Plant-based dairy products are pulling ahead of their meat and seafood counterparts, driven by better prices, taste, and consumer familiarity.

The category—including milk, yogurt, ice cream, and cheese—generated roughly $22.5 billion in global sales in 2024, eclipsing the $6.1 billion claimed by plant-based meat analogs, according to the Good Food Institute.

What’s more, manufacturers and consumers are becoming more comfortable with innovation in the space, setting the stage for a new era of growth.

“Plant-based is not trending like it was a few years ago in CPG… There are, however, pockets of growth,” Sally Lyons Wyatt, EVP at Circana, said in a recent webinar.

Dairy is one key area enjoying the boom.

At retail and in foodservice, these products are bucking the inflation trends, as innovation has made these price points more accessible. Plant-based milk and butter prices at retail, for example, 1% between 2023 and 2024. On the other hand, plant-based meat alternatives grew 4% over the period.

In foodservice, research from Menu Data found that offerings with plant-based yogurts fell 2% between Q1 and Q2 2025, and plant-based milk products dropped by 3.2% over the period. This compares to the historically high food-away-from-home inflation affecting the American consumer.

These moves, combined with the fact that plant-based products are improving their taste perception, indicate that consumers are more willing to try these alternatives and stick with them once they enjoy the experience.

Plant-Based Milk

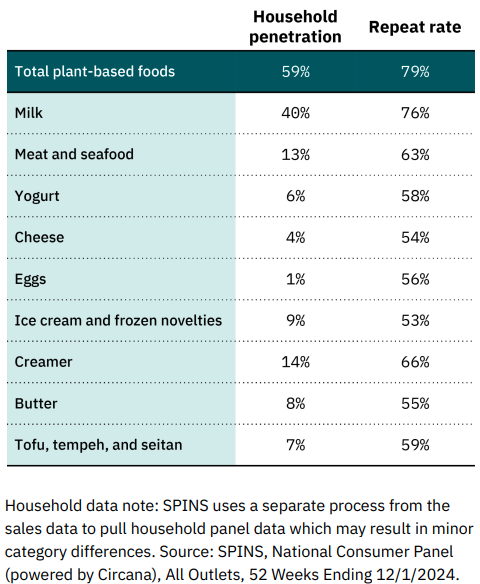

Of the dairy-alternative categories, plant-based milks are the most integrated into U.S. culture, with many popular brands, such as Silk, Oatly, and Califia Farms reaching sizeable household penetration rates on their own. In fact, of the household penetration of all plant-based categories, milk comes out on top at 40%, compared to meat and seafood at 13%.

Some restaurants and cafés leveraging plant-based milk innovations include The Punchbowl’s Mayan Mocha (Los Angeles, California), which incorporates cashew milk and coconut butter into the coffee beverage that also includes banana, cayenne pepper, and cacao nibs. Additionally, Modern Love (Brooklyn, New York) developed a Strawberry Swirl Shake that includes cashew ice cream, oat milk, and a coconut whip.

On the retail end, manufacturers are exploring different fruits and vegetables to foster innovation. Some recent developments include Força Foods’ MILKish made from watermelon seeds, as well as emerging brands producing pea milk and corn milk. Nevertheless, almond milk still has the largest share of the market in both retail and foodservice sectors, according to data from Menu Data and Circana.

Plant-Based Yogurt, Cheese

When it comes to household penetration, yogurt and cheese analogs are much smaller, holding steady at 6% and 4%, respectively. Innovations that mimic the qualities of the dairy-based cognates, however, have supported burgeoning growth in foodservice.

In the yogurt space, plant-based items have increased 35.7% menus between Q1 and Q2 of this year, while overall menu penetration has grown 33.3%, according to Menu Data. This acceleration is likely due, in part, to increased interest in breakfast yogurt bowls and condiment sauces that leverage plant-based yogurts; however, these alternatives are also increasingly being used in baked goods, such as Flourish Baking Company’s Fancy Vanilla Cupcakes (Scarsdale, New York), which incorporates oat milk yogurt into the batter.

For plant-based cheeses, menu items incorporating these offerings grew 4.9% on menus between Q1 and Q2 of this year.

Daiya Foods, known for its plant-based cheeses that mimic the “meltability” of dairy milk cheese, leads in this space with 34% of the plant-based dairy market by penetration.

Broken down by type, plant-based mozzarella comes out on top, accounting for 61% of plant-based cheese on the market, followed by plant-based cheddar (15.7%) and plant-based parmesan (9.5%).

Some of the innovation in yogurts and cheeses comes from the fact that manufacturers are treating these alternatives like their dairy analogs in the fermentation process. RIND’s Blue Crumbles, for example, features a plant-based bleu cheese that is made from the same cultures used to age Roquefort cheese.

The Food Institute Podcast

How will the One Big Beautiful Bill Act (OBBBA) impact your food business? Unraveling the implications of new legislation is never easy, but Patrick O’Reilly and Jeff Pera of CBIZ explain how provisions of the bill related to no tax on tips, depreciation and expensing of capital purchases, and research and development will impact the industry.