Target’s latest wellness bid, expanding its assortment by 30%, is shaping it up to go toe-to-toe with the likes of Whole Foods, operating as both a threat to the natural grocer and its parent, Amazon.

But is this enough to raise its disappointing sales performance, especially at a time when the consumer expresses more value-oriented behaviors?

The company’s recent net sales ended 1.5% lower than 2024, a thorn in the side of investors who’ve lamented the retailer’s steady stock decline since its November 2021 peak. Even in the past year, the stock price has fallen by roughly 21.5% as of Jan. 8. Nevertheless, the recent announcement inspired a more local bump, accounting for a 10% spike YTD, indicating support for the retailer’s value play.

On the other hand, competitors Walmart and Amazon continue to capture incremental growth while the chain struggles, despite playing in similar spaces. Walmart also recently debuted a deeper investment in personal healthcare, slashing the price of more than 1,000 wellness items, similar to what Target did in November, albeit more concentrated on the specific assortment.

Target’s latest wellness push is part of a longer-term strategy. Last January, the retail giant expanded its wellness assortment with 2,000 items, with a focus on lower-priced items ($10 or less).

Both expansion announcements emphasize F&B’s stake in the segment, with notable recent additions such as ButcherBox’s retail debut of grass-fed beef; protein snacks and powders from Misfits, David, and Bloom; functional and non-alcoholic beverages from Ryze, Protein Pop, and Naked Life, and gut health support from The Coconut Cult and Seed.

“About 70% of guests are already shopping wellness at Target and right in time for the new year, we’re bringing them even more newness and value,” said Lisa Roath, EVP and chief merchandising officer of food, essentials and beauty at Target, in a statement.

David and Goliath: Taking on Whole Foods (+ Amazon)

The shift towards wellness blurs the lines between hypermarket and natural grocer: Target wants a stellar, premium suite of better-for-you products while still out-pricing the legacy leader, Whole Foods.

This competition is a play for the “better-for-you” shopper, a segment that dominates Amazon brands’ shopper base. To target these consumers, the hypermarket chain is challenging Whole Food’s “aspirational” wellness stigma by positing their healthy assortment as an everyday luxury. The move also carefully navigates the line between Walmart’s hyper-value niche and Amazon’s online, pantry-stocking endeavor.

“Our goal is to make wellness really accessible – fun, easy, affordable and personalized,” Roath said.

In recent months, Whole Foods has worked to separate itself from the premium-priced stigma, which, if successful, would complicate Target’s value proposition. In a conversation at Groceryshop, Whole Foods chief merchandising and marketing officer Sonya Gafsi Oblisk noted that the company is innovating with the value-oriented modern shopper in mind.

“We want our shoppers to walk in and see a sea of yellow,” she said, referring to the sale signs that indicate deep discounts across the grocer’s assortment.

Today’s consumer is focused on shopping deals and reducing food budgets. If Target can capture these shoppers who feel priced out of Whole Food’s premium space, it can secure a path toward growth that can return net sales to the green.

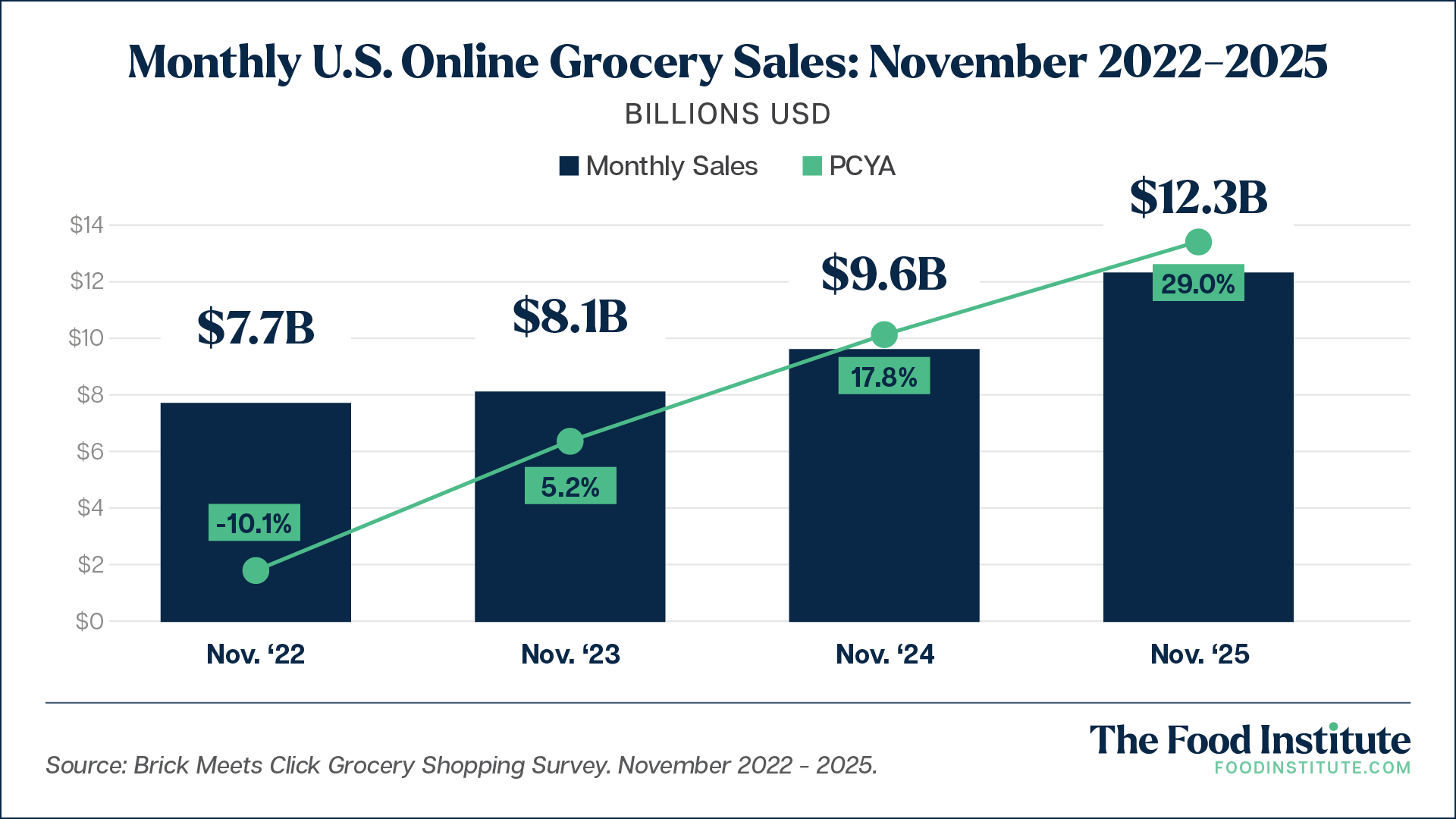

Zooming out, Target’s supply chain operations are aligning with Walmart and Amazon’s model to more adequately compete on online grocery, the most optimistic growth driver with consistent double-digit year-over-year gains.

In December, the chain expanded its next-day delivery capabilities with a “stores-as-hubs” model that allows brick-and-mortar locations to operate as sortation centers. As Target improves service for same-day and next-day delivery, Amazon is pushing the envelope, piloting ultrafast delivery (sub 30 minutes) in Seattle and Philadelphia.

Food for Thought Leadership

This Episode is Sponsored by: Koelnmesse

Snacking in the U.S. has been on the rise for many years, but is this a global phenomenon? Sabine Schommer, Director, ISM, and Guido Hentschke, Director, ProSweets Cologne and ISM Ingredients, explore European and global snacking trends, and how the trio of ISM, ISM Ingredients, and ProSweets Cologne serve as a meeting place for the global snacking industry.