Government data uncovering record-high meat prices has consumers wondering what has happened to beef.

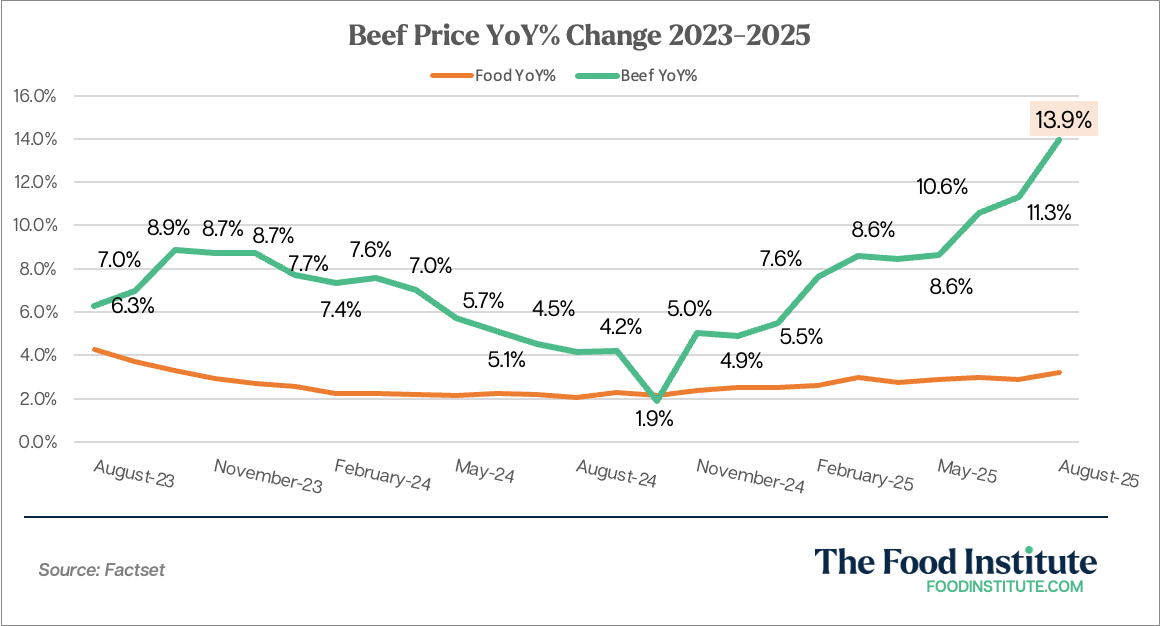

Beef and veal prices were up 13.9% year-over-year in August, after multiple years of record highs, according to consumer price index (CPI) data from the Bureau of Labor Statistics, a marker for inflation.

The segment is a major contributor to overall food inflation, both because of its overall scale and because of its historically unprecedented heights.

This recent acceleration comes two months after ground beef exceeded $6 per pound. And there’s no sign of stopping: August ground beef prices sat at $6.3 per pound, compared to July’s $6.25 per pound.

The mid-year cattle report from the USDA showed that reduced estimates of expected calves in late 2025 and early 2026 are likely to continue straining supplies. Plus, the August update showed reduced beef imports expected from Brazil. Year-to-date, Brazil accounts for 25% of beef imports, meaning reduced shipment volumes are likely to keep prices high.

The flesh-eating parasite New World screwworm also continues to mute imports from Mexico and other Latin American countries. The U.S. government is currently working with local officials to mitigate the outbreak. Most recently, a case has been detected as north as Nuevo León, Mexico, 70 miles from the U.S. Mexico border.

Now that tariffs are in effect, many beef-exporting regions will likely also rethink their U.S. strategy.

“Prices for beef will continue to be tumultuous for the next two to four years,” Patrick Montgomery, CEO of KC Cattle Company, told Axios.

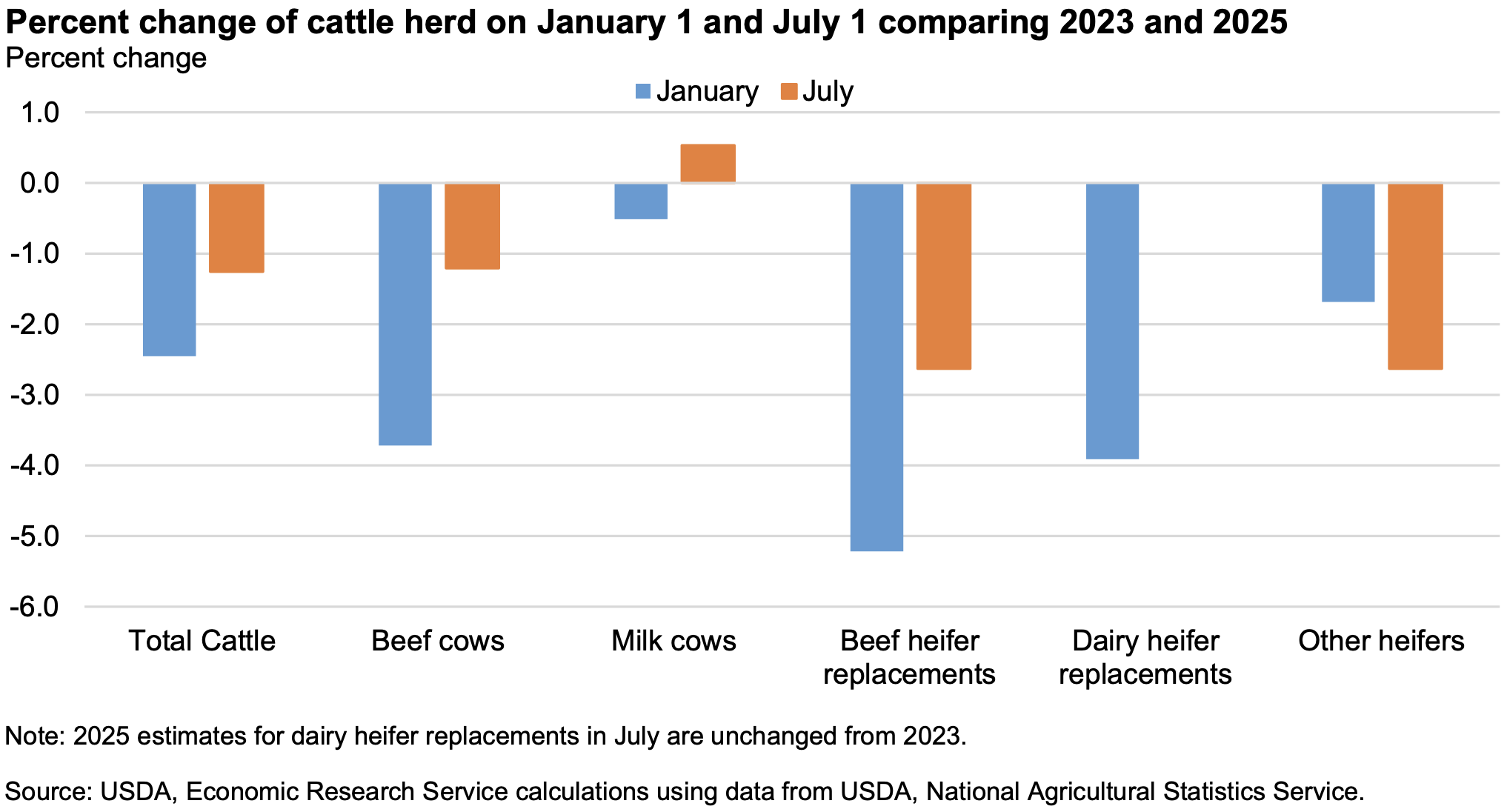

Additional factors include droughts throughout the western U.S. that have forced ranchers to sell off their beef cows and reduce their available feedstock, according to CBS News.

In fact, government data shows that, between 2023 and 2025, the number of beef cows has fallen by a startling amount in both January and July of this year, compared to 2023.

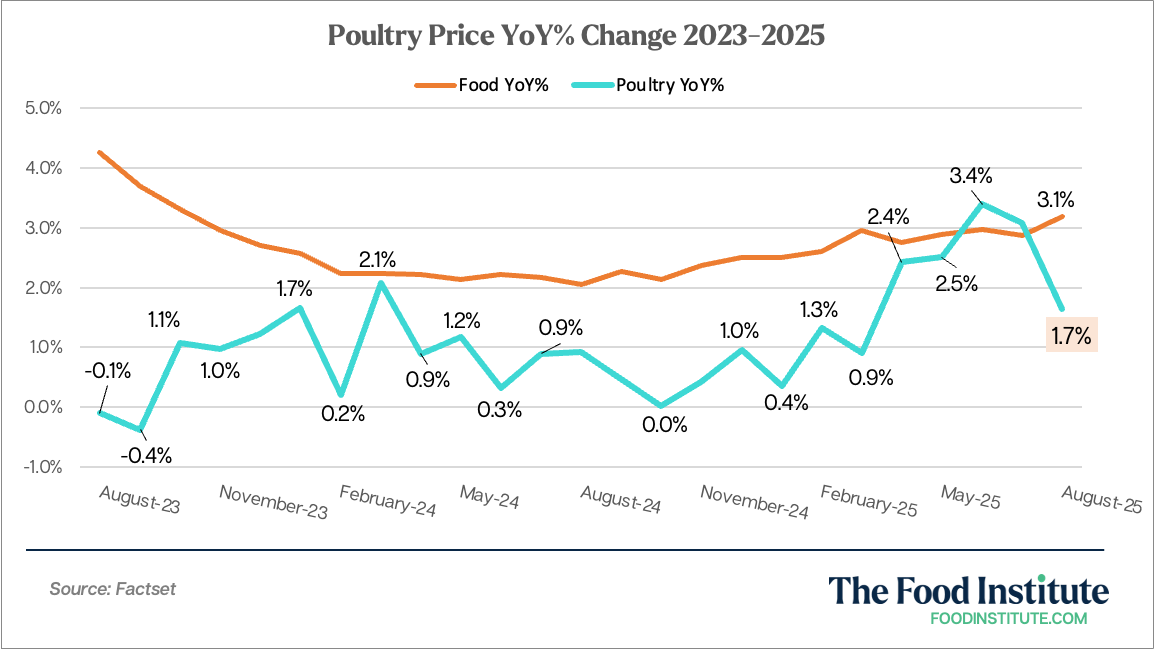

A University of Michigan report from earlier this year found that consumer confidence in beef during May 2025 was down 26.5% from the year before, noting how this suggests demand will follow a complementary downward trend.

As a result, consumers are pulling back their beef spending, opting for relatively stable alternatives such as poultry or pork. With the exception of June and July, poultry sales have been consistently below the average food inflation rate on a year-over-year basis.

Beef isn’t the only vertical keeping prices high.

The August report also showed that coffee prices are up 20.9% YoY, pushing up the beverage materials category up 12.1% and the overall non-alcoholic beverage market up 4.6% YoY.

The Food Institute Podcast

How can a food industry trade show spark global culinary creativity? Anuga’s JP Hartmann, U.S. Consul General Preeti Shah, and World Food Championships’ Nikki Jackson share their perspectives on how the U.S. presence at Anuga 2025 is helping to bridge culinary experiences together.