Yes, consumers are cash-strapped, but that doesn’t mean that they’re not willing to spend more for foods they feel nourish them. Fresh grocery formats and food trends are in vogue, with consumer trends leading many to think critically about their personal health goals.

“We’re seeing strength among fresh [grocery] formats,” said R.J. Hottovy, CFA, head of analytical research at Placer.ai, during a webinar on the topic.

“That’s telling us that…they’re willing to pay a premium for something unique that you can’t get at traditional grocery stores.”

The Food Institute’s webinar, titled “Eyes on the Aisle: A Mid-Year Food Retail Update,” featured a data-driven conversation between Hottovy and Sally Lyons Wyatt, global EVP & chief advisor for consumer goods & foodservice insights at market insights platform Circana.

Where Hottovy spoke about the macrotrends shaping the F&B landscape, Lyons Wyatt unpacked the implications on the consumer level.

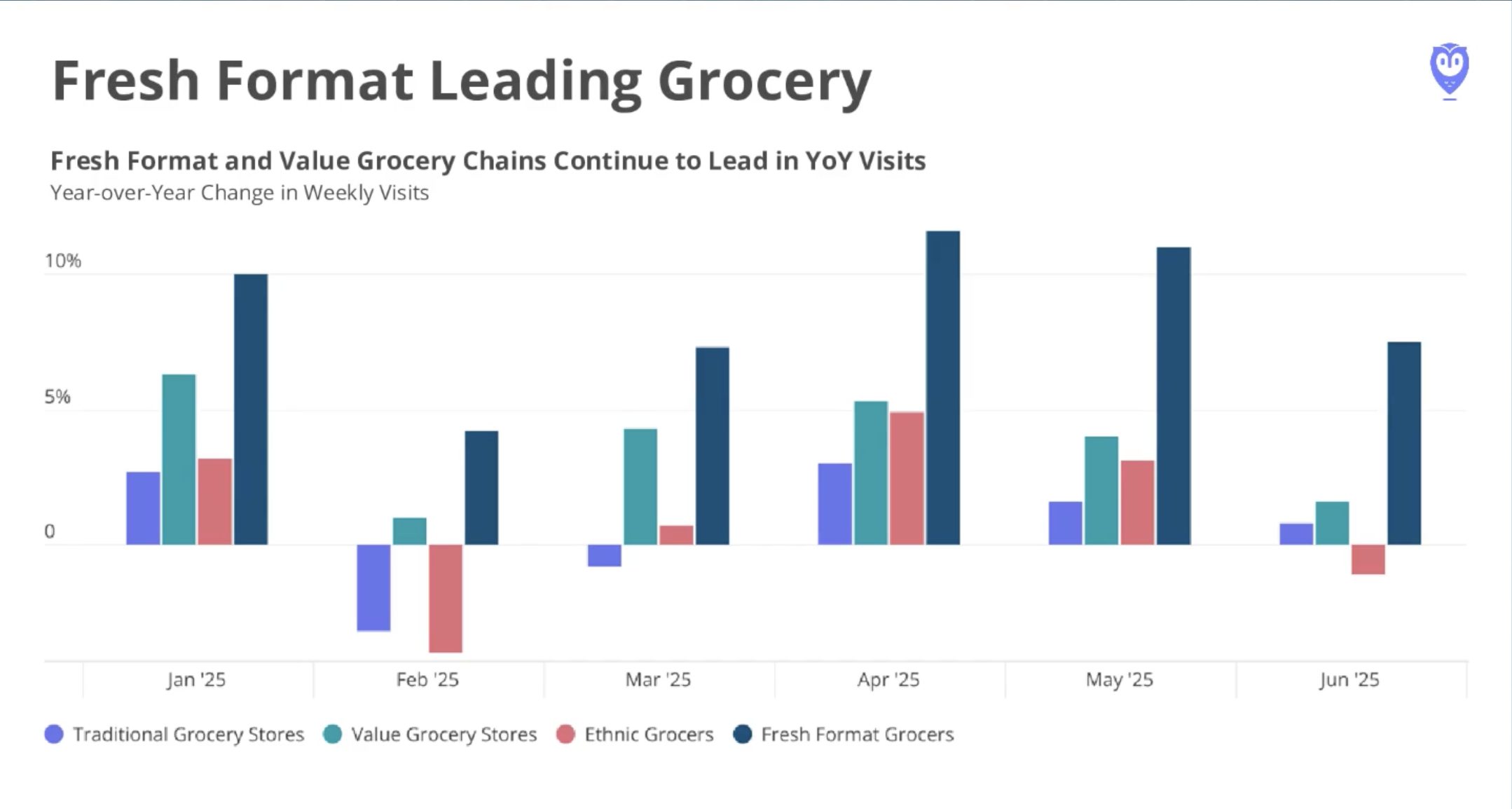

Overall, grocery growth (+12% year-on-year) has lagged other retail and foodservice darlings such as convenience stores (+16%) and dollar/discount stores (+26%); however, a breakdown of the category tells a slightly different story.

In the first half of the year, traditional and ethnic grocery stores tended to pull down the category, while fresh format grocers, such as Whole Foods or The Fresh Market, continue to outperform their competitors, achieving double-digit year-on-year growth in three out of the first six months of the year.

Fresh food interest and social media culinary trends that showcase specialty ingredients are the backbone of this growth, playing to macrotrends such as the “Make America Healthy Again” movement, and the desire for experiential connections to food and food culture.

Lyons Wyatt added that Americans have come a long way, too, when evaluating the products they put into their bodies.

“Roughly 60% of consumers today are looking at food labels before they make their purchases,” she said. “This was not true even five years ago.”

She added that GLP-1 medications mean consumers are looking for lower-sugar and higher-protein offerings, and younger generations are treating wellness as a lifestyle by prioritizing their mental, emotional, and physical wellbeing, and leveraging food and beverage as a complement to these efforts.

Moreover, the accelerated growth of other retail and foodservice formats is likely a result of new entrants into the fresh space. For example, convenience players such as Wawa, Sheetz, and Casey’s are generally seeing positive traffic because their fresh food portfolio has set them apart, Hottovy said.

As a result, these moves are leading to an increased share of the lunch day part, pulling business from traditional grocers’ prepared food sections, as well as QSRs and full-serve restaurants.

To learn more about the state of the food and beverage retail and foodservice environment, FI members can watch the webinar here.

The Food Institute Podcast

It’s a big world out there – what trends are percolating on the global scene? JP Hartmann, director of Anuga, joined The Food Institute Podcast to discuss the intersection of U.S. and international trends and how the Anuga show is one not to miss.