Recently, the so-called ‘K-shaped economy’ has taken on an ‘L’ shape of sorts. After all, these days, even high-income consumers are feeling a financial pinch. And experts feel this current L-shaped economy could linger.

“We’ve seen higher-income households trading down for some time,” noted Greg Zakowicz, an e-commerce and retail advisor to Omnisend. “We may be shifting to an L-shaped (economy) sooner rather than later. Layoffs continue to mount – many in white-collar roles – and the cost of goods from groceries to home renovations continues to climb.

“This continues to put pressure on households of all income levels, and there’s no real end in sight,” Zakowicz told The Food Institute.

Consumer Confidence Craters

Over the past three years, spending among wealthy Americans and those with college degrees increased more quickly than that of lower-income consumers, LinkedIn News noted. Recent New York Fed statistics show that households with incomes of at least $125,000 have boosted their spending 2.3% (adjusted for inflation) since 2023, while middle-income households – those between $40,000 and $125,000 – have increased their spending by just 1.6%, reported AP News.

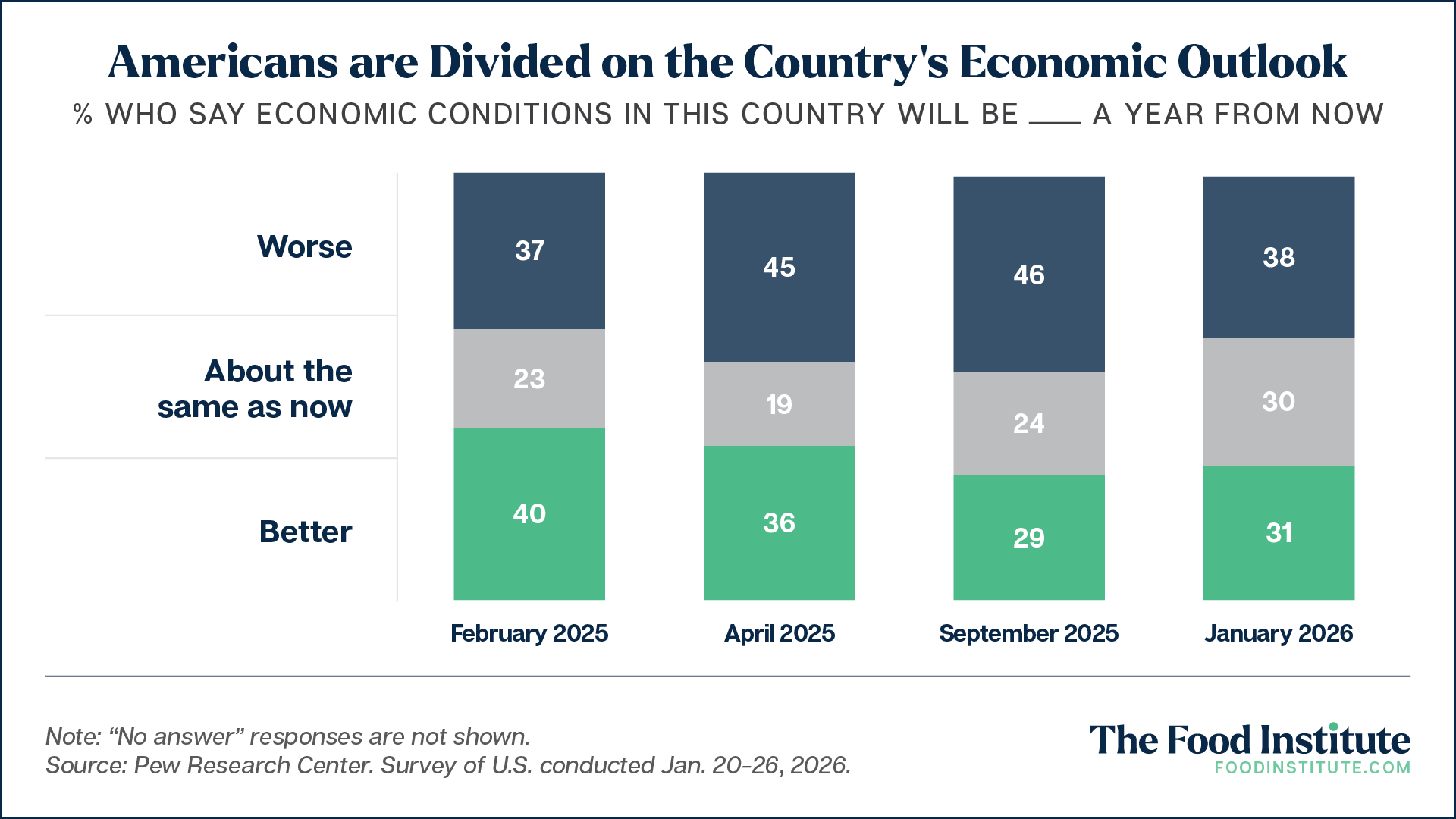

That said, overall U.S. consumer confidence recently dipped to its lowest level since 2014, with Americans saddled with increasing pessimism regarding the economy. The Conference Board’s measure of consumer confidence dropped to 84.5 in January, compared to 94.2 the month prior.

That was eye-opening for economists, whose estimates were consistently higher.

A year into President Donald Trump’s second term, Pew Research Center has found that the majority of Americans say they’re very concerned about the cost of food, consumer goods, and health care.

Pew found that 72% of American adults currently rate economic conditions in the U.S. as fair or poor.

A recent Pew survey of more than 8,500 American adults found that 49% of Republicans rated the economy positively, compared to just 10% of those in the Democratic camp. The survey also revealed that 66% of U.S. adults are currently concerned about the price of food and consumer goods.

Meanwhile, approximately 45% of those surveyed by Pew are very concerned about the availability of jobs.

How Long Will The K-Shaped Economy Continue?

The K-shaped economy, or L-shaped economy (or … perhaps I-shaped economy?) could yet prove to be a rather temporary correction, driven by inflation fatigue, high interest rates, and shrinking savings.

“It’s a moderate structural shift, but I don’t think it will fundamentally change how consumers view things in the long-term,” Zakowicz said.

Paul Nelson, managing director at Method1, voiced similar sentiments. He feels food and beverage brands have little need to panic. The current economic storm, ultimately, will pass in due time.

“Call it K-shaped, L-shaped, or just ‘exhausted,’ what matters is what consumers do inside it,” Nelson said. Consumers are more selective right now, he added, but they haven’t stopped treating themselves on special occasions.

“That’s why I always think it’s a mistake to dilute your premium because you – not your consumer – think economic conditions have made it too expensive,” Nelson added. “Look at Lindt; they raised prices 19 percent last year and still grew 12 percent.”

More than anything, the marketing expert feels brands need to focus on signaling quality at every touchpoint right now.