The food sector is likely facing a tough year with narrow margins being squeezed by a variety of factors, prompting a wave of bankruptcies, experts told The Food Institute.

Whether it be rising labor costs or increases in ingredient costs, restaurants, grocers, and food manufacturers could find themselves in court seeking financial relief through Chapter 11 bankruptcy reorganization.

The latest franchisers seeking protection from creditors are FAT Brands and its spinoff chain, Twin Peaks.

“When companies experience fast growth, they sometimes take excessive debt, and this needs to be restructured to improve the health of the balance sheet. It is not specific to the restaurant business,” said Professor Ernan Haruby of McGill University.

An S&P Global Market Intelligence analysis reported bankruptcy filings numbered 72 in December, up from 63 in November.

December’s bankruptcy filings were second only to July 2020 and August 2025, which recorded 74 each.

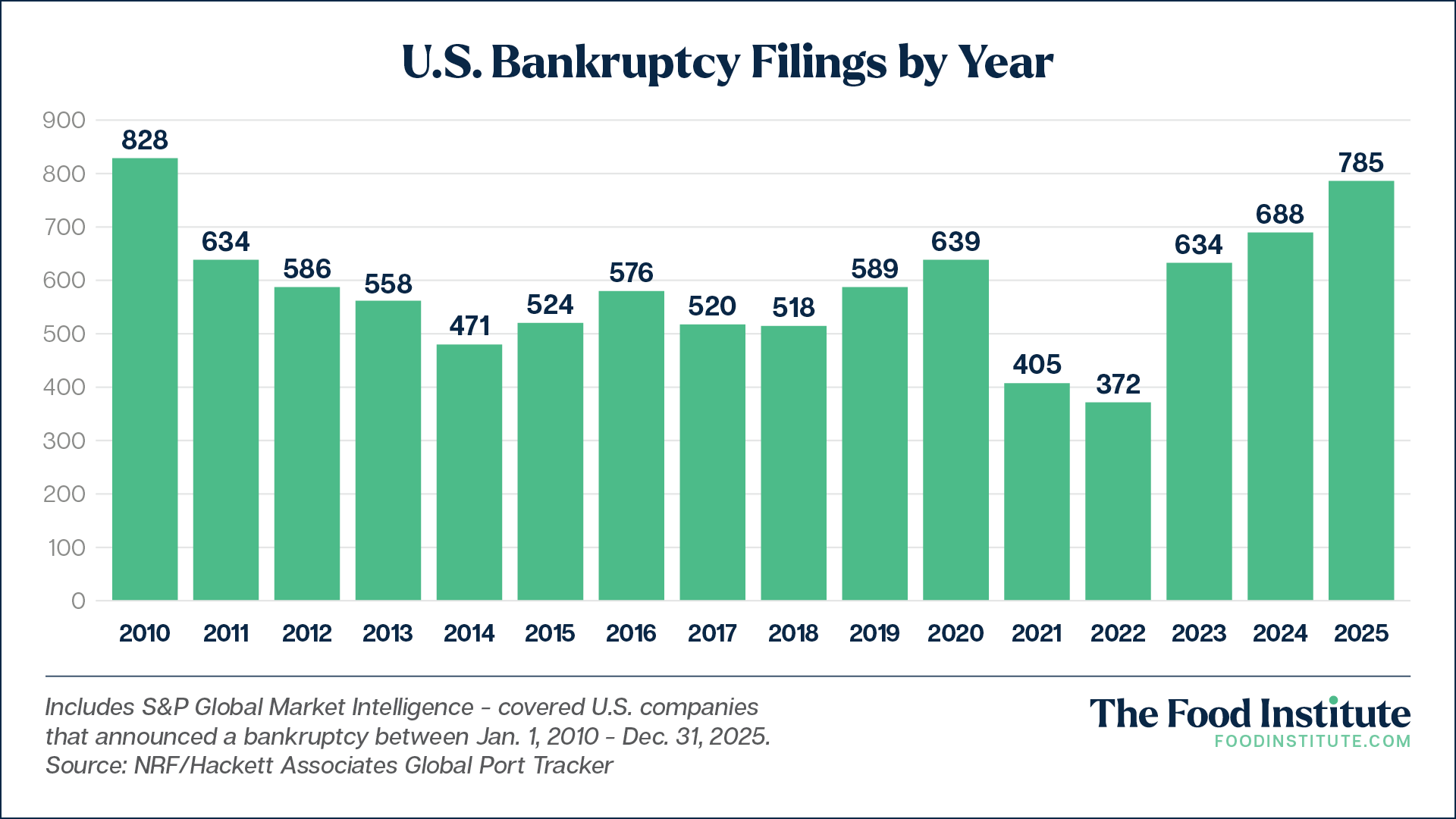

For the year, there were 785 filings for companies with public debt and at least $2 million in assets or liabilities, as well as private companies with at least $10 million in assets or liabilities. The number was the highest since 2010.

Of that total, 20 were restaurant chains while major grocers shuttered dozens of stores and companies like Del Monte sought relief.

Barbara Sibley, president of the New York chapter of Les Dames d’Escoffier International and chef at La Palapa Cocina Mexicana and La Palapa Taco bars, told FI that rising costs, uncertainty around imported ingredients and the delayed impact of COVID-era loan repayments are playing a significant role.

“The result is significant financial strain for operators already operating with little room for error,” Sibley said.

“Many business plans, particularly those created pre-COVID, rely on assumptions that no longer hold in a market reshaped by labor shortages, shifting demographics and volatile consumer demand.”

The S&P analysis noted the rise in bankruptcies correlates with the rise in interest rates enacted to combat post-pandemic inflation. At its latest meeting, the Federal Reserve opted to pause rate cuts, currently at a three-year low, following three cuts last year.

In a statement following its Texas filing, FAT Brands said it would use the proceedings to “deleverage” its balance sheet. The franchise currently has 2,200 restaurant locations globally, including Fatburger, Johnny Rockets, and Great American Cookies.

Food for Thought Leadership

It’s undeniable that restaurants were challenged heavily in 2025, but what does that mean for 2026? Foodservice industry veteran John Inwright discusses the prospects for a new year, what’s working for successful operators, and the headwinds and tailwinds that could define the year.