Unfazed by market conditions that have led to the price creep of Halloween treats, as well as recent trends favoring healthy alternatives to indulgent snacks, consumers have shown that, now more than ever, there is a place for candy, chocolate, and sweets.

Savvy celebrators, however, are changing how they prepare for the season: 42% of consumers begin planning for the holiday before October even begins, according to research from Kroger’s data insights arm 84.51°.

Moreover, Shopkick research from Trax found that most consumers said they’ve noticed price increases coming from candy, and 83% of celebrants plan to spend less than $100 on Halloween candy, decorations, and costumes this year.

As of now, however, that value shift seems like a pipe dream, as the National Retail Federation anticipates spending to hit $13.1 billion, up from last year’s $11.6 billion.

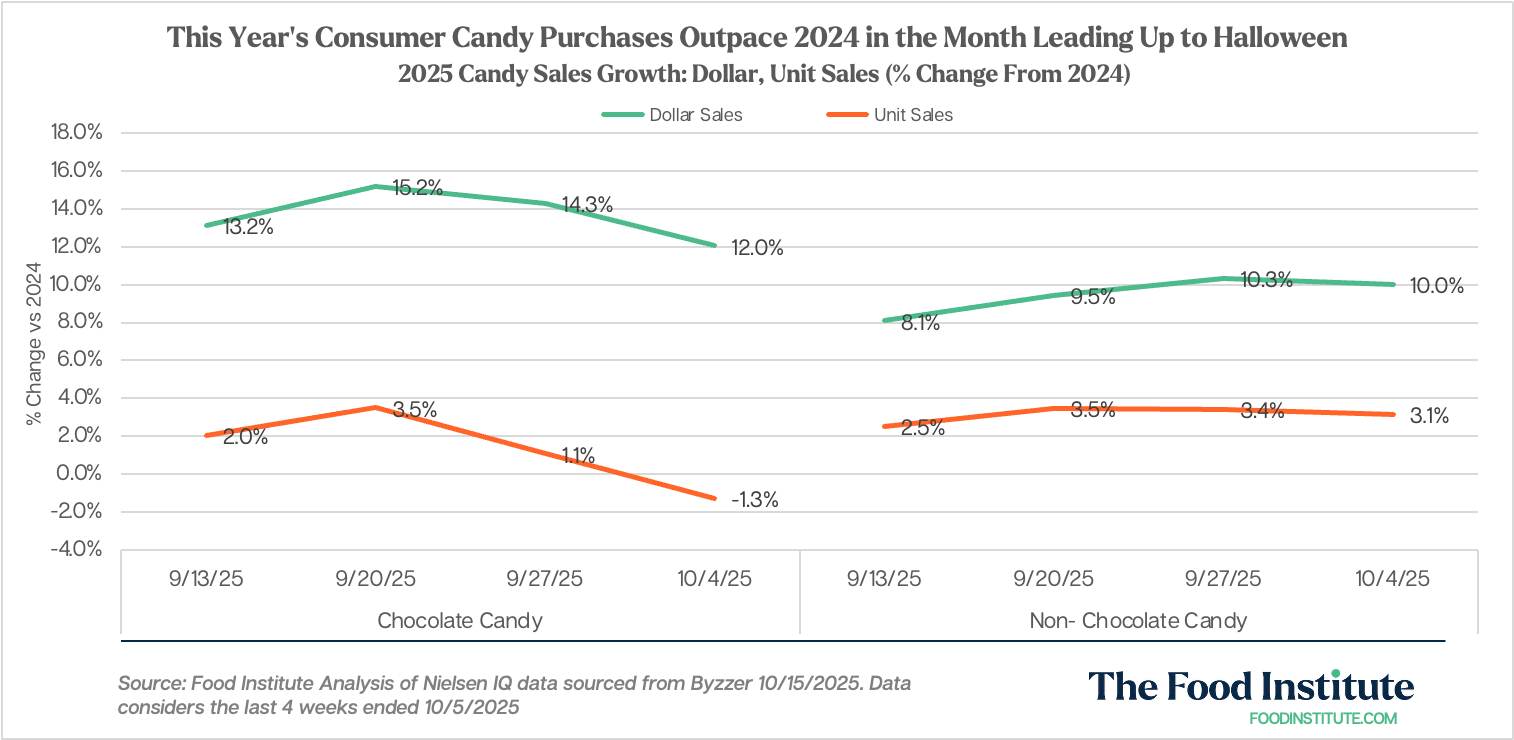

Data from Nielsen IQ corroborates these findings. Already, a notable ramp-up in candy sales leading up to the holiday month can be observed across all retail and convenience channels.

A look at both dollar and unit sales reveals, however, that pressure is coming to the candy aisle. Chocolate candy, in particular, shows outsized dollar growth relative to unit sales.

Note, the wider gap between dollar and unit sales for chocolate candy versus non-chocolate candy is likely a result of supply-side factors disproportionately affecting the cocoa market. Such issues include adverse weather conditions in key growing regions, crop diseases, and tariffs on cocoa-producing countries.

This is likely why chocolate unit sales begin to drop off for as the season nears – cash-strapped consumers look to confectionery to satisfy their sweet tooth and their budgets.

Moreover, the unit sale decline in chocolate candy in the week ending October 4, compared to non-chocolate candy’s 3.1% growth over the period, reaffirms that other confectionery treats may get the spotlight on Halloween day.

When it comes to how shoppers plan to prepare as the holiday nears, 84.51° found that chocolate-based treats are still a favorite. Nevertheless, other sweet offerings are also compelling, for example:

- roughly 55% of consumers will buy chewy or fruity candies

- approximately 36% will seek out hard candies and lollipops

- as much as 28% will stick with classic Halloween treats.

Candy Still Got It

Despite the growing market for macronutrient-fortified snacks, indulgent snacks, especially those that accompany nostalgic events, such as Halloween or movie-going, are still growing at a rapid pace.

At Groceryshop 2025 in Las Vegas, Sept. 28 – Oct. 1, Jennie Bell, managing director for consumables at NielsenIQ, explained that, even though 87% of consumers are changing how they shop to save money, there are still opportunities for CPGs to grow.

Candy sales, for example, have been performing well on TikTok Shop, accounting for nearly 20% of food purchases on the platform.

Moreover, brands are shifting to new channels to support growth strategies. M&M’s, for example, recently released a freeze-dried offering, M&M’s Pop’d Caramel, with a go-to-market strategy that begins with TikTok Shop in November before rolling out nationwide in January 2026.

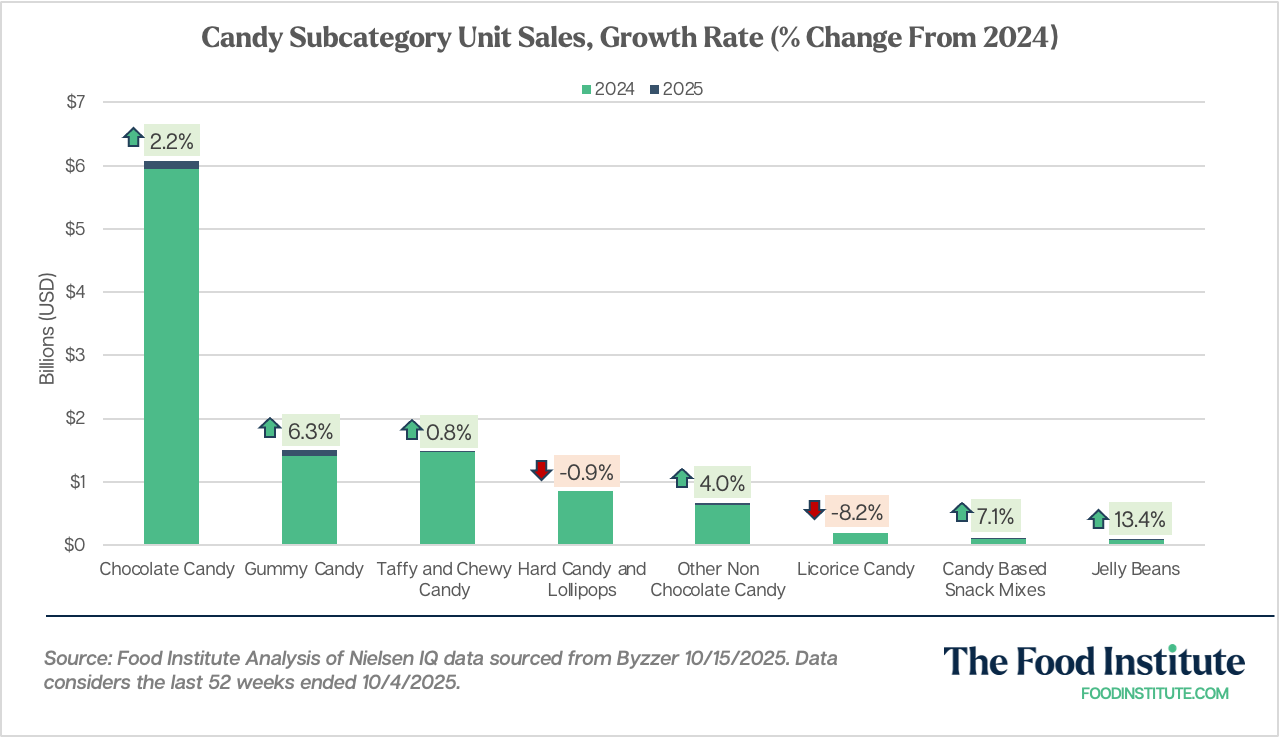

These new channels may contribute to the gains in non-chocolate candy across gummies, jelly beans, candy-based snack mixes, and chewy candy, all of which experienced positive unit and dollar sales growth and positive press on social media.

Earlier this year, for example, singer Taylor Swift helped Smarties chewy candy brand Squashies make headlines when she called it her favorite candy, prompting a frenzy online.

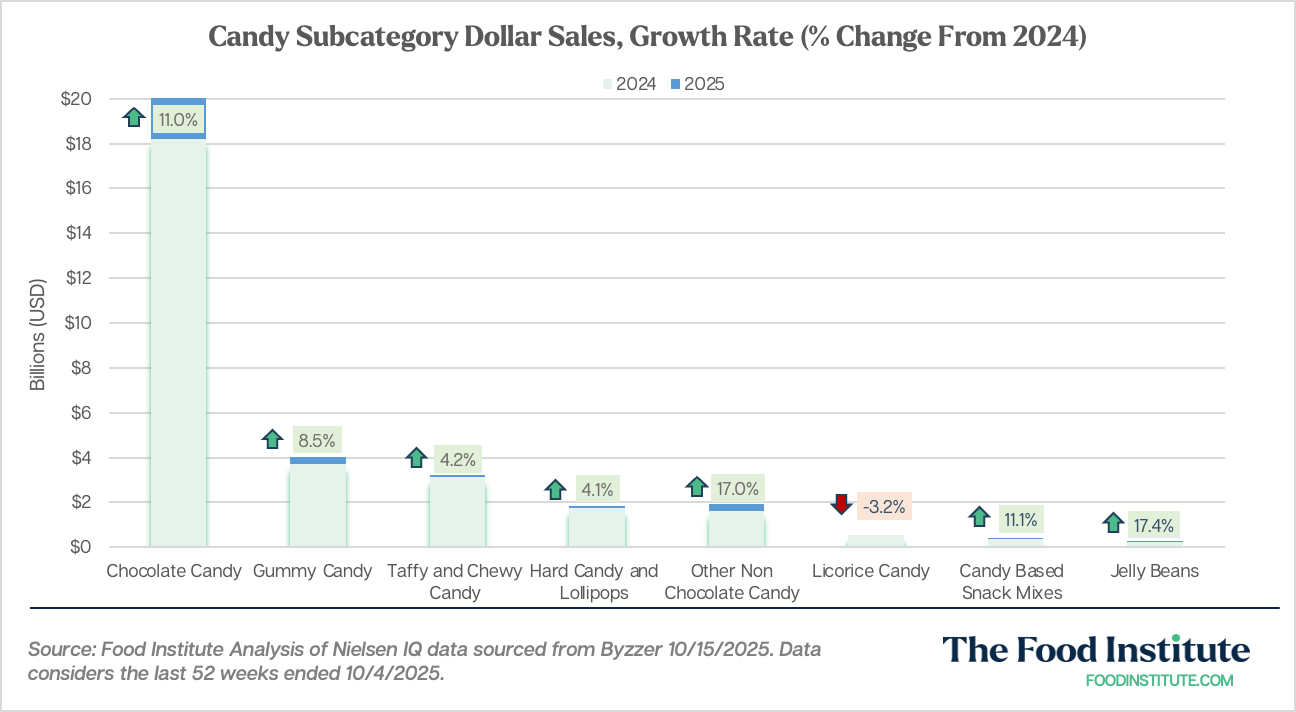

Once again, the disproportionate dollar growth of chocolate candy sales reflects the larger market headwinds pushing up cocoa inputs compared to other confectionery. The bad news: it doesn’t seem like it’s getting any better.

As a result, expect to see chocolate makers continue to reformulate to platform relatively cheaper ingredients, as with Reese’s in 2024. The Jumbo Cup featured much more peanut butter filling compared to the chocolate layer quantity increase. Moreover, M&M’s recent innovation, the aforementioned Pop’d Caramel candy, also emphasizes the caramel flavoring instead of the chocolate coating.

The data also shows that non-chocolate candy is having its moment, with gummy candy dollar sales increasing 8.5% year-over-year in October and jelly beans increasing 17.4% over the period, with comparably large unit sales growth showing both profitability and consumer interest are correlated.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.