In terms of the headlines, Walmart’s second quarter earnings report on Thursday morning was a ‘good news, bad news’ quarter. Relative to Wall Street expectations, sales were a full $3 billion better than expected. But net profits were lower than consensus estimates, by about $500 million.

That’s an unusual split for a retailer: profits generally rise alongside revenue (and usually at a faster rate). But, of course, it is an unusual environment, and there’s an obvious culprit here: tariffs.

The most notable commentary from the earnings call came from CEO Doug McMillon, who said Walmart’s costs from tariffs are going up each week as the company has to replenish inventory.

A surprise stock in health costs also pressured Walmart’s bottom line. What’s notable in the context of those prices is that the consumer hasn’t quite responded yet. The CEO noted shifts among lower- to middle-class customers, but emphasized that “any behavioral adjustments by the customer have been somewhat muted.”

After the call, CFO John David Rainey told CNBC that private label sales were actually flat year-over-year. General merchandise sales increased during the quarter, with volume down only modestly.

At least so far, the tariff-driven bloodbath in general merchandise hasn’t yet materialized.

But given the uncertainty around tariffs, and the likely increase in the second half of the year, that doesn’t mean it won’t. Walmart did expand its guidance range around profits for the full year, in large part because even the company with more economic data than perhaps any company in the world isn’t not entirely sure how the next five-plus months will play out.

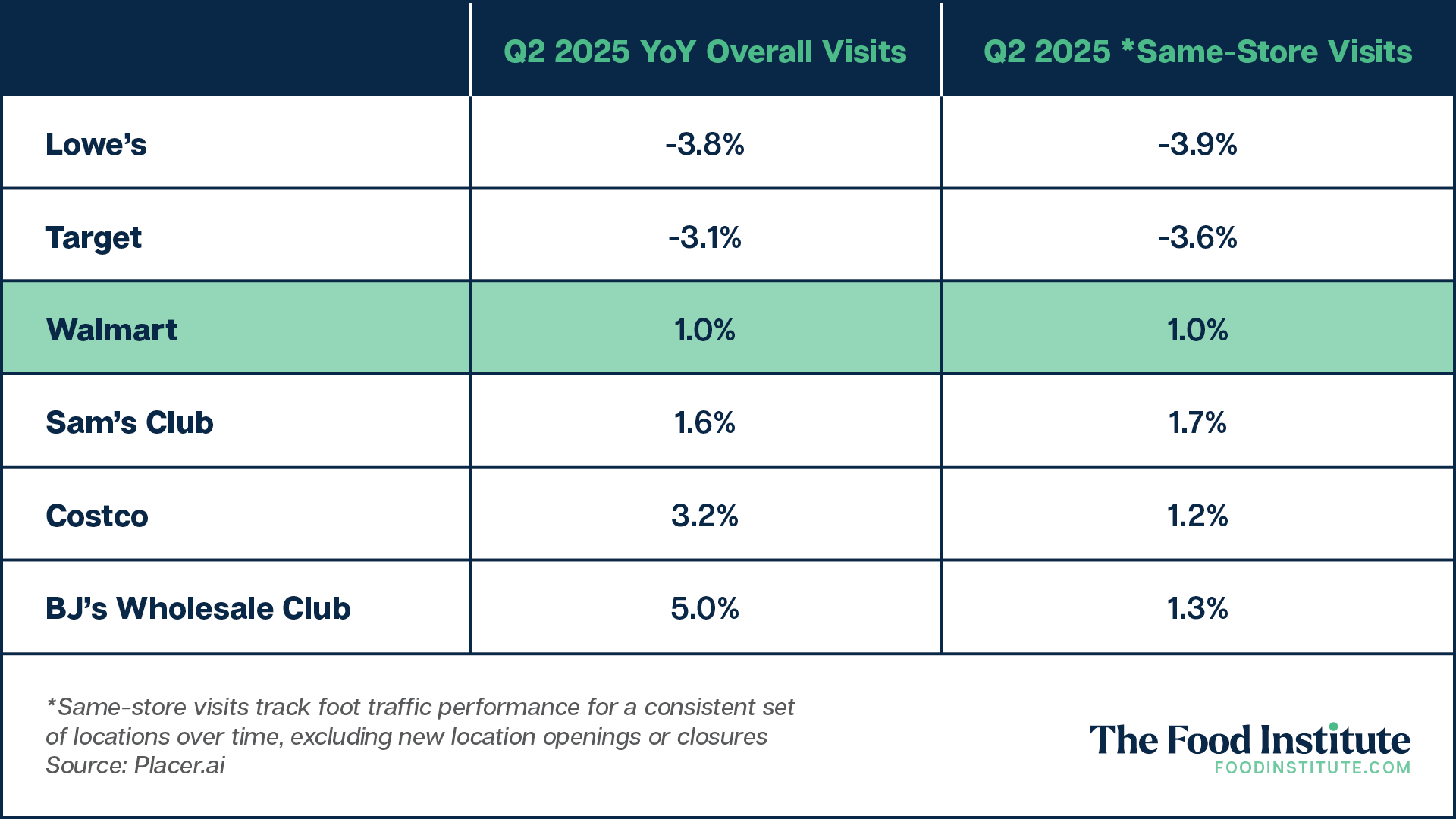

But in terms of what Walmart can control, we highlighted in June. The retailer didn’t give specific figures for grocery, but given ‘strong’ performance against an overall 4.6% increase in same-store sales, it seems almost certain its share gains in that category are increasing.

The turnaround at Sam’s Club is continuing, with same-store sales growth just shy of 6%, and strength in grocery in that unit as well; Rainey said fresh and frozen revenues were up more than 10%.

The ancillary efforts too are cruising along. Walmart+ membership revenue was up “double digits”. The ‘omnichannel’ model here continues to work: eCommerce sales rose 26% at both Walmart and Sam’s. And advertising sales rose 31%, though some of that comes from last year’s acquisition of Vizio.

To be sure, the initial response from the market was, to use McMillion’s phrasing, “somewhat muted’. Walmart stock was down about 3% in early trading. That seems both a reflection of the stock’s huge run — WMT is up 40% over the past year — and a tariff impact that seems potentially higher than investors expected.

But in terms of the underlying business here, the Q2 report shows that Walmart is firing on all cylinders.

The retail giant is taking share in grocery, rebounding against Costco in club, and fulfilling its mission of low pricing. What we’ll learn in the next two quarters is, in a tariff environment, how it fulfills that mission, and who pays for it: investors, customers, or suppliers.

Vince Martin is an analyst and author whose work has appeared on multiple financial industry websites for more than a decade; he’s currently the lead writer for Wall Street & Main. He has no positions in any companies mentioned.

The Food Institute Podcast

How will the One Big Beautiful Bill Act (OBBBA) impact your food business? Unraveling the implications of new legislation is never easy, but Patrick O’Reilly and Jeff Pera of CBIZ explain how provisions of the bill related to no tax on tips, depreciation and expensing of capital purchases, and research and development will impact the industry.