Consumers are feeling the pressure of inflated beef prices, which were up 13.9% year-over-year in August, according to the latest Bureau of Labor Statistics data. President Donald Trump’s solution is to import cattle from Argentina.

“We would buy some beef from Argentina. If we do that, that will bring our beef prices down,” Trump told reporters on Oct. 19.

Today, Trump raised the tariff quota on Argentine beef to 80,000 metric tons, allowing Argentina to export more beef at a lower duty rate. This is quadruple the former rate.

The news comes weeks after the U.S. agreed to buy $20 billion in pesos (with some reporting this could reach as high as $40 billion) as part of a currency swap framework with Argentina’s central bank. Conservative Argentine president and ally of Trump, Javier Milei, previously indicated issues with the country’s financial health.

Already, beef imports are up 13% year-over-year as of September, according to USDA.

The top countries supplying domestic beef include Brazil (24%), Australia (21%), Canada (16%), New Zealand (12%), and Mexico (11%) as of July 2025; however, foreign policy decisions such as tariffs on key trading partners, a decade of relatively harsh weather domestically, and a parasitic fly outbreak in Mexico and Latin America, the New World screwworm, continues to affect the industry.

At the time of reporting, Argentina makes up roughly 2% of total U.S. imports.

The decision to increase investments in Argentine beef led to bipartisan criticism and dissent among cattle farmers.

“Bottom line: if the goal is addressing beef prices at the grocery store, this isn’t the way,” Senator Deb Fischer (R-Nebr.) wrote in a statement on X.

“Nebraska’s ranchers cannot afford to have the rug pulled out from under them when they’re just getting ahead or simply breaking even.”

Ground beef prices are roughly $6.3 dollars per pound, a historically unprecedented level that is causing consumers to rethink their budgets.

“We’re seeing people opt away from beef,” Circana EVP Chris Dubois told NPR. “For years, all we saw were increasing prices and increasing demand… This is the moment of change.”

Geopolitical Implications

On the surface, the decision is simple: the U.S. needs beef and Argentina has it. Critics, however, point to the larger sociopolitical climate as a key headwind.

In September, a trade dispute with China left the U.S.’s largest importer of soybeans searching for a new international source to fulfill their soybean needs, eventually accelerating purchases with Argentina and Brazil. Conversely, U.S. soybean producers have been decimated: China accounted for $12.6 billion in exports in 2024; however, in September, the country imported zero U.S. soybeans for the first time since 2018.

In a conversation with PBS, Monica de Bolle of the Peterson Institute for International Economics explained that Trumps interest in the region is twofold: to support a political ally (Milei) secure office during his re-election in two years, and to challenge China’s growing position in the region.

“I see this move by the administration as being completely geopolitical and political in nature, not economic at all,” she said.

The additional declaration to import cattle from Argentina, however, adds an economic incentive to the U.S.’s developing relationship with the country.

The National Cattlemen’s Beef Association (NCBA) formally spurned the decision in a statement Monday, citing the region’s history with foot-and-mouth disease that could allegedly harm domestic livestock production. CEO Colin Woodall also cited the unbalanced trade relationship between both countries as a reason to dissent.

“This plan only creates chaos at a critical time of the year for American cattle producers, while doing nothing to lower grocery store prices,” he said.

USDA Agriculture Secretary Brooke Rollins confirmed Trump’s substantive conversations with Milei regarding Argentine beef in an interview with CNBC, Tuesday. During the interview, she added that securing the domestic beef supply will be a priority following a new nutrition framework spearheaded by the USDA and HHS that prioritizes saturated fats and meat-based proteins.

The Future of U.S. Beef

Wednesday, Rollins also unveiled a plan to support the U.S. cattle industry in a three-point plan to protect ranching; expand processing, access, and consumer transparency; and build demand.

The decision demonstrates the country’s willingness to support its domestic farmer network. The communities, however, remain upset with Trump’s decision to flood the market with foreign-bought beef.

Cattle farming has been in decline for years because of ranchers having to sell their beef cows and reduce their available feedstock following a series of droughts throughout the western U.S., as well as other structural issues, such as increased input costs.

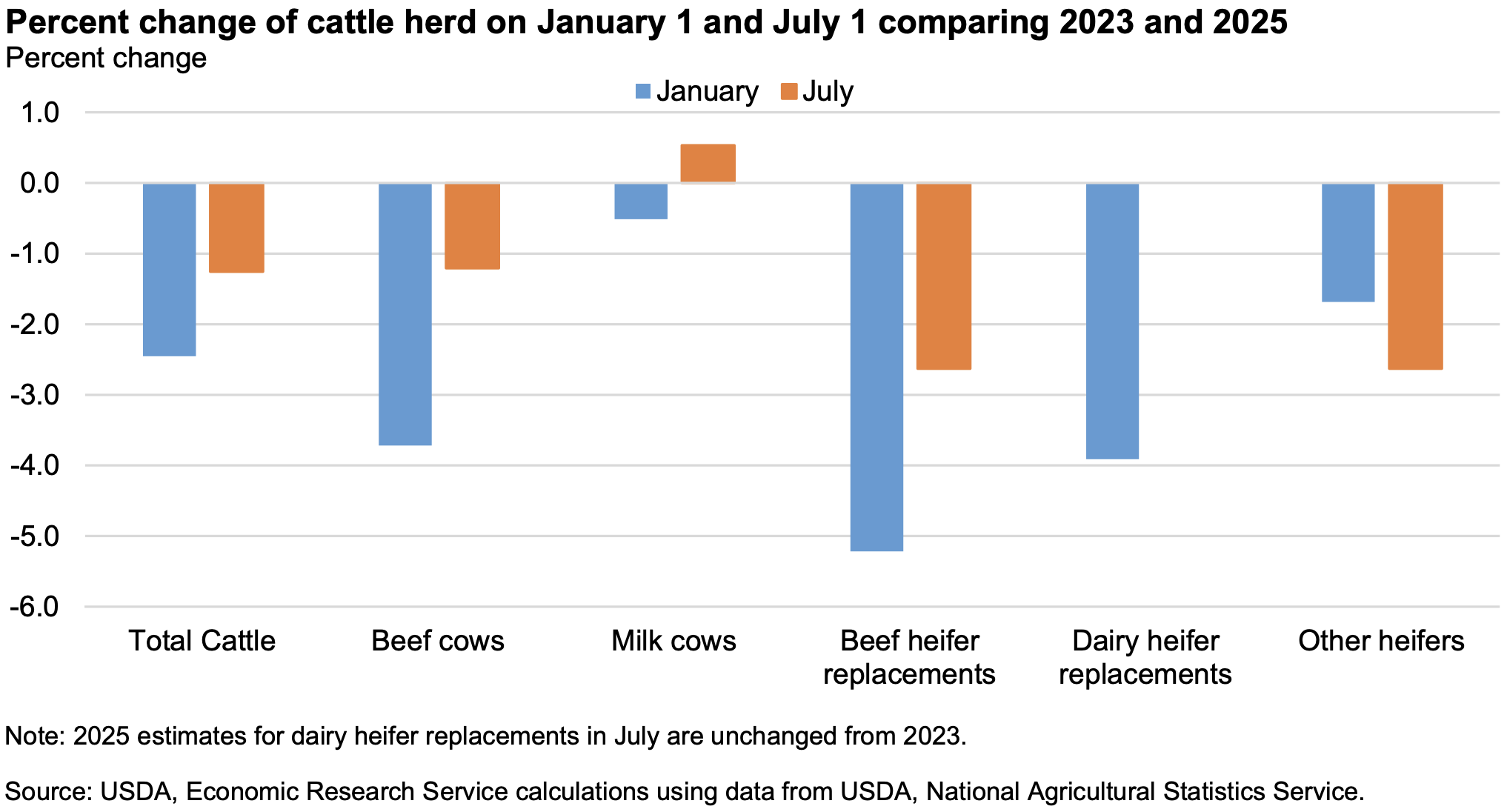

Over the last two years, in fact, USDA data shows that the total cattle population has fallen dramatically in both January and July of this year compared to 2023.

“There’s healthy competition for the cattle, and there’s not enough of them to fulfill the demand. And so it has driven prices to historic highs,” Brady Blackett, a third-generation Angus cattle producer in Utah told NPR.

Note: The article was updated on October 24, 2025 following news that President Donald Trump increased the tariff rate quota for Argentina to export beef to the U.S.

Food for Thought Leadership

Is the future of flavor increasingly borderless? Valda Coryat, vice president of marketing for condiments and sauces at McCormick, reveals how curiosity powers McCormick’s flavor foresight, why segmentation by “flavor personality” matters, and how flavors are becoming more culturally driven.