Pumpkin pie, crouton stuffing, cranberry sauce – the trappings of a Thanksgiving dinner. Is it sacrilege to substitute store brands for the name brands that came up with the recipes in the name of saving a few bucks?

A survey by the Wells Fargo Agri-Food Institute found consumers can save $17 on a turkey day dinner for 10 – $73 vs. $90 – if they substitute store brands for the name brands that have graced many a table.

“Seventeen dollars in savings may not sound like much, but during a season when costs keep rising, it can make a noticeable difference for many families, especially when that difference is multiplied throughout an entire shopping list,” Clay Cary, of CouponFollow told The Food Institute.

“While many treasured recipes and traditions specify brand-name ingredients, very often, families find the store brands to be comparable in quality for basics such as canned vegetables.”

Overall food costs are up 2.1% this year compared to last, government statistics show. That’s atop a 2.9% increase from 2022 to 2023 and 7.1% the previous 12-month period.

A survey of consumers commissioned by Bazaarvoice found 88% of respondents said they were more conscious of prices.

Approximately 63% of consumers indicate there are only certain products for which they insist on brand names.

A Focus on the Familiar

A recent Circana report found that despite higher costs over the past few years, 79% of consumers plan to celebrate Thanksgiving with the usual traditions and 34% plan to not cut back on their purchases.

Additionally, 61% of Americans plan to eat their main Thanksgiving meal at home—a slight decline from previous years—creating greater opportunities for retailers to promote host-friendly gift options.

That said, more intimate celebrations were being planned, according to Acosta, which found one-third of gatherings would include 10 or more people. Additionally, 20% of those celebrating Thanksgiving planned on attending 2 or more gatherings.

Some Sitting Thanksgiving Out

Recent research from retail data science company 84.51° also illustrates that many shoppers seek value as Thanksgiving 2024 approaches. Among 84.51°’s noteworthy findings:

- 71% of consumers expressed a preference for sales this holiday season

- 46% plan to be Thanksgiving guests at someone else’s home

- 29% expect to host a Thanksgiving meal themselves

- 11% will not celebrate Thanksgiving this year, with a portion of those individuals having an income of $50,000 or less.

“When asked about the biggest challenges in preparing for Thanksgiving, 28 percent cited cooking the meal, followed by coordinating with family and friends” (23 percent), noted Alex Trott, director of insights at 84.51°.

Turkey Prices Hold Steady

The good news in the Wells Fargo survey is that turkey prices are unchanged from a year ago despite the continuing avian influenza outbreak. Name-brand turkeys are actually 2% cheaper than last year while store brands are up 5%, though still less expensive than the brand-name birds.

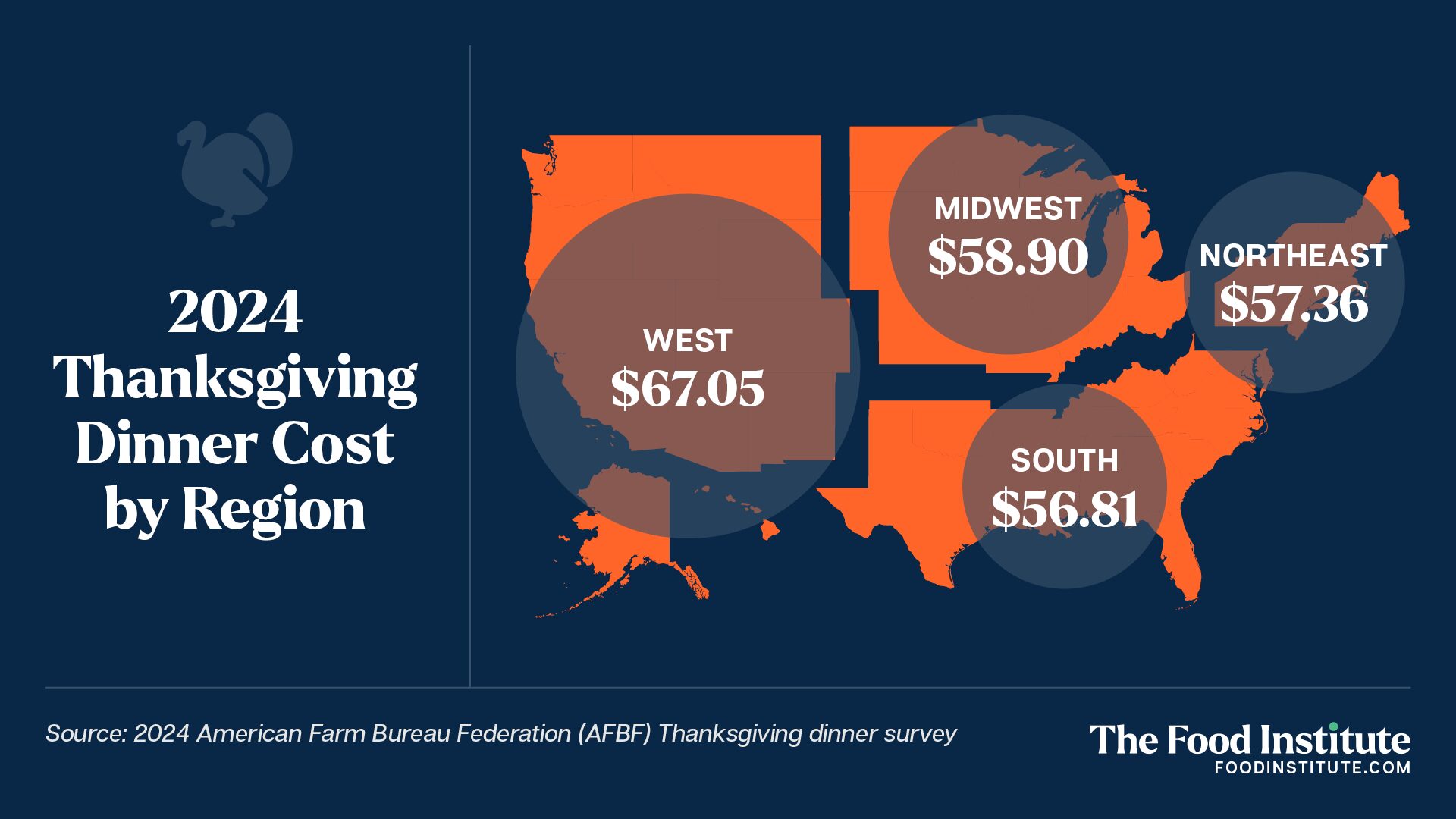

This trend was reinforced by the American Farm Bureau Federation (AFBF), which reported prices for turkeys were down 6% when compared to the prior year in its annual Thanksgiving dinner report. Additionally, AFBF reported that turkey accounted for 44.2% of the cost of a classic 10-person feast, which was in line with the historical average of 43%.

“Consumers are exhausted from years of inflation, and it will take more than the past two years’ improvements to ease the pain. However, these declines are reflective of the greater affordability of food in the U.S.,” said report authors Samantha Ayoub and Bernt Nelson.

When it comes to stuffing, name brands are up 9% while store brands are up 3%, and dinner rolls also are more expensive with store brands costing $4 less than the name brands. Pumpkin pies are more expensive, with brand names up 1% and store brands up 3%.

Beverage prices, meanwhile, are all over the place. The Consumer Price Index shows beer up 3.3% from last year and wine up 2.4%. Twelve-ounce cans of soft drinks are up 1.7%.

“Thanksgiving is deeply rooted in tradition where family recipes hold great sentimental value,” Matt Bellarose of Lobsterorder told FI. “While Wells Fargo’s analysis shows that opting for store brands can save $17 on the meal, the decision isn’t solely about economics.”

“Many families feel nostalgic ties to specific name-brand ingredients that have been part of their recipes for generations.”

“However, with food prices,” he added. “I believe we’ll see a more pragmatic approach: People may choose store brands for less critical items while still splurging on select brand-name staples that uphold their cherished flavors. This balance allows them to honor traditions while being mindful of current financial constraints.”

84.51°’s research revealed that 91% of consumers expect to spend the same or less than last year.

“It’s important to note that consumer sentiment around inflation remains high,” Trott said, “with 63% of shoppers expressing concern, despite the lower inflation rate (of late).”

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.