Nearly 20% of U.S. adults are either currently taking or considering a GLP-1 drug for weight loss purposes, according to recent data from Civic Science.

This shift now means that more consumers are using a GLP-1 for weight loss than its intended diabetes application, Glanbia Nutritionals senior customer marketing manager Bill Waltzek said on a recent FI webinar titled “Metabolic Health and Weight Management in the GLP-1 Era.”

FI CEO Brian Choi added that the sustained interest in GLP-1 drugs – a class of medication that mimics the effect of a naturally occurring hormone that regulates metabolic and cardiovascular processes – is thanks to the concurrent interest in personal health and wellbeing.

“Health and wellness 3.0” is a macrotrend shaping domestic consumer behaviors wherein consumers are focused on one’s personal relationship with their body, and are much more knowledgeable about the foods they consume.

“We’re now at a stage where consumers are hyper-focused on their health, especially weight loss, and clean nutrition,” Choi said.

Where Does GLP-1 Fit In?

“[GLP-1s] are another tool in the toolbox” to help a consumer manage their nutrition goals, Waltzek explained.

It’s a major driver for weight loss, as research shows that it is an effective tool to lose weight, especially if someone suffers from obesity.

This interest has created multiple classes of offerings that are changing the functional food and beverage market. Choi explained that CPGs and foodservice are getting behind the GLP-1 craze with protein and macronutrient-rich products, such as Smoothie King’s Gladiator GLP-1, which helps medication users meet their health goals despite consuming fewer categories.

These shoppers over-index for nutrient-dense protein products, such as protein bars, powders, and fortified cereals.

Additionally, Waltzek noted the immense potential that the food and beverage industry can provide to GLP-1 users experiencing negative side effects or curious consumers worried about them. Research cited in the webinar found that 77% of users have experienced negative side effects, and 69% of global consumers are interested in medication-free food and beverage alternatives that stimulate GLP-1 hormones.

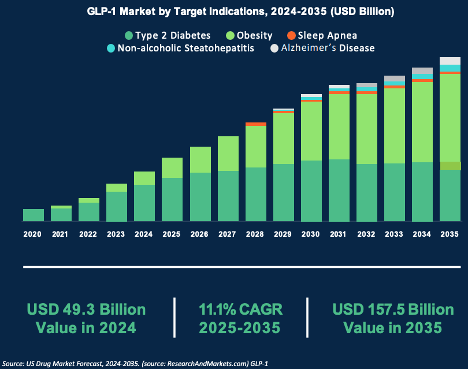

Here, the food and beverage industry is prepared to capitalize. Some research firms, such as Research and Markets, project the market to grow by a compound annual growth rate (CAGR) of 11.1%, ending 2035 with a valuation of as much as $157.5 billion.

“There are a lot of food and beverage manufacturers, and there are not that many products on the market,” said Choi.

“Now is a great time to be in the lab and working… to test new products that service consumers who are on a GLP-1 diet.”

If you’re interested in watching the webinar, become an FI member to access this and all of The Food Institute’s educational content.

The Food Institute Podcast

How can a food industry trade show spark global culinary creativity? Anuga’s JP Hartmann, U.S. Consul General Preeti Shah, and World Food Championships’ Nikki Jackson share their perspectives on how the U.S. presence at Anuga 2025 is helping to bridge culinary experiences together.