With 66% of Americans reporting that protein content is important to them when grocery shopping, according to data provided by Civic Science, the macronutrient is becoming a clear differentiator to reignite plant-based food and beverage industry growth.

Danone is investing in the trend with its high-protein Silk line. At 13 grams of plant-based protein per serving, the offerings have 50% more protein than its legacy line while also exceeding the animal-based whole milk alternative’s 8 grams of protein per serving at a lower sugar level.

“We really see a gap in the marketplace for a good plant-based, higher protein offering that just hasn’t been there, and that consumers are demanding,” Wendy Nunnelley, president of plant-based for Danone North America, told Food Dive.

The plant-based industry has stagnated somewhat, contracting 4% between 2023 and 2024, according to EAT Foundation’s Grains of Truth Report. Even milk, the historic market leader, contracted 5%. In evaluating pockets of growth, however, plant-based options with protein lead.

Protein liquids and powders increased 11% over the period; yogurt grew 1%; and tofu, tempeh, and seitan were up 7%. All these categories boast high protein levels and have helped offset losses in other key areas.

In recent years, the brand has doubled down on its protein fortification. Rafael Acevedo, Danone North America president of yogurt, told FI earlier this year that it has been a main lever for innovation. In particular, it has been a strategy for the brand to meet the needs of the GLP-1 consumer with products such as high-protein Oikos yogurt drinks.

“If we put the consumer first, we are seeing GLP-1 users are gravitating towards nutritionally dense food and smaller portion sizes,” he said.

Protein is the key unlock for nutrition density, with fiber close behind.

The Protein Play

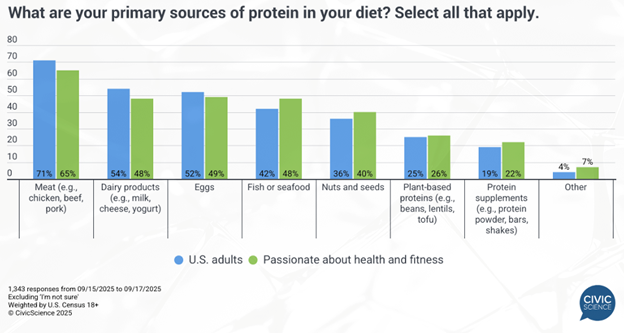

Civic Science found that 25% of Americans get their main sources of protein from plant-based foods, while 19% get them from supplements. In both cases, these values increase for subgroups that are passionate about health and fitness.

Providing more plant-based protein options enables these health-conscious flexitarians to consider the plant-based category, while also helping evangelists meet their nutrient goals.

Moreover, by putting protein at the center of the plant-based dairy category, it can pull dairy-based protein consumers into the plant-based ecosystem.

Despite this momentum, Mintel data cited by Danone found that fewer than 1% of protein-focused innovations are coming to the plant-based beverages vertical, indicating its untapped potential.

Other challenger plant-based brands endeavoring to achieve protein parity with animal-based dairy include Ripple’s pea milk (8g per serving) and Whole Moon’s protein fortified oat, pistachio, and almond milks (6g per serving).

These goals are part of a larger movement in plant-based 2.0 to focus on the segment’s ability to stand out with its own line of great tasting, nutrient-rich products rather than compete directly with animal-based alternatives.

As consumers look for products to fulfill their protein needs, they are still looking for clean labels, so natural additives that support protein fortification, such as nuts, seeds, and legumes, will resonate with shoppers.

Civic Science data finds that the nuts and seeds vertical piques the interest of health and fitness aficionados even more than the average consumer.

Food for Thought Leadership

This Episode is Sponsored by: Performance Foodservice

How important is it as a food distributor to build a brand for foodservice – especially since consumers may never see or recognize it? Mike Seidel, vice president of procurement at Performance Foodservice Corporate, shares how the company views the development of its existing foodservice brands, including Roma and Contigo, and how they helped in the creation of its most recent Mediterranean concept Zebec.