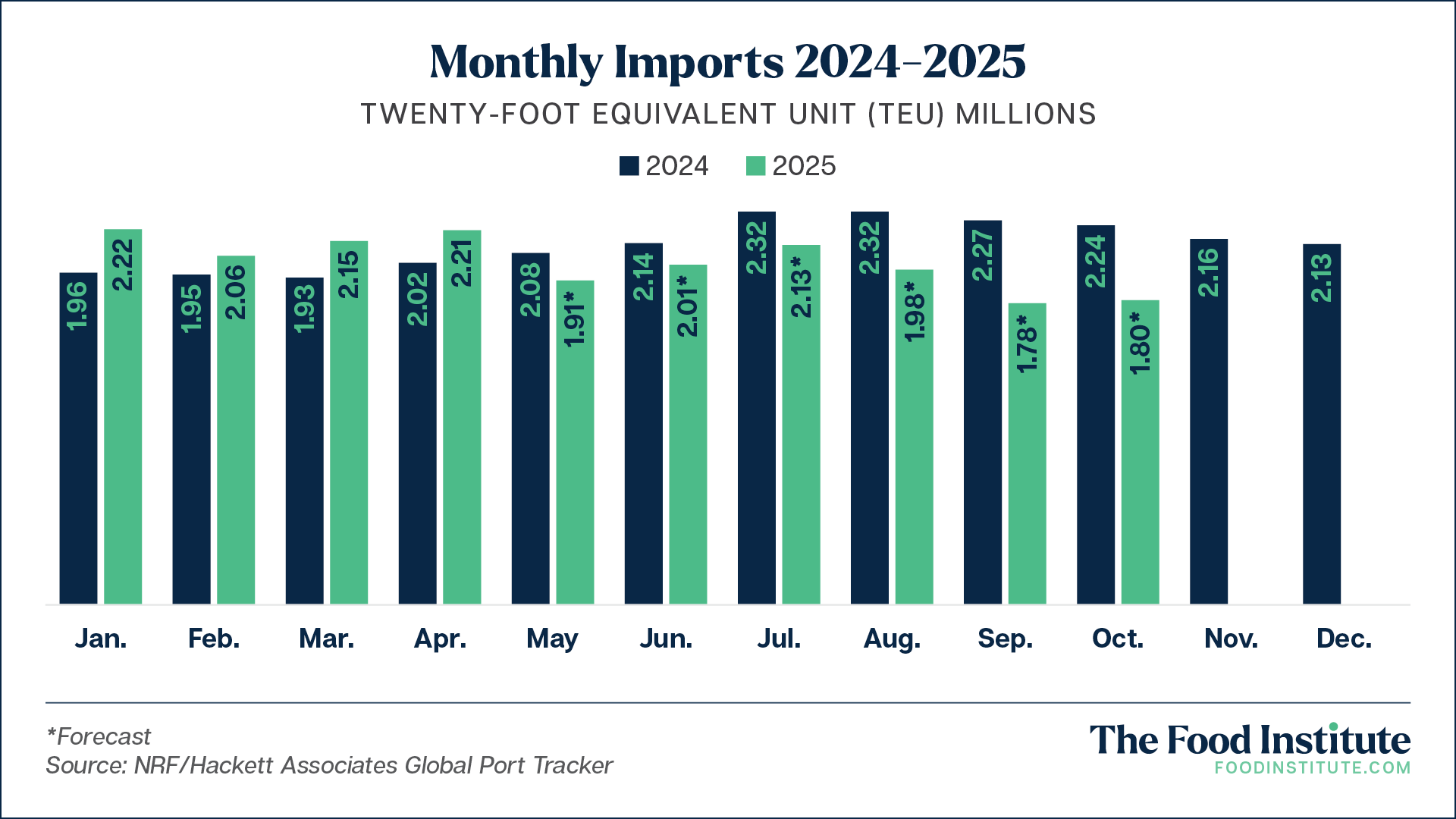

Analysts portend a summer surge in retail cargo heading into July and August as businesses ready their supplies for the back-to-school season and Q3 and Q4 holiday rush.

This year, however, monthly traffic will likely remain below last year as consumers exhibit cautious spending behaviors.

The import sector must reckon with Trump administration tariffs, including the recently instated doubled levies on steel and aluminum, which can affect building bottom lines and packaging costs. Moreover, companies are preoccupied with additional measures like the reciprocal tariffs that are paused until July 9 and the 145% tariff on China that was reduced to 30% until August 12.

June 11, President Donald Trump said he would be willing to extend the reciprocal tariff pause, but suggested that he didn’t believe it necessary, as his administration is engaging in negotiations with roughly 15 countries. So far, however, only a deal with Britain has been brokered, reported Reuters.

In June, the National Retail Federation expects cargo TEUs (Twenty-Foot Equivalent Units, the industry standard) to fall 6.2% on a year-over-year basis, while July’s imports are projected to drop 8.1%. After that, imports will likely drop sharply following a 14.7% downturn in August.

The Consumer Side

As it stands, a separate NRF report developed with Affinity Solutions found that, in May, total retail sales (excluding gasoline and automobiles) were up 0.49% seasonally adjusted and 4.44% unadjusted year-over-year, a marked slowdown from the 0.72% MoM and 6.76% YoY gains in April. These findings signal that some of that pre-tariff consumer purchase rush has begun to stagnate.

“While momentum remains, the nature of consumer spending is shifting as economic uncertainty increases,” NRF President and CEO Matthew Shay said in a statement.

For grocery and beverage stores, retail sales narrowly lag behind the month-over-month average, ending 0.03 percentage points below, seasonally adjusted in May; on a year-over-year unadjusted basis, however, these sales are 0.09 percentage points above the mean. This indicates consumers’ relative resilience when it comes to their grocery budget, especially as food inflation enters a period of outpacing wage gains, according to The Food Institute analysis.

Sky-High Shipments

The state of the domestic economy is affecting interesting parts of the import industry.

A recent Forbes report found that air cargo has begun taking a larger market share of transportation methods, accounting for more than 30% of the value of imports in the five months following December 2024. In March, it accounted for as much as 38.91%, with ocean import responsible for 35.66%, and land import for only 25.43%. That month, it was the first time ever it had overtaken ocean shipments in terms of value, the traditional market leader.

The rising market share for air cargo transportation suggests a shifting supply chain in the face of economic factors. Although food and beverage items are typically shipped by ocean or land, air cargo, which is typically quicker at the expense of higher rates and smaller capacity, may need to shift their shipment assortments.

Mostly responsible for higher-value items, including automotive volumes, fast fashion, consumer electronics, and toys, tariffs and the end of the de minimis exemption for China and Hong Kong exports to the U.S. may be responsible for an air cargo-heavy global supply chain, reported Supply Chain Dive. De minimis is a ruling that allowed shipments under $800 bound for the U.S. to be exempt from additional tariffs and duties; the provision ended on May 2, 2025, and helped keep e-commerce international purchases low for American shoppers.

These modifications likely facilitated the March spike in air cargo transport, and mean air freight volumes will likely fall by as much as 50% in a “post-de minimis” America. As a result, shippers are shifting their capacity and even prioritizing routes away from China, the largest beneficiary of de minimis exemption, according to the report.

Shippers, however, are holding their breath to see how tariff modifications play out.

The Food Institute Podcast

Just how difficult is it to scale a better-for-you snack company? Rebecca Brady, founder and CEO of Top Seedz, shares how she turned a homegrown idea into a rapidly scaling snack brand and breaks down the strategy behind her growth, from bootstrapping production to landing national retail partnerships.