Latin American (LATAM) and Hispanic consumers fuel 16% of total CPG growth in the U.S., according to a report from Circana, representing sizeable buying power for the consumer base. Moreover, younger generations are more likely to identify as Hispanic, with Gen Z and Gen Alpha having crossed the 25% threshold in 2023 (now 26%).

This means these shoppers and their influence have never been more impactful to CPG bottom lines.

“Global isn’t even global to many consumers anymore; it is simply how they grew up,” Claire Conaghan, trendologist and associate director at Datassential, told FI in a conversation about the growing interest in multicultural grocers and flavors for an FI Monthly Report on the topic.

The demand for these ingredients may seem like a newer trend, with how many sources are reporting on the topic; however, it has shaped the modern macroenvironment for generations. The only difference now is that a more diverse demographic group is empowered to celebrate and share their culinary traditions.

The U.S. has a storied history of Mexican cuisine impacting the foodservice and retail markets: data from MenuData found that Mexican food is the fourth largest cuisine type by market penetration. Now, however, cuisine types from other LATAM countries are getting recognized.

This has inspired two-fold growth: on one hand, immigrants and their children (and grandchildren) are asking for these foods or opening restaurants to showcase these cultural delights, and on the other hand, the contact with this culinary diversity has impacted the taste buds of other Americans and immigrants from other regions.

The result — sustained demand for LATAM cooking.

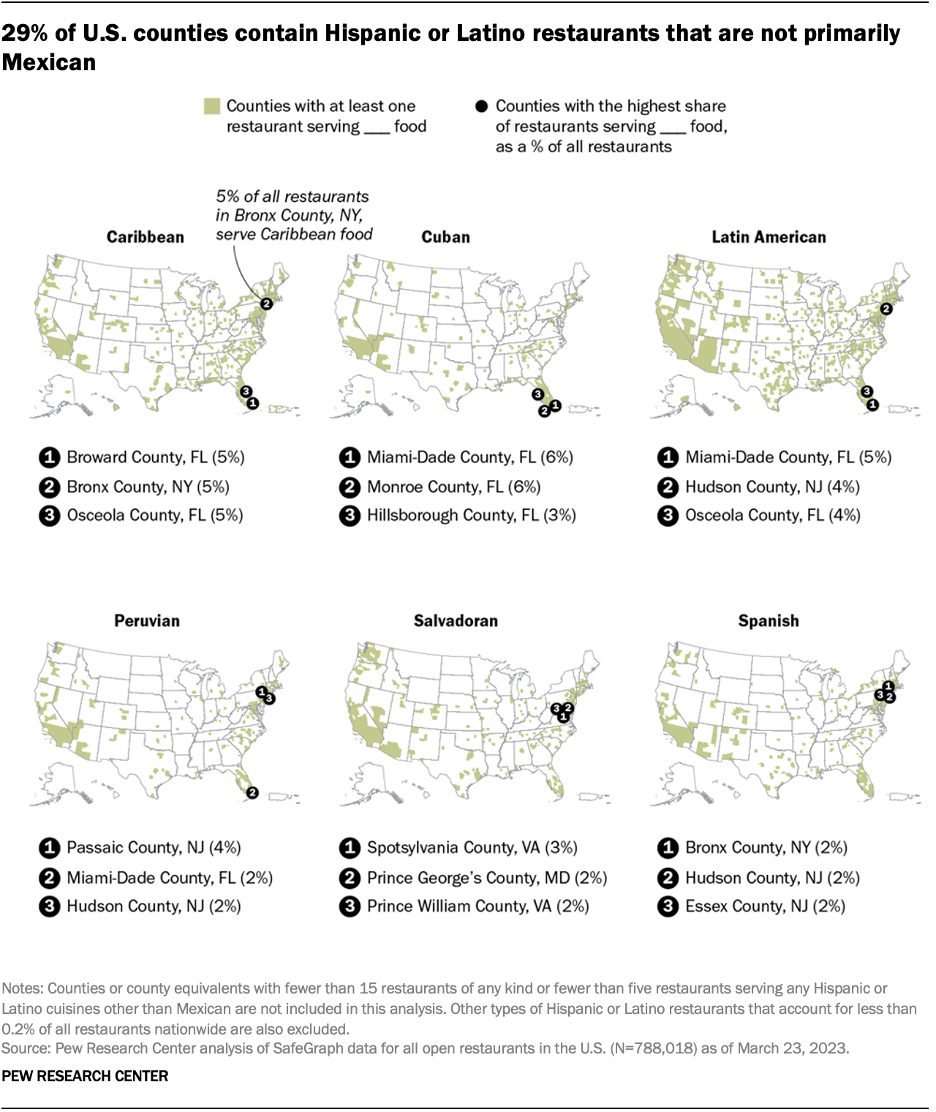

Source: Pew Research Center

Across the board, these foods are growing, primarily throughout the East, Southeast, and West. The implication of this growth has also meant that restaurants that don’t consider themselves LATAM have begun offering dishes inspired by these countries on their menus.

Although middle America’s growth is slower, LATAM restaurants are still betting big in the region. International Brazilian steakhouse Fogo de Chão, for example, recently announced plans to expand to Ohio and Tennessee, adding to its existing domestic footprint that spans New York, Oklahoma, Virginia, New Jersey, Washington, and Maryland.

Breaking Down the LATAM Consumer

LATAM shoppers, especially, are looking for culturally relevant ingredients to connect with their heritage.

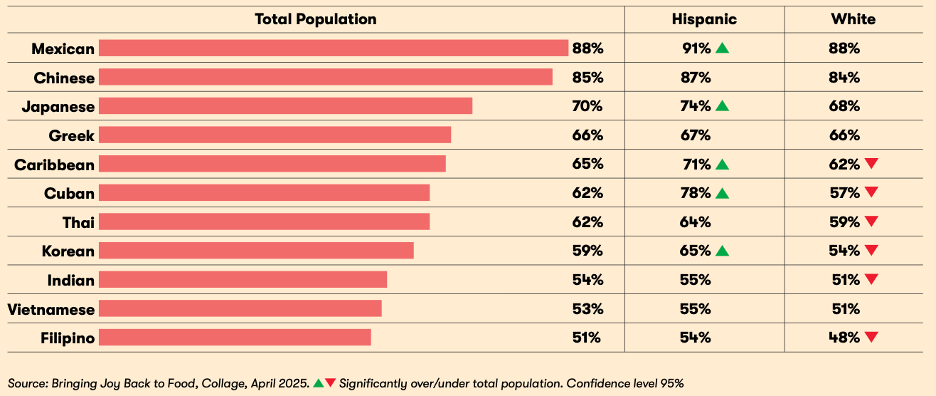

A report about Hispanic shoppers, many of whom also likely identify as LATAM due to the crossover of both markers, found that roughly 40% see connecting with culture as a big reason to cook, compared to 23% for white consumers. Moreover, these consumers are more likely to be “adventurous” eaters, with 51% agreeing that food is an opportunity to experiment, according to findings from Collage’s Bringing Joy Back to Food report.

Broken down by cuisine type, these consumers are more open than their white counterparts to try food from myriad demographic subgroups.

Additionally, many LATAM shoppers are more profitable – for those who identify as Hispanic, almost twice as much, in fact. Hispanic households lead in dollar sales growth for the F&B industry: up 3.5% compared to 1.7% for non-Hispanic households, according to a report from Circana.

The takeaway is simple. Restaurants and retailers need to understand the impact that these shoppers have on their margins and cater to these demographic subgroups, where appropriate. It can be a boon for operators as U.S. economic uncertainty persists.