This article is sponsored and written by CohnReznick.

The food manufacturing sector was active during the second quarter and much debt was refinanced during the three month period. Deals of note included Anchor Packaging’s $790 million dividend recapitalization, and the acquisition of Corbion’s business division by Kingswood Capital Management for $362 million. Debt refinancings occurring in Q2 included Coca-Cola Consolidated with a $6.3 billion debt raise, Lamb Weston Holdings receiving $450 million of debt, McDonald’s closing on $2 billion of debt, and United Natural Foods refinanced $630 million in debt.

Similar to the overall M&D market, we have also seen renewed interest by venture capital investors in the F&B industry. The top investors in the food and beverage space for the past six months in 2024 are heavily weighted towards venture capital with a few private equity deals getting completed. In the past six months, Gaingels completed six transactions, Plug and Play Tech Center completed five transactions, Branch Venture Group closed three transactions, Ackley Brands completed three transactions, and Encore Consumer Capital closed two transactions.

We are seeing geopolitical impacts on the supply chain in the form of access to raw materials, wars, and recurring supply chain disruptions. New laws, acts, and regulations (e.g., IISA, IRA, CHIPS Act, etc.); the persistent labor shortage; the drive to automate and digitalize; and increasing cybercrime levels are also impacting the food manufacturing sector.

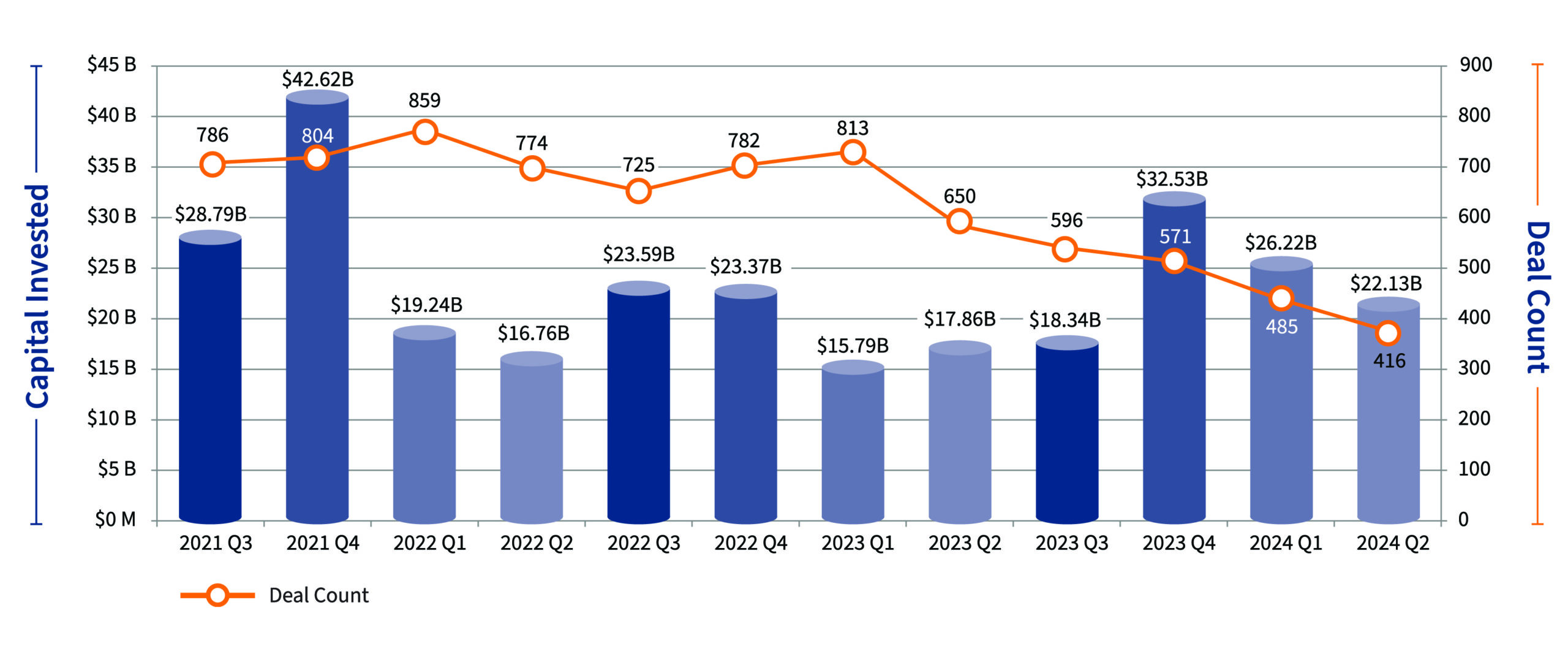

QUARTERLY TRENDING NUMBERS

All data gathered from PitchBook Data, Inc., as of July 11, 2024

Food and beverage manufacturing capital invested by deal count

To download the report, click here.

About CohnReznick

CohnReznick helps organizations optimize performance, manage risk, and maximize value through associated firms operating under the CohnReznick brand: CohnReznick LLP, a licensed CPA firm providing assurance services; and CohnReznick Advisory LLC (not a licensed firm) providing advisory and tax services. Together, CohnReznick provides leaders with deep industry knowledge and relationships, solutions to address clients’ unique business goals and risks, and insight on how emerging market forces can drive opportunity. With offices nationwide, CohnReznick serves organizations around the world as an independent member of Nexia. For more information, visit www.cohnreznick.com/manufacturing.

Contact:

Helana Robbins Huddleston, CPA, CIRA

Partner, Manufacturing and Distribution Industry – Co-Leader

Transaction Advisory Services

312.508.5813

helana.robbins@cohnreznick.com

Henrietta Fuchs, CPA

Partner, Manufacturing and Distribution Industry – Co-Leader

646.762.3432

henrietta.fuchs@cohnreznick.com