The current state of the economy has consumers anxious about their food bill, and the prolonged threat of tariffs has only exacerbated these fears.

Even the recent welcome Bureau of Labor Statistics report showing worker pay growth up 0.4% on average (+3.9% from YA) has done little to assuage fears.

The Food Industry Association (FMI) recently uncovered the level of these tensions in a sentiment analysis that found 73% of consumers are worried about grocery prices increasing. Additionally, consumers are worried that tariffs will only exacerbate this issue, both in terms of imported ingredients such as produce and consumer packaged goods inputs.

Already, the Trump administration recently approved a 50% tariff on imported steel and aluminum, which food and beverage stakeholders anticipate will lead to market volatility. Both materials are important to various F&B operations, including packaging, manufacturing equipment, and facility development (e.g., storefront, factory, distribution center).

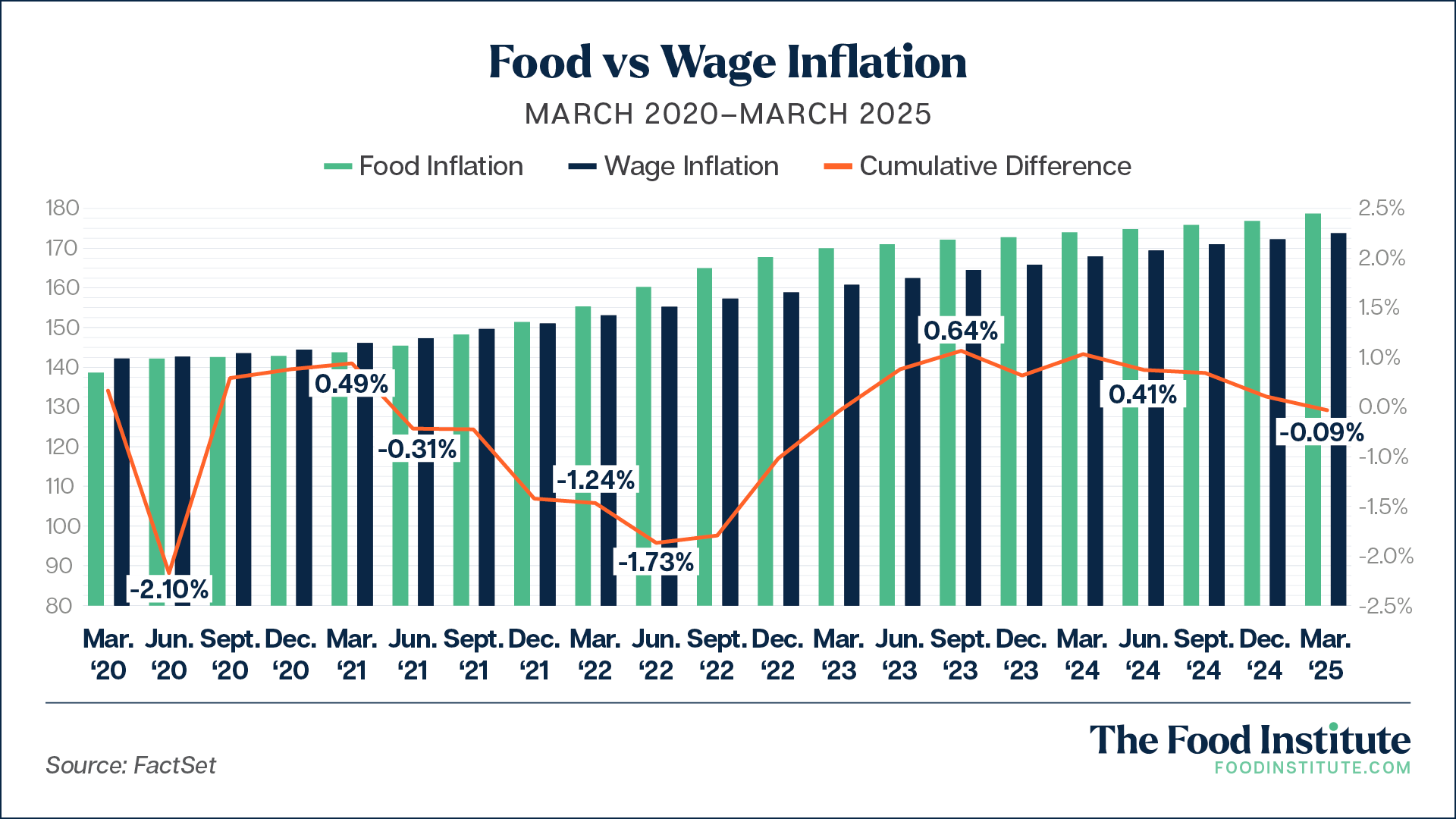

The Food Institute analyzed government data to understand the anxieties that underpin the modern consumer. The facts: food inflation is outpacing wage growth.

There is a structural imbalance where wages have not kept pace with the rising cost of essential goods, particularly during major global economic disruptions such as the COVID pandemic and overall economic instability in 2022 as a result of regional conflicts, including the ongoing war between Russia and Ukraine.

The most recent data reveals the wedge between food prices and wages continues to grow.

In the last quarter, the U.S. entered a new period of a negative cumulative difference, dipping to -0.09%, attributable to an elevated food bill. This is the third time this has happened since 2020, and, although it is only minimally below the average, it augurs steeper declines while capturing today’s sentiments.

Tariffs Cause Food Bill Tumult

For 30% of shoppers, any price increase from retailers would be too much for them, according to a recent report from First Insight. This highlights how sensitive consumers’ thresholds are for discretionary purchases.

Despite this, national retailers, such as Walmart, continue to consider price hikes as the Trump administration tariffs pose a threat to retail margins. Evidence suggests, however, that the move may prove too radical for today’s consumers. Across all retail industries, 83% of executives plan to raise prices even though 73% of consumers report “frustration” if affected by these increases on-shelf.

For retailers who choose to raise prices, shopper loyalty may be threatened, as most shoppers are skeptical that some of these businesses are using tariffs as an excuse to increase prices.

Consumers have become jaded by industry price fluctuations. Recent FI analysis of Bureau of Labor Statistics data shows prices across the board are up year-over-year, even though key commodities are down month-over-month on an unadjusted basis. For example, meats, poultry, fish, and eggs are down 0.5% MoM, yet they are still holding high at +6.1% YoY due to elevated prices in the beef and veal category (+8.6% YoY) as well as eggs (+41.5% YoY).

Moreover, events, such as the bombshell pandemic-era supply chain disruptions that increased prices across grocery chains, have helped contribute to a perception of cynicism within the industry. Last year, the Federal Trade Commission published a report alleging anti-competitive practices that facilitated elevated profits while consumers suffered.

The Food Institute Podcast

Just how difficult is it to scale a better-for-you snack company? Rebecca Brady, founder and CEO of Top Seedz, shares how she turned a homegrown idea into a rapidly scaling snack brand and breaks down the strategy behind her growth, from bootstrapping production to landing national retail partnerships.