Costco, BJ’s Wholesale, and Sam’s Club have proved reliable, attractive solutions for family grocery runs, and they just keep growing. These club channels have the power, and they know how to wield it.

Since the COVID pandemic, these retailers have experienced jaw-dropping valuation gains: Costco’s stock is up 127% over the past five years ended Dec. 16 and BJ’s grew by an even more impressive 159%. As a subsidiary of Walmart, Sam’s Club’s impact isn’t as easy to parse, but the parent did note that it has seen steady growth in member counts and renewal rates in Q3.

In fact, each chain has experienced increased patronage, and they’re participating in aggressive growth strategies to facilitate this support.

In 2025, Costco added 25 new locations, and is planning to add an additional 35 in 2026. Sam’s Club, on the other hand, noted in April that it would open 15 clubs and renovate all 600 of its locations, and BJ’s said at the top of the year that it would add between 25-30 new locations over the next two years.

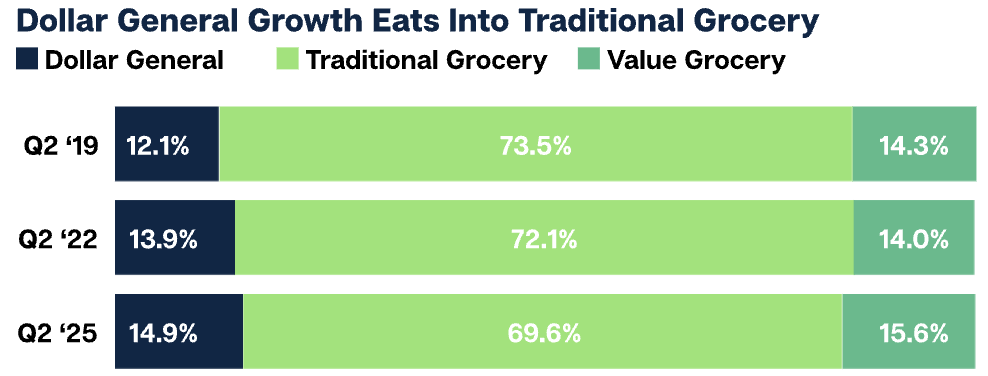

This optimism compares to the rest of the market, where traditional grocers are struggling, losing market share to these club stores and discounters such as Aldi or Dollar General.

Source: Placer.ai

This begs the question: why are clubs performing so well? Although the answer is rather clear, it’s complicated. For one, outsized food-away-from-home inflation continues to outpace food-at-home, leading many to consider eating at home with more frequency.

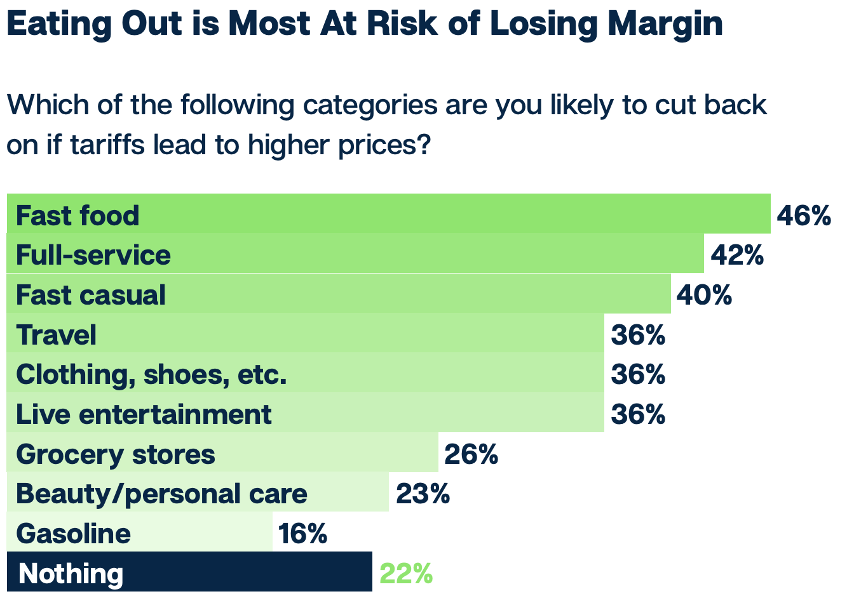

Tariff concerns continue to also threaten foodservice channels, as evidenced by a recent CivicScience report provided to The Food Institute.

Beyond that, however, it boils down to these channels simply “understanding” their core consumer.

Case Study: Costco, The North Star

“Costco has been consistent, providing goods at scale for a manageable price,” Brian Pham, Influencer’s VP of strategy, media, & production, told FI in a recent conversation.

Food court staples such as the rotisserie chicken and hot dog have remained affordable. The chain takes this a step further by maintaining its hot dog and soda combo at $1.50 despite inflation.

This consistency has meant that consumers can rely on the chain to offer good deals and pragmatic solutions to stretched food budgets. For a modest annual fee, consumers can ensure they will benefit from outsized savings.

Pham noted that, on top of this, there is a generational “passing of the baton” to Millennial and Gen Z consumers shopping the store.

“There’s a ‘newstalgia’ aspect of these young adults becoming parents and seeing the true value behind [club stores],” Pham noted.

The term describes Americans’ growing interest in nostalgic offerings and experiences. For Costco, the shopping experience is nostalgic, because of how little has changed, however it offers a twist with its unique assortment.

The chain, for example, merchandizes a protein-enhanced water with 30 grams of protein. This, and similar on-trend items, create social media hype that organically piques consumer excitement.

“No one really talked about its taste, but everyone mentioned the low-cost and overall value of it,” Pham said.

Other club channels, such as BJ’s (debuted in 1984) and Sam’s Club (started in 1983) leverage its historic precedence and consistent promise, but not as effectively as Costco, which constantly captures the bulk of media attention.

The One Place Where Loyalty Matters

As paid membership programs, the club channel is well-insulated from larger industry headwinds related to waning loyalty and increased “channel switching,” wherein consumers shop each store less to get better deals.

“Consumers’ willingness to switch stores or brands shows that value and trust now outweigh legacy brand loyalty,” Curious Plot’s Alison Buckneberg, told FI in the recent State of the Consumer Report.

Shoppers are voting with their food dollars and club stores are winning, having refined their value proposition and leading with consumer trust.

The data speaks for itself. Despite Costco increasing fees by 14% year-over-year in Q4 FY 2025, paid memberships were up 6.3% and executive memberships jumped 9.3%. Recent data from BJ’s found that memberships topped 8 million in Q2, up 6.7% from Q3 2024.

Private Label Hype Market

Beyond its branded assortment, private label has become another key growth area for club channels. For one, consumers are more comfortable switching to less-expensive private label options, and in some cases, even prefer these products.

Costco is a pro in this department, having garnered a cult-like following of its Kirkland Signature brand. The Wall Street Journal reported that it accounts for roughly 33% of the company’s $254.5 billion annual revenue.

“Owned-brand products also deliver higher penny profit for us, which we can use to invest back into the member experience, further propelling the flywheel that drives our business,” CEO Bob Eddy said in a recent analyst call.

The brand features many third-party claims that resonate with today’s shopper, such as “Organic” or “Fair Trade,” at a cheaper price point, giving cash-strapped better-for-you shoppers the opportunity to spend more on their values or personal health goals without breaking the bank.

Sam’s Club is following in Costco’s footsteps. The chain also has a premium private label portfolio with affordable organic and special diet items, under the Member’s Mark brand. Earlier this year, Walmart said that it would remove artificial dyes from the brand, highlighting its desire to address the needs of the modern consumer.

Image via: Wikimedia Commons (GoToVan)

Food for Thought Leadership

In this episode of Food for Thought Leadership, Food Institute VP of content and client relationships Chris Campbell sits down with Barry Thomas, senior thought leader at Kantar, to unpack the rapid rise of agentic AI — a new class of AI systems that don’t just generate information but take action on behalf of the user.