At a time when retailer and brand loyalty wavers, and consumers are increasing cross-shopping practices, devoting a smaller share of basket to individual retailers, fresh produce and meat stand out as the single largest differentiator.

It keeps shoppers coming into their store, as they tend to trust third-party delivery couriers less with these purchases, plus it offers what consumers want: real, clean-label foods that support personal wellness goals.

“Winning share and attracting more shoppers starts with a robust, differentiated fresh assortment,” UNFI president of fresh, Ron Selders, told FI in an interview on the topic.

“Retailers that lead with fresh create a clear reason for shoppers to continue to choose their product offerings and store.”

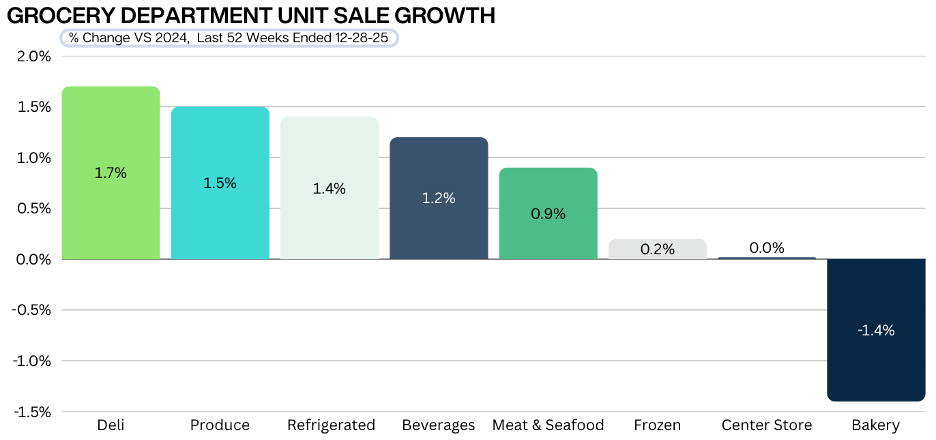

A comprehensive, high-quality portfolio also appeals to better-for-you shoppers, who tend to spend more per visit than their conventional counterparts. As a result, fresh produce and deli sections have experienced burgeoning year-over-year unit and dollar growth, ending the year outpacing center store, refrigerated, and frozen aisles, according to Circana data. Meat and seafood also trail close behind.

Source: Circana, a Chicago-based market research firm (@WeAreCircana), latest 52 weeks ending 01-20-2025. Total US Multi-Outlet.

Selders anticipates this trend to continue, partially due to macro trends shaping consumer consumption behaviors. One notable shift – GLP-1 drugs. Recent reports estimate that roughly 12% of Americans are currently taking one of these drugs; moreover, with recent FDA approvals for pill forms of these medications, that number is likely to grow in the year ahead.

“It’s changing how people shop,” Selders explained. “The shift is reshaping fresh purchasing behavior, including driving demand for smaller portions, higher-protein options, and clearer nutritional cues, making it even more important for retailers to simplify choices and adapt assortments to evolving needs.”

Rather than view this caloric and nutrient shift as a burden, retailers must understand the purchase drivers for these shoppers and innovate assortments and planograms to fit – fresh portfolios can create cross-shopping opportunities for center store and frozen/refrigerated aisles if done correctly.

Both GLP-1 drugs’ influence and the general interest in personal healthcare are motivating a “health halo.” Selders noted the importance of signage, shelf tags, and straightforward health rating systems to call out health value propositions across the store can support the effect. Hy-Vee, for example, recently introduced “FoodHealth Scores” to its catalog, which assigns a single value to judge each offering on nutrient density and ingredient quality.

Callouts are particularly important at a time when nutritional information and labeling can lead to consumer confusion. A key solution is to organize the floor with obvious health benefits in mind, so consumers can readily understand if a product supports functional health goals, such as gut support, protein and fiber intake, or psychological benefits.

As consumers make conscious health-first food decisions, retailers’ north star should be to make this seamless and efficient while still delighting with unique, special offerings.

Although price is among the most important factors for food purchase decisions, consumers also value convenience.

“One of the most effective ways to enhance convenience is by streamlining the decision-making process for shoppers,” Selders said.

Food for Thought Leadership

In this episode of Food for Thought Leadership, host Chris Campbell is joined by food and nutrition expert Marie Molde to explore how health and wellness trends are reshaping the food and beverage industry heading into 2026.