This article is sponsored and written by CohnReznick.

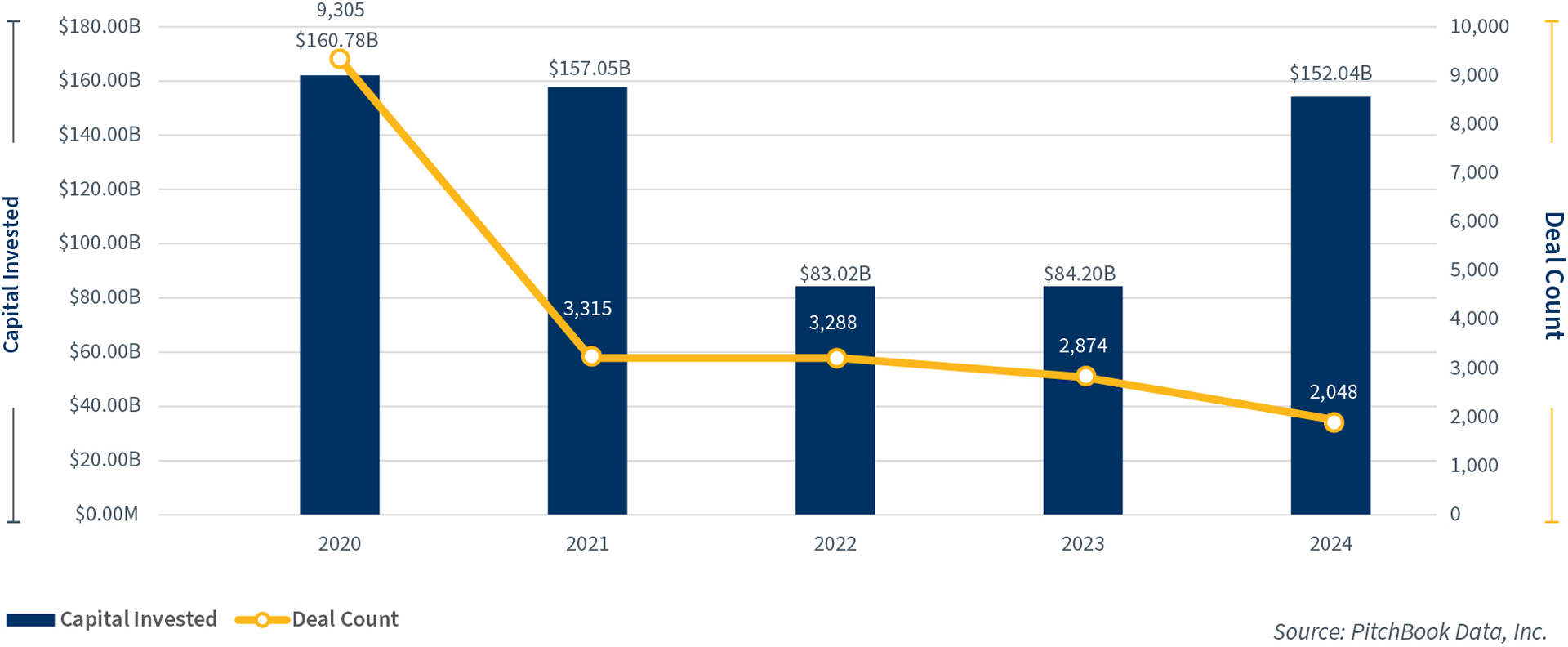

The food and beverage space had a higher volume of M&A activity in 2024, when more deals closed and a much higher deal volume was reported ($149.9 billion) versus 2023’s $83.1 billion. Specific to Q4, a total of $24.8 billion in deals closed across 351 deals, compared to $64.4 billion and 506 deals the prior quarter. This represented the highest level of activity across all four quarters in 2024.

Many of the food and beverage deals closed during Q4 involved beverage makers and distributors. Some of the biggest transactions included BlueTriton Brands’ $9 billion acquisition of the bottle beverage company Primo Brands Corp, Performance Food Group’s purchase of food and grocery distributor Cheney Brothers for $2.1 billion, and Butterfly Equity’s $1.95 billion acquisition of The Duckhorn Portfolio, a producer of high-end wines.

Trending Numbers

All data gathered from PitchBook Data, Inc.

Year-end: Capital invested by deal count

To download the report, click here.

About CohnReznick

CohnReznick helps organizations optimize performance, manage risk, and maximize value through associated firms operating under the CohnReznick brand: CohnReznick LLP, a licensed CPA firm providing assurance services; and CohnReznick Advisory LLC (not a licensed firm) providing advisory and tax services. Together, CohnReznick provides leaders with deep industry knowledge and relationships, solutions to address clients’ unique business goals and risks, and insight on how emerging market forces can drive opportunity. With offices nationwide, CohnReznick serves organizations around the world as an independent member of Nexia. For more information, visit www.cohnreznick.com/manufacturing.

Contact:

Helana Robbins Huddleston, CPA, CIRA

Partner, Manufacturing and Distribution Industry – Co-Leader

Transaction Advisory Services

312.508.5813

helana.robbins@cohnreznick.com

Henrietta Fuchs, CPA

Partner, Manufacturing and Distribution Industry – Co-Leader

646.762.3432

henrietta.fuchs@cohnreznick.com