In a recent webinar, Food Business News shared emerging data, trends, innovations, and consumer insights impacting the alternative meat, dairy, and seafood markets.

Although the $1.03 billion industry experienced astronomical growth from 2018-19, sales sharply declined in the following years due to widespread industry consolidation, oversaturation of plant-based products, and pricing concerns.

Minding a Meaty Price Gap

While alternative dairy and seafood products are regaining momentum, meat alternatives continue to lag, partially due to the massive price-per-pound gap between their products and standard meat.

Clocking in at $4.20 per pound, this gap is significantly larger than that of alternative dairy ($0.31/lb.) and seafood ($1.27/lb.) and highlights a pressing need for alternative meat manufacturers to find innovative ways to bridge this gap.

Fresh vs. Frozen Meat Alternatives

Despite a recent growth spurt in the fresh category, frozen meat alternatives continue to outperform fresh year over year, but both have their place. The 2024 Integrated Fresh Scan Panel by Circana revealed that 29% of shoppers are buying both fresh and frozen, with 36% of frozen buyers also purchasing fresh items and 63% of fresh fans buying frozen as well.

Circana Executive Vice President and Perimeter Practice Leader Chris DuBois attributes some of this difference to the location of these products in supermarkets. “It’s important to consider where shoppers are expecting to find meat, seafood, and dairy alternatives,” he told webinar attendees.

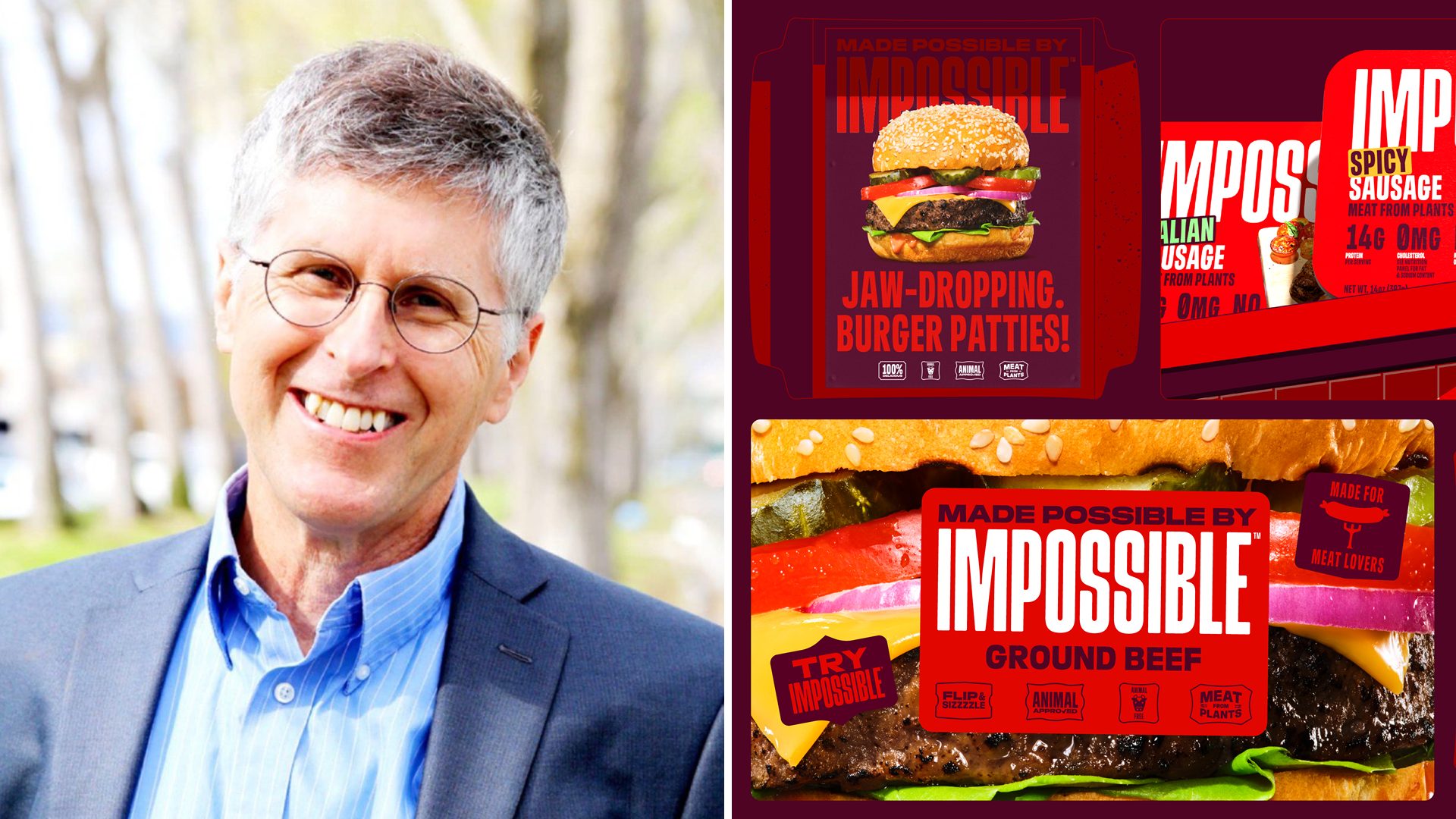

This brings to mind Impossible’s pivot to sell their ground “beef” in the fresh meat section a few years ago to capture shoppers who are more flexible in their meat consumption.

Alternative Meat Market Demographics

Considering that 12% of respondents categorized themselves as flexitarians in a recent Circana survey compared with 80% identifying as meat eaters, 7% as vegetarians or vegans, and 1% as pescatarians, Impossible’s decision has proven to be a smart move in terms of reaching the carnivorous and flexitarian crowds.

On the plant-based side, Millennial and Gen X households with higher incomes reign supreme, and the heaviest buyers make up only 20% of the market yet account for 75% of dollar sales.

They also make four times as many grocery trips and spend twice as much per visit, making them an audience that manufacturers cannot afford to ignore.

So, what do these consumers care about?

Winner Winner Alt. Chicken and Turkey for Dinner

Producers of alternative chicken and turkey patties are jumping on the better-for-you bandwagon as a lean protein option. Health-conscious flexitarians are particularly interested in chicken alternatives since they’re already flocking to the poultry aisle fairly often.

Another product resonating with the alternative meat market is plant-based deli meat like Tofurky’s Roasted Turk’y, which is part of a collection that also includes vegan bologna and smoked ham.

Transparent Labels and Simple Ingredients

In light of the recent ultra-processed panic, mindful product packaging is paramount — and the more certifications from trusted entities like the American Heart Association, the better.

Alternative meat companies that prioritize clean ingredients and straightforward labels are expected to dominate the future market.

Consumers want to know how their alternative sausage is made, so to speak.

Flavor-Forward Options and Elevated Experiences

Other ways to resonate with alternative meat buyers include incorporating on-trend flavors, especially ethnic offerings like Abbot’s PB Fajita Chick’n, and spin-offs of restaurant favorites — better yet, collaborations with them.

Case in point, the Impossible Whopper has made its way onto Burger King’s menu and Morningstar Farms recently launched Pringles-flavored Chik’n Fries.

That said, it’s crucial for brands to avoid moving so quickly that they leave consumers behind, as risk aversion remains strong. Many shoppers say they’d rather eat the same alt. meats on repeat than risk disappointment from newer and expensive plant-based products they try but dislike.

The Future of Meat Alternatives

Cultivated meat continues gaining momentum, and 174 producers are now on the market despite multiple U.S. states banning sales earlier this year.

Fermented meat is also winning over new customers. Over the last 52 weeks, meati was second in dollar growth within the alternative meat market.

Irina Gerry, spokesperson for the Precision Fermentation Alliance, told FI in February, “Companies are actively focusing on developing foundational industry capabilities, showcasing their commitment to innovation and diversification of protein supply.”

The Food Institute Podcast

U.S. grocery retailers are facing regulatory scrutiny on pricing, ever-increasing shrink and a financially-stretched consumer, but how can they adapt to these new market pressures? Supermarket Guru Phil Lempert joined The Food Institute Podcast to discuss the Kroger-Albertsons merger, the rise of private label and more.