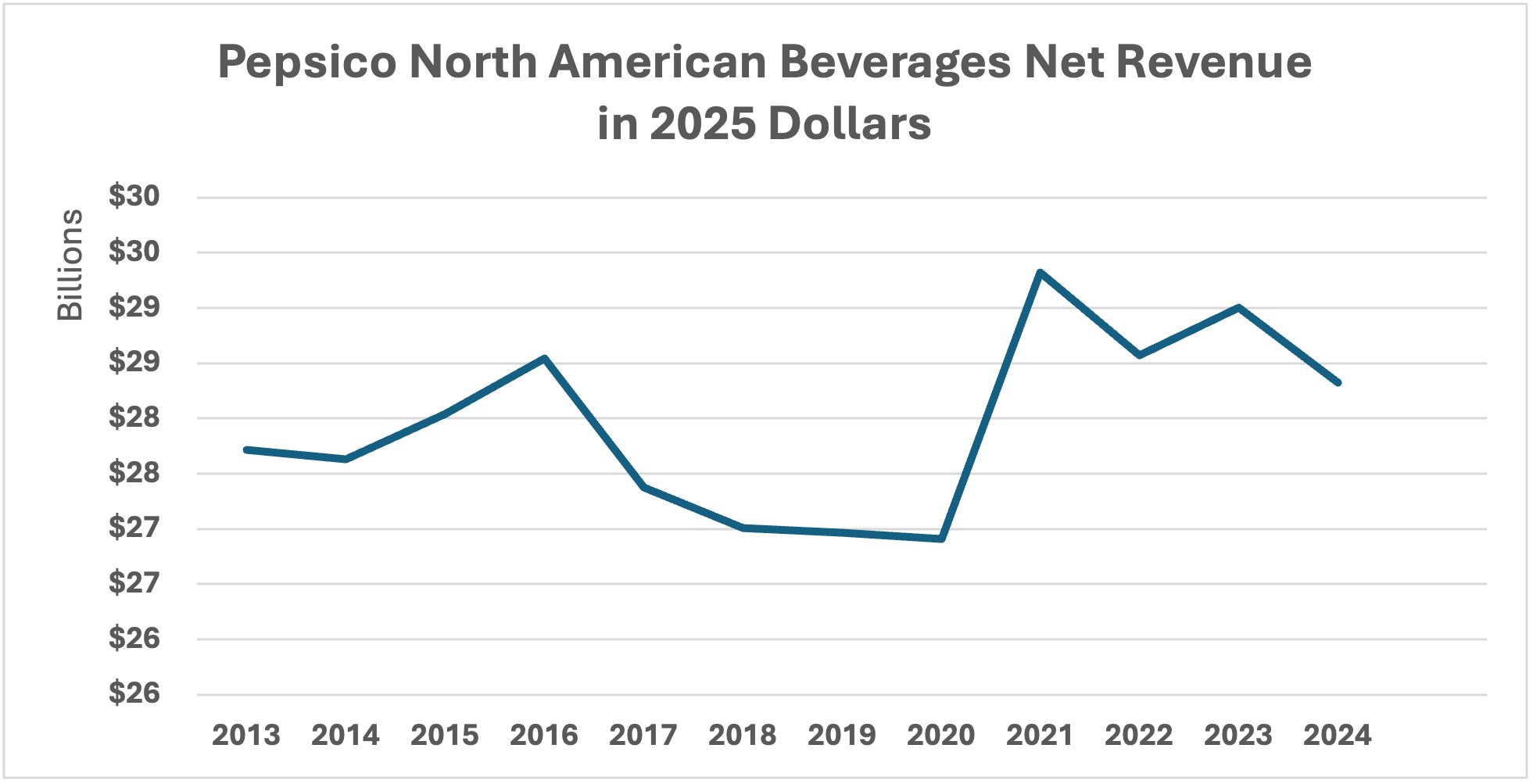

To figure out what leads a holding company to fire out a copycat brand extension so soon after acquiring a similar insurgent, it helps to look at the PepsiCo North American Beverages segment (PBNA) more closely and recognize how holding companies tend to respond to what we see.

PBNA contains mega brands such as: Pepsi, Mountain Dew, 7 Up (international), Starry (formerly Sierra Mist), Gatorade, Aquafina, Tropicana, Tropicana juice drinks, Naked Juice, Izze, SoBe Lifewater, AMP Energy, Lipton (ready-to-drink), Mug Root Beer, Rockstar Energy, and Soda Stream. It also earns JV distribution fees for Starbucks’ multibillion-dollar RTD coffee business.

This is a dated portfolio full of corn syrup and sweetness. Starbucks’ new Cold Brew line does not change this much. Even the newer energy drink brands Pepsi distributes are full of corn syrup and sugar. Serving sugar reduction needs in the market has always been a brand extension move for the large players, such as Diet Pepsi, Coke Zero, Gatorade Zero, Rockstar Sugar Free, and even No Added Sugar Frappuccinos in a bottle. Rarely have beverage conglomerates acquired a pure-play low-sugar brand (outside of water) outright.

As of 2024, U.S. ready-to-drink beverage demand (measured by volume in gallons) is only growing in bottled water and energy drinks, according to data published by the Beverage Marketing Corporation. Carbonated drinks (a category that includes zero calorie offerings) are flat in terms of volume and growing revenue primarily due to pack-price mix changes and price increases. Bottled tea, value-added water, sports drinks, fruit juice, and coffee are all losing volume and are flat in terms of revenue.

Per capita consumption of soda is down across all age groups, especially teens (i.e., Gen Z and Gen Alpha).

Before the pandemic, PBNA, specifically, struggled with consistent volume declines and flat revenue for years. The pandemic lent the whole business a “hybrid work” baseline boost (as has been true across most food categories). Then the slow decline resumed in 2022 when we factor out inflation-adjusted pricing actions.

In 2025, total volumes for PBNA are down 3% already (excluding acquisitions and divestitures), with the volume problem accelerating in Q2.

However, underneath the line in the chart above is a darker tale of nonstop leakage. According to the Beverage Digest, the volume (in gallons) of core Pepsi-branded trademarks declined 32% from 2010 to 2023.

At the corporate level, PepsiCo stock is down 19% in the past 12 months, and GAAP-reported EPS has been collapsing (hence the former statistic). PepsiCo’s core foods portfolio in the U.S. is not helping matters due in part to the effect of GLP-1 medications now operating at scale. As of July 17, the company is forecasting a total core EPS hit of -1.5% for the year, up from worse estimates earlier in the year, around the time they acquired a trendy brand called Poppi.

Ah hah!

The March 2025 timing of the Poppi acquisition was urgent and defensive, not simply opportunistic deal-making. PepsiCo had tried to acquire Olipop in 2023 but was rebuffed. As of March, Pepsi needed a significant acquisition to boost EPS and fix its PBNA revenue trajectory as it continues to engage in aggressive cost-optimizations.

As a $500 million business growing in the mid-double digits, Poppi could add 2% revenue growth for PBNA within the next 2-3 years if it continues to grow. That’s a significant upswing for just one brand, really big.

The strategic imperative of large business units in structural volume decline, like PBNA, is to aggregate any profitable slivers of upward-trending volume growth to stabilize the beast. Rarely is the idea to return the entire portfolio to growth, but rather, simply halt the leaking. The beast is too large and old to plot even 5% or 10% organic growth. PBNA is not managing a brand on the Skate Ramp.

OK, you might say, this explains acquiring a fast-growing, $500M brand, an upward tilting sliver of profitable volume growth, but Pepsi prebiotic?

Pepsi Prebiotic Soda – Why?

Pepsi Prebiotic Soda – Why?

Why launch a gut health extension of Pepsi’s flagship cola brand to compete directly with your recent acquisition? This is the question thousands of industry observers and pundits have posed breathlessly in the weeks since this announcement. Casual observers and cultural critics have trashed the idea as doomed to failure without considering why holding companies make these kinds of seemingly duplicative moves. Or how complicated the consumer base is inside of even slowly dying trademarks like Pepsi.

There are at least three misplaced criticisms of Pepsi prebiotic soda I keep reading:

- It competes with the acquisition of Poppi – does it, though?

- No one who likes Pepsi is interested in a trendy gut health version – Really?

- This is nothing more than a trendy Gen Z marketing experiment in brand extension form with minimal revenue expectations internally – possibly, but unlikely.

Before I address these “hot takes,” it’s important to understand one thing germane to iconic soda brands in particular. Every flagship soda icon (Pepsi, Coke, Mt. Dew, Mug, Sprite, etc.) functions in our consumer culture as a branded flavor equity. These soda brands are exactly like candy brands. The brand IS a flavor experience. While there may be throwback offshoots like Vanilla Pepsi and Wild Cherry Pepsi, these don’t drive core volumes for these kinds of trademarks. The fact that Diet Coke and Diet Pepsi drinkers swear by each version of the same artificially sweetened liquid is further proof that these brands have an irrational flavor hold on their adherents.

I bring this up because we should always assume there is a large group of Pepsi or Coke drinkers who simply refuse to give up on the branded flavor experience or who merely trust it far more than something new they see on the shelf (and not on TikTok or YouTube).

1. Pepsi Prebiotic will compete with the acquisition of Poppi

This assumes the audiences for Pepsi and Poppi do not feature a significant demographic divide separating them. Let’s think this through.

Health and wellness trends like “prebiotic” cut across significant demographic variables (age, gender, income), except for educational attainment. But even the high-school-only crowd gets on board with the right motivators. Think of this endless parade of modern health attributes as “the what” in monetizing health trends. Pepsi wants its fair share of the entire prebiotic-inclined consumer base. This is the luxury of being a market-leading company.

Yet, emerging brands in food and drink tend to create heavy users, mainly among the younger generations alive when they launch. Think of brand as “the how” in trend delivery. This is where I suspect Pepsi prebiotic makes sense.

Twenty years ago, Frito-Lay North America created a nine-figure platform known as “Simply” to create additive-free, “natural” versions of most of its iconic salty snacks. They did this to retain consumers who might otherwise experiment with natural alternatives but who trusted the Frito-Lay brands far more than the emerging ones to deliver on a great taste experience. My Gen X wife and I were the target audience, for sure. This strategy is about extending brands to retain slivers of demand (i.e., young households that might otherwise be lost).

It’s fair to say that PBNA is smart enough to recognize that a similar thing is probably going on with the prebiotic soda trend. Older consumers, especially, will prefer these trends to appear in high-trust brands and familiar flavor bases; higher trust than even the trendy Poppi.

And, remember, it only takes 2-3% of U.S. households to generate $100M in annual sales for an average-priced food or drink beverage. It takes fewer households if there are extremely heavy users in the mix.

2. Absolutely no one who likes Pepsi is interested in a trendy gut health version

After sixty years of intense youth marketing, Pepsi has a loyal Silent generation cohort, a loyal Boomer cohort, a loyal Gen X cohort, a loyal Millennial cohort, etc. If we accept this reality of broad age-based household penetration for most soda brands, then we have to ask if some Baby Boomer Pepsi lovers are interested in gut health trends.

Absolutely! In fact, there is a nearly 100-year-old cultural practice that younger people have not clued into due to our extreme youth culture – fiber supplementation increases as we age. Older Americans have been using soluble fiber to eliminate constipation since the advent of prune juice and Benefiber. Surely, there is an older demographic that thinks they need all the fiber they can muster, AND who loves Pepsi.

Since the word “prebiotic” simply cues a ‘new’ soluble fiber supplement to those learning about the term, it is very possible that Baby Boomers simply see this trend as another way to slip some added fiber into their diets under an ancient rubric of ‘more fiber for better transit.’ Very few will bother to discover that Pepsi’s prebiotic fiber is made from corn, not inulin or cassava (i.e., Poppi). Most will never care.

Furthermore, many older soda consumers switched to diet soda during their lifetimes. And, though not zero calorie, Pepsi prebiotic will go to market as a near-diet drink that should appeal to all but the diabetic minority of diet Pepsi lovers.

In other words, Pepsi prebiotic seems well designed to tap into Gen X and Baby Boomer Diet Pepsi love with a trendy source of soluble fiber that brands like Olipop and Poppi have established does not affect the taste or texture of these drinks. Diet Pepsi is where cannibalization may occur, possibly. Or it will bring Pepsi-lovers back. Or simply offer something new to throw into one’s CSD rotation.

3. Pepsi prebiotic is a marketing stunt, nothing more.

I would believe this IF they hadn’t already announced plans to go into retailers. If it were simply an Amazon online release, then this dismissal makes more sense. Instead, I honestly think they have data suggesting there’s an older, fiber-loving segment of Pepsi and Diet Pepsi drinkers out there who aren’t interested in a new brand – they want the latest trend from their favorite brands in a brand-dominated category where private label is a miniscule percent of sales and new brands have rarely succeeded in capturing share like the prebiotic wonder twins.

In sum, Pepsi’s prebiotic could easily generate $100-200M in upward-tilting, slow-growth sales that any executive at Pepsi would be crazy to ignore, given how easy it is for them to fire out a Pepsi line with corn fiber tossed in. When you have an installed base of fans, even when you’re declining, it’s remarkable how a brand extension can generate a new sliver of growth if you get it out there and marketed to the right folks.

The privilege of being Pepsi is to wait for insurgent brands like Poppi to validate the national scale of emerging health attributes and then ensure your other brands get their fair share of the trend.

So, be prepared for prebiotic Lipton tea, prebiotic Diet Pepsi, and prebiotic Tropicana! Seriously.

Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage CPG brands. As a professionally trained cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, including brands owned by Coca-Cola Venturing and Emerging Brands, The Hershey Company, General Mills, and Frito-Lay, as well as other emerging brands such as Once Upon a Farm, Rebel creamery, and June Shine kombucha.

Dr. Richardson is also the author of “Ramping Your Brand: How to Ride the Killer CPG Growth Curve,” a #1 Best-seller in Business Consulting on Amazon. He also hosts his podcast – Startup Confidential.

The Food Institute Podcast

It’s a big world out there – what trends are percolating on the global scene? JP Hartmann, director of Anuga, joined The Food Institute Podcast to discuss the intersection of U.S. and international trends and how the Anuga show is one not to miss.