The plant-based market has hit an inflection point in its maturation phase. The good news is, household penetration remains strong. However, with the “hype” now over, it’s facing the same market headwinds as the rest of the grocery segment.

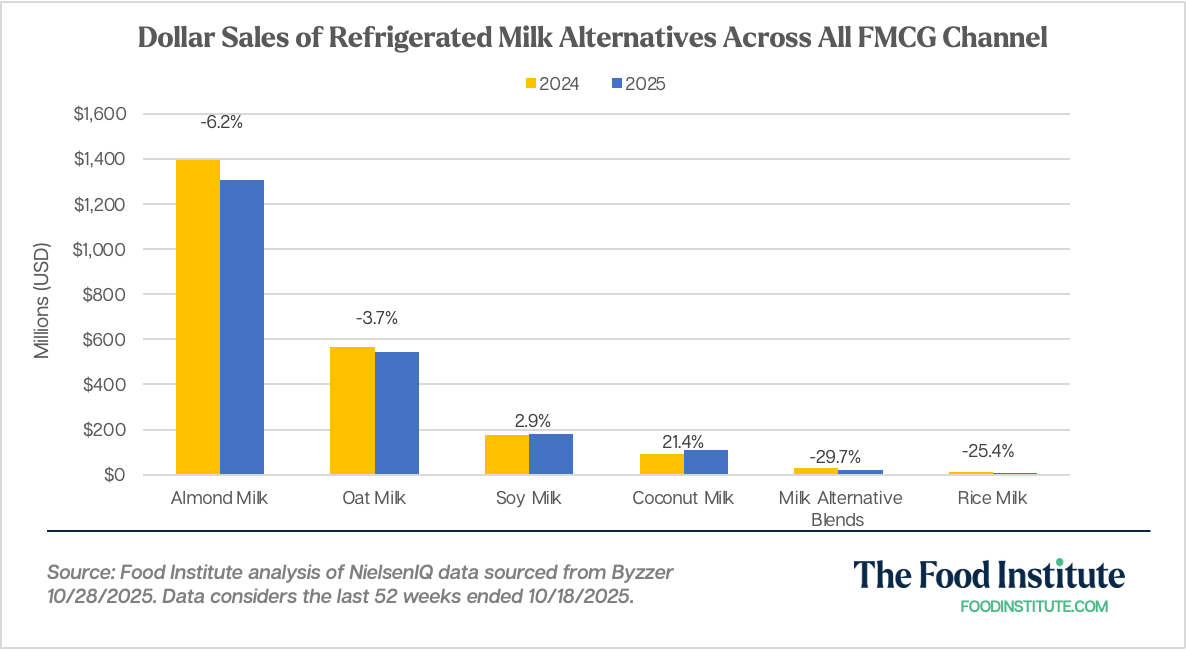

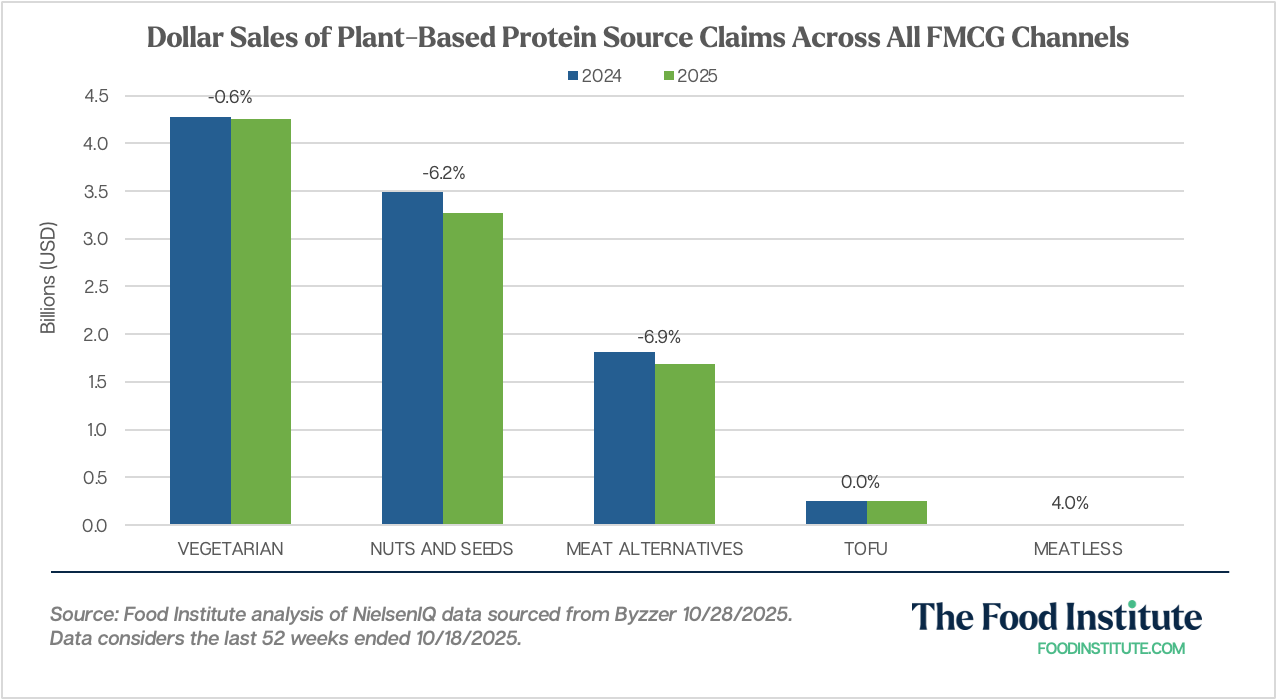

Despite these headwinds, there are still pockets of growth: Dollar sales of products boasting the term “meatless” on packaging are up 4% year over year across FMCG channels (grocery, mass, drug, dollar, military, and club stores), and plant-based milks continue to be a boon for the industry, and a bellwether for other plant-based markets, according to data sourced on Oct. 28 from NielsenIQ’s Byzzer platform, which tracks syndicated retail data across the market.

The new savvy shopper is price-sensitive and budget-conscious, posing difficulties for the plant-based industry, which is often priced at a premium related to their animal-based analogs. In some areas, such as milk, plant-based alternatives buck the trend.

Plant-Based Milk Outlook

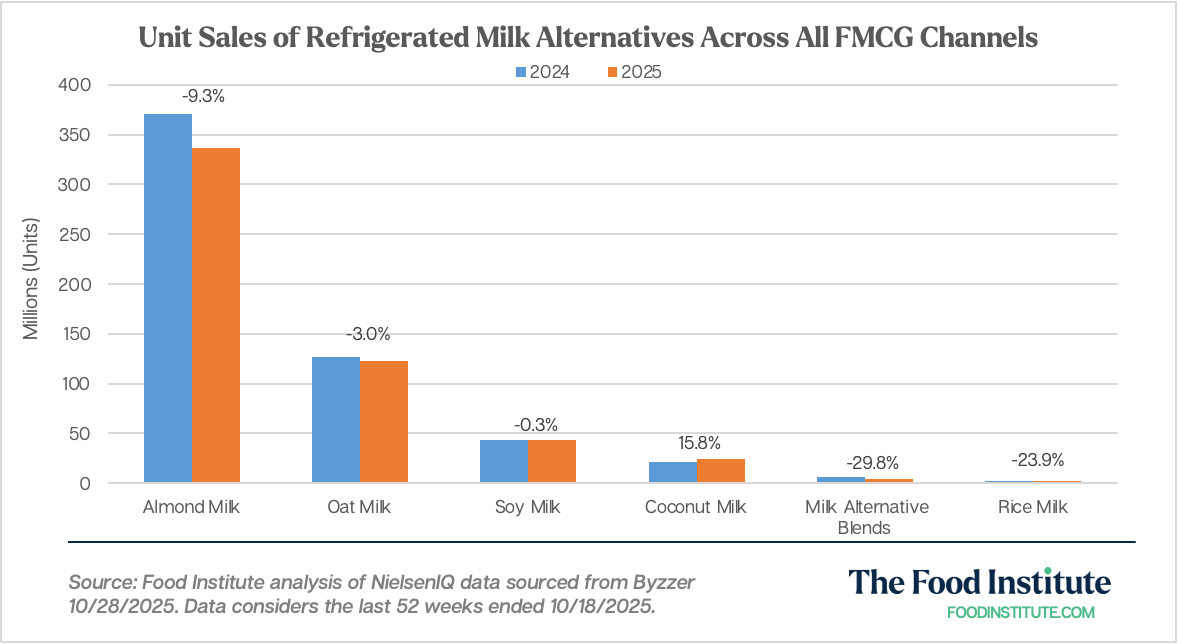

Without context, the plant-based milk market would seem like it’s been struggling in its maturity. In the refrigerator aisle, unit sales of almond milk were down 9% year over year in the 52 weeks ending Oct. 18, while oat milk fell 4%.

However, another factor is at play: Americans are simply drinking less milk in general.

Recent data from the USDA found that dairy milk is struggling. Across milk products, unit sales fell 1.6% year over year in March. To dig deeper, low-fat milk weathered a 4.9% decline, while reduced-fat milk plunged 5.1%.

With this in mind, oat milk’s decline makes more sense; plus, the unit gains to refrigerated coconut milk (+17% year over year) prove to be even more of an accomplishment.

Refrigerated coconut milk saw significant growth, while soymilk unit sales remained flat. Both are comparable to the steep declines in conventional milk.

Overall, plant-based milk has demonstrated tenacity despite the odds being stacked against it.

Since breaking into the industry, it has had to contend with animal-based milks that are made artificially cheaper by government subsidies. Even as price parity continues to waver as a result of inflationary factors, the industry subgroup continues to satisfy unit demand.

Plus, despite prices getting more expensive for these alternatives, converted consumers continue to show willingness to keep them in their carts. For example, soy Milk unit sales may have dropped 0.3% year-over-year, but dollar sales are still up nearly 3% over the period.

Plant-Based Meat Outlook

Similar to the dairy industry, plant-based meat losses are also commensurate with their animal-based analogs. A USDA report found that the dollar sale value for chicken, turkey, and eggs increased by only 4% in 2024, largely supported by inflation in the egg vertical. Chicken alone increased by less than 6% year over year, while turkey fell 44%.

Plant-based protein source claims are losing market share; however, this lower rate is to be expected at a time when consumers are pulling back on spending.

For now, stable tofu sales, along with relative stabilization of the vegetarian claim, signal category resilience.

The sector is reckoning with a consumer base wherein 31% say they are switching to lower-priced options, 30% are prioritizing promotions, and 29% are monitoring the overall cost of their grocery baskets, according to NielsenIQ research. Yet consumer sentiment reporting also reveals a bright spot: Although consumers plan to step up their fresh meat expenses somewhat in 2026, they are prioritizing fresh produce and health and wellness purchases much more frequently.

Looking ahead, the high costs for beef are likely to continue affecting the industry, leading consumers to switch to protein alternatives. Domestic supplies are constrained, and the U.S. is exploring a deal to purchase beef from Argentina to fill the gap.

Climate factors, such as droughts in cattle-raising regions, have created a structural issue that presents an opportunity for the plant-based industry to offer flexitarian and veggie-curious consumers a helping hand.

Plus, consumers’ growing interest in personal health and wellness is likely to create headwinds for red meat, which has been associated with negative health outcomes.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.