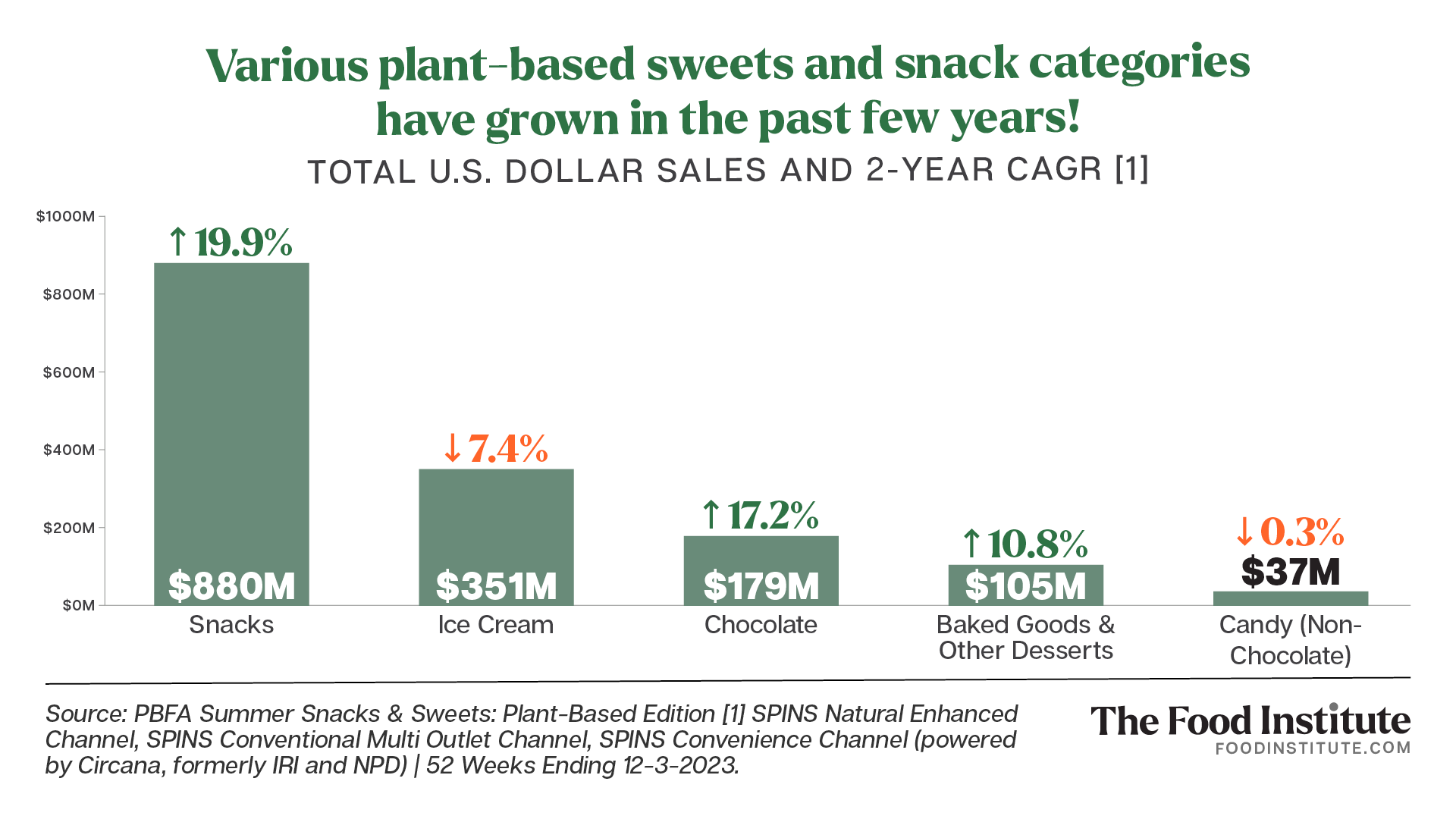

More consumers are seeking out plant-based sweets and snacks, according to a new report from the Plant-Based Food Association (PBFA). Plant-based snacks grew nearly 20% in dollar sales from 2022 to 2023, while chocolate, baked goods, and other desserts also enjoyed a considerable sales lift.

But what makes a snack plant-based? Many snack foods and desserts are largely comprised of plant-based ingredients, although not necessarily healthy or better-for-you.

When compiling data and insights for its Summer Snacks and Sweets report, PBFA only included products that do not contain animal-based ingredients.

“We do not want to over-inflate the numbers by including traditionally plant-based snacks like potato chips, tortilla chips, pretzels, inherently plant-based popcorn or inherently plant-based sweets such as lollipops,” said Linette Kwon, Data & Consumer Insights Analyst at PBFA.

Popcorn, Granola Bars Driving Plant-Based Snack Sales

Plant-based popcorn accounted for the largest share of snack sales, growing 6.6% year over year, followed by puffed snacks and straws. Buttery and cheesy seasonings were popular across both subcategories, while puffed varieties also saw success with flavors like peanut butter, cinnamon, and sea salt.

Meanwhile, granola bars and snacks saw a tremendous 32.8% growth spike YOY reflecting consumers’ interest in more natural and convenient snacks.

Twenty-nine percent of U.S. consumers say that their healthy snack consumption has increased in the past 12 months, with 55% eating a healthy snack at least once a day.

Cookie Dough, Ice Cream Among Popular Sweet Treats

In the sweets and treats department, nostalgia and health drove shopper preferences in 2023. Ready-to-eat cookie dough gained popularity along with lemon-flavored baked goods, nutty chocolates, and smaller bite-sized ice cream treats.

Overall, the household penetration rate of plant-based ice cream was 10.4% and the repeat rate grew across different regions with states in the Western U.S. taking the lead. However, per Circana, dollar sales for dairy alternative ice cream/sherbet were down 3.8% in the 52 weeks ending 6-23-24, and alternative frozen novelties were down 19.3%. What’s holding the category back?

According to Julie Emmett, VP of Marketplace Development at PBFA, merchandising hurdles in the frozen food aisle can make it difficult for consumers to know what is plant-based or animal-based, as both types are placed together, often with no shelf tags or other indications.

“Some strategies we believe could mitigate this challenge include freezer clings/signs and category blocking with shelf tags to make it easier for shoppers to find,” Emmett told FI.

Another challenge is that the persistent price gap between plant-based and animal-based ice creams — coupled with inflation’s impact on discretionary spending.

“Our analysis revealed that the average retail price of plant-based ice creams in 2023 was still nearly 18% higher than that of animal-based ice creams,” said Kwon. “Although inflation can sometimes increase indulgent purchases as a form of comfort, shoppers are still more likely to purchase what is less expensive, which is likely animal-based ice cream and private label ice creams.”

While the price gap exists, the average retail price animal-based ice creams increased by 8.8% in the past year, nearly double that plant-based varieties (4.5%), which demonstrates the resilience of the category amidst inflation and rising food costs.

Labeling and Certifications

The importance of labels and claims on plant-based products is also growing as consumers become more conscious of how food choices impact health and the planet.

Labels and certifications make it easier for shoppers to find sustainable food options and feel more confident in their choices, says Emmett.

“We believe consumers’ increasing desire for more transparency and information will be key for building further trust, loyalty, and purchases in the plant-based industry.”

A recent survey PBFA conducted with Qualtrics found that 98% of primary grocery shoppers are aware of certifications, 79% believe certifications are important, and 74% trust products with certified seals more than ones without.

Some trending claims for plant-based snacks and sweets in 20232 include vegan, gluten free, high protein, and fair trade.

The Food Institute Podcast

Tom Hamill, a food and beverage senior analyst for RSM US LLP, joined The Food Institute Podcast to recap the 2024 Summer Fancy Food Show. Hamill shares his thoughts on burgeoning trends from the show and how emerging specialty food brands can best navigate economic factors in the years to come.