Editor’s note: This column represents the opinions of industry consultant Dr. James Richardson and not necessarily those of The Food Institute.

For years, foodservice has been an early cash-flow lifeline for CPG founders, especially in food and beverage. You can drive your product to cafes in your home city and get paid in weeks, not months. Yet, as with tiny independent health food stores, same-location velocities rarely grow much in foodservice because the typical location has a tiny addressable market on a weekly basis compared to a Safeway or a Walmart Supercenter.

The amazing thing about away-from-home foodservice is that impulse sales can be remarkably stable, even when no one knows your brand. You win solely on underrepresented attributes and a lack of visible competition. You compete on a more level playing field than on your local grocery store shelves. This is an undercapitalized founder’s dream.

Chains like Starbucks, Chipotle, and Mod Pizza are the real ‘prize’ because they have long favored emerging snack and beverage brands and can scale a brand to thousands of locations with above-average foot traffic. Starbucks can still create millions in annual revenue for an emerging brand lucky enough to get in its POS cases.

Yet, how you design and negotiate this initial foodservice access matters in the long term. The initial strategy you bring can haunt your business later when you desire to expand beyond foodservice.

Classic Approaches to the Foodservice Channel for Retail-Focused Brands

The classic approach CPG operators have used is to sell their retail-labeled products inside the food/beverage cases of local cafes, QSRs, etc. With help from partners like DOT Foods, it’s far easier to get into foodservice indies than into chains. Founders who intended all along to be a consumer-facing brand tend to use this approach to jump-start initial cash flow.

As retail brands grow, some founders turn to foodservice outlets as self-funded marketing billboards to support awareness-building for their much larger core retail business. This is clever but requires discipline and dedicated sales support to deliver any awareness upside, given that the business line will be only 1-5% of the brand’s dollar volume. The right locations are paramount.

There is another way into foodservice, though, one that many of us have forgotten: as an ingredient. Emerging CPG brands like Yellowbird hot sauce do this with their retail packaging, offering a critical long-term advantage: clean branding that transfers to shoppers across any channel. Restaurant diners use Yellowbird hot sauce ‘for free’, sample the outcomes, and can memorize the exact same brand identity and packaging they will find in local retailers.

If you sell your product in foodservice packaging as a back-of-house ingredient, though, you will not build brand awareness with consumers … unless you deploy the long-forgotten technique of America’s soda giants.

The ‘Forgotten’ Syrup/Concentrate Approach

You may have noticed bright red or blue soda fountain machines at your local fast-food chain. Get your eyesight checked if you have not. These brightly lit fountain machines sell America’s iconic soda brands in rapid gushes of carbonated fluid. Coke, Pepsi, and Keurig/Dr Pepper sell concentrated syrup containers to restaurants, which they then transform into finished carbonated beverages. Soda makers, in turn, maximize their profits and can support the enormous weekly soda volumes generated by their largest customers.

Liquid concentrates were the forgotten route-to-market for Tractor Beverage when it launched in 2014. I can’t recall any other emerging beverage during my career that chose to start with liquid foodservice concentrates. Not one since Oregon Chai in the mid 1990s (which proved the concept in Portland cafes in 1994-95 before going national in natural foods retail when they were operating at a smaller scale than Tractor is today).

Tractor’s Bubbler Insertion Was Radical

There are many reasons you might choose this lesser-known route to market with liquid concentrate. Higher dollar volume sales. Lower packaging costs per ounce. Those are two financial reasons. But the key rationale for Tractor was also that it was required to be sold as a drink option right next to the very, very busy Coke/Pepsi machines. If you want to get your emerging beverage into these high-traffic locations, you need to convince customers to add a bubbler. If you can pull it off, that’s a great moat, in business terms. This is the major reason Tractor has taken ten years to get to 10,000 locations (out of ~1 million in the U.S. foodservice ecosystem).

Panera first pioneered the idea of offering a CSD fountain and adjacent ‘healthy drinks’ – iced teas and lemonade in opaque urns back in the early 2000s. They got millions of Americans used to the idea of fresher-seeming, ‘healthier’ beverages at upscale chains long before Tractor’s partnership with Chipotle restaurants began in 2020. In fact, Panera may have copied Tractor’s bubbler approach in 2017 with its own rapid national roll-out. Was it defense inspired by Tractor’s sales team? We may never know.

This is what Tractor’s Chipotle bubblers look like today (see Figure 1). I have a question sent in from your local optometrist. Can you locate the trademark in Figure 1?

The photo in Figure 1 is a good representation of what you see when you approach the Tractor bubbler with your Chipotle cup. “Tractor” is at the bottom in a very small, barely visible font. The eye goes straight to the juice flavor, because it’s the biggest font. And I imagine Chipotle wants it to be this way, because it encourages you to think that this is their drink, when, in reality, it isn’t. Neither Coke nor Pepsi would ever allow this.

Here is a Tractor bubbler at a smaller chain (Beyond Bread)(Figure 2). This time, we can see the TRACTOR on the left very quickly as we approach. And a quick internet search revealed an even bolder design with the trademark in a huge vertically aligned font, running up the side of each bubbler! This best-practice version does not appear to have any meaningful location footprint.

In 2026, Tractor is in about 10,000 foodservice locations, but almost half are at Chipotle. And none of the other 6,000 are as powerful in terms of traffic as Chipotle. Figure 1 depicts what can safely be assumed is the highest reach Tractor bubbler in modern foodservice; at least when you estimate the annual eyeballs walking in front it (number of locations x daily average traffic x 365). The Chipotle machine is the barely branded bubbler that most Tractor consumers have seen and used. The net effect is inconsistent branding of Tractor’s foodservice bubblers nationwide.

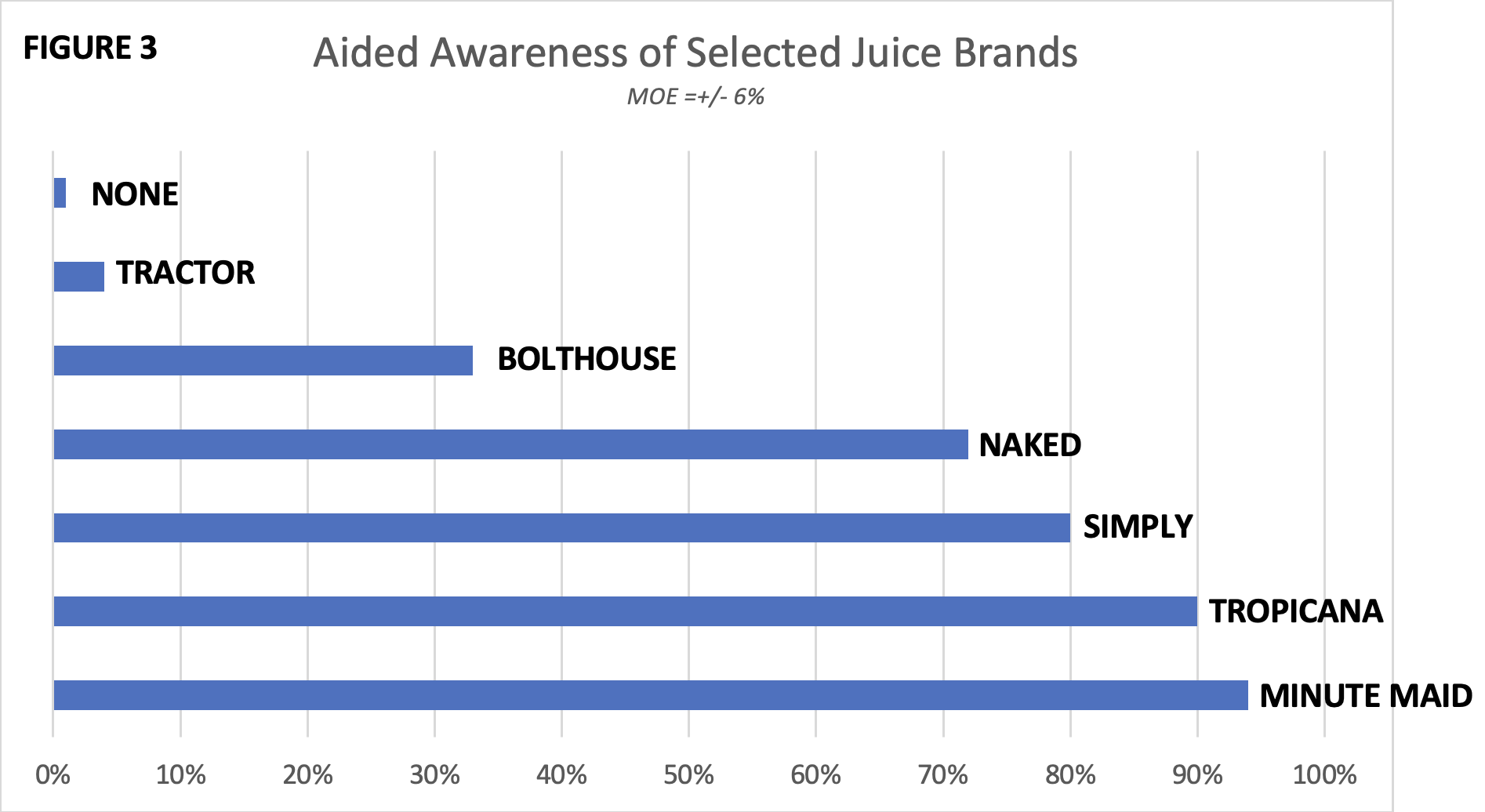

As I drafted this piece, I hypothesized that the resulting national awareness is quite low, even after five years as a standard, healthier beverage option at Chipotle. When I ran a Gen Pop awareness poll of juice brands to test this hypothesis, Figure 3 shows the findings.

Source: PGS Survey via Pollfish, January 2026, n=290 U.S. adults, post-stratified by age and gender to match U.S. adult population 16+; MOE = +/- 6%

Tractor has been busy for a decade building an organic, non-GMO foodservice beverage platform, a suite of offerings capable of serving healthy modern beverages at healthy fast-food outlets like Chipotle or Beyond Bread, on one side, and a complete soda/iced tea/juice lineup at independents unwilling or unable to get involved with Coke or Pepsi.

The strategic priority appears to have been selling whatever the customer wants, not pursuing a tightly focused beverage offering meant all along to lead to an RTD retail push. There’s no inherent brand-building logic in selling ‘root beer’ along with spiced, organic fruit juice blends. This is NOT how Coke or Pepsi built their own highly focused, solo flavor brands decades ago. But there is definitely a sales-and-cashflow logic to what Tractor has done, one amenable to venture capitalists like those who have piled onto the Tractor cap table.

Look, Tractor has done a phenomenal job of appearing alongside the soda giants in thousands of foodservice locations, giving them a distinct health halo (despite the 130 calories per serving). And they are not charging any foodservice fountain price premium, either. This move maximizes the reach to any location-specific audience that wants a non-CSD, less-sweet drink with their meal (less sweet than mainline soda).

However, the cumulative effect on brand awareness from all this hard work is minimal. And there’s simply no coherent brand experience once you leave the 4,000 or so Chipotle locations. It’s 4,000 locations of coherence and 6,000 locations of customized sell-ins. In fact, Tractor sells 39 different foodservice UPCs according to Webrestaurantstore.com. It sells concentrates for bubblers and frozen beverages, as well as odd items like cherry cream soda and root beer.

Tractor may have scaled the business into the eight figures and created profitable growth, but there’s no scientific evidence of a brand, the one thing that lends CPG businesses enormous financial efficiency AND return on marketing investments long-term.

So, How Does Tractor Go Omni-Channel? And Should It?

What does all this mean for Tractor’s recent retail launch? It doesn’t bode well if you believe in tightly focused, strategic, high velocity growth. But if you’re an investor simply trying to pump and exit, it could work.

Tractor is starting with a very small, aware audience whose experience with Tractor products is not uniform. The low awareness situation is one they probably already know internally, which is why a national Sprouts launch was their first move. Tractor is awfully close to launching the brand in retail as if for the first time. Had the brand-building effect of the base business been stronger, it would have made far more sense to launch big in Target, Kroger, and Safeway, if not Tier 1 Walmart stores.

My research has indicated that emerging CPG brands need at least 30% aided awareness in the general population to sell well in conventional chain outlets. Less than that, and they will have to sell entirely on the basis of the attribute-outcome symbolism on their packaging.

There is, however, another hidden barrier to awareness transfer that any brand would want to avoid as it enters a new channel. The drinks Tractor has launched into Sprouts are not the same as the ones they sell at Chipotle. Not even the lemonade surrogate (e.g., citrus Ginger Organic Haymaker) is the same as the turmeric-infused lemonade at Chipotle. I drank everything myself to confirm these two lines are not identical.

The Haymaker line in retail is actually a sour, kombucha-like carbonated beverage using less sweetener (or juice) than the Chipotle bubbler offerings. It offers 5g of sugar, not the 27g found in the bubbler Lemonade.

The one thing Tractor excels at is executing whatever they intend to do. Look at this end cap display at Sprouts (Figure 4). Beautiful and not cheap. It smells of investor capital.

But this is yet another line of beverages within a brand that already has too many disconnected ones. This is not how you go omni-channel unless you are simply playing a financial game.

Here’s the final confusing thing about the Haymaker launch at Sprouts. Tractor already sells RTD canned versions of the exact same drinks they offer at Chipotle for foodservice grab-n-go single-serve beverage cases (see Figure 5). But they are NOT selling these UPCs into chain retail.

Instead, they invented a totally new line of apple cider vinegar-based drinks (with spices) in Sprouts. No doubt this is due to the very high sugar load of their foodservice liquid concentrates. When you have to put the NFP on your package in front of the consumer, you think twice.

To me, all of the above was a bizarre series of logical compromises, given how disconnected the result is from Tractor’s foodservice juices. Why not figure out refrigerated juice distribution and extend the primary, known spicy-juice experience into the ultimate ‘fresh’ zone of retail? Perhaps the key investor, Keurig Dr. Pepper, simply prescribed chilled distribution up front as they joined the cap table.

There are plenty of folks who would drink the refrigerated canned beverage in Figure 5 because of its very unique spiced-juice flavor. And they don’t care about the calories. They also shop at Walmart and ordinary grocery stores. And they also eat at Chipotle.

Source: Web Restaurant Store

I believe Tractor’s current retail line was a missed opportunity, one that was avoided due to failures in marketing and/or logistical imagination.

Will Tractor’s new take on the heretofore failed ‘switchel’ segment actually work?

It might work in the natural channel, but Americans don’t like sour or tart beverages as sources of refreshment. Americans love beverages that Tractor already sells at Chipotle because they’re sweet but not sickly sweet. That was the strategic innovation that Tractor failed to launch here.

Personally, I would stay out of retail and focus on the next 100,000 foodservice locations with the core bubbler juices. They still have plenty of upside, despite the trend against sugary drinks at home.

About the author: Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for high-performing consumer brands in the eight- and nine-figure range. He is one of the few independent specialists in scaling new CPG brands and has worked with some of America’s fastest-growing, founder-controlled consumer brands in recent years, including Dude Wipes, Doctor Squatch Soap, Once Upon a Farm, and Made Good. Dr. Richardson is also the author of “Ramping Your Brand: How to Ride the Killer CPG Growth Curve,” considered by many to be the “Bible” of emerging consumer brands. You can also watch him share entertaining advice to his potential clients on his top-rated, Top 2% global ranking podcast – Startup Confidential.

Food for Thought Leadership

It’s undeniable that restaurants were challenged heavily in 2025, but what does that mean for 2026? Foodservice industry veteran John Inwright discusses the prospects for a new year, what’s working for successful operators, and the headwinds and tailwinds that could define the year.