Coca-Cola tried to spice things up in 2024. Unfortunately for the 138-year-old beverage company, customers largely prefer its old standby. So, when Coca-Cola recently announced it was discontinuing its “Spiced,” raspberry-flavored soda, few industry analysts were surprised.

Matthew Herbert, co-CEO of the Tracksuit platform, told The Food Institute that the main weakness of Coca-Cola’s brands is that “they’re not seen as innovative, and they’re not seen as a brand that’s on the way up, compared to an Olipop.

“What’s the brand promise between Coca-Cola and its products? It’s trusted,” Herbert added. “People know Coke, it’s established, and people just want what they do great.

“When (consumers) are looking for an alternative in terms of innovation, they’re not looking to go to a Coca-Cola.”

According to The Associated Press, Coca-Cola Spiced was developed in just seven weeks. Now, the multinational corporation is left searching for its next big thing, though it promises to replace Spiced with a new flavor to be introduced in 2025.

“We’re always looking at what our consumers like and adjusting our range of products,” the company said in a statement.

Herbert, a marketing expert, said the downfall of the Spiced soft drink may have been a misalignment between the product, consumers’ expectations, and Coca-Cola’s messaging.

“For Coca-Cola to pull it after that, I’m sure they were looking at the signals,” said the Tracksuit co-founder. “I’m sure they were looking at the consumer feedback about all those key metrics that were important to them and made the decision to pull it.”

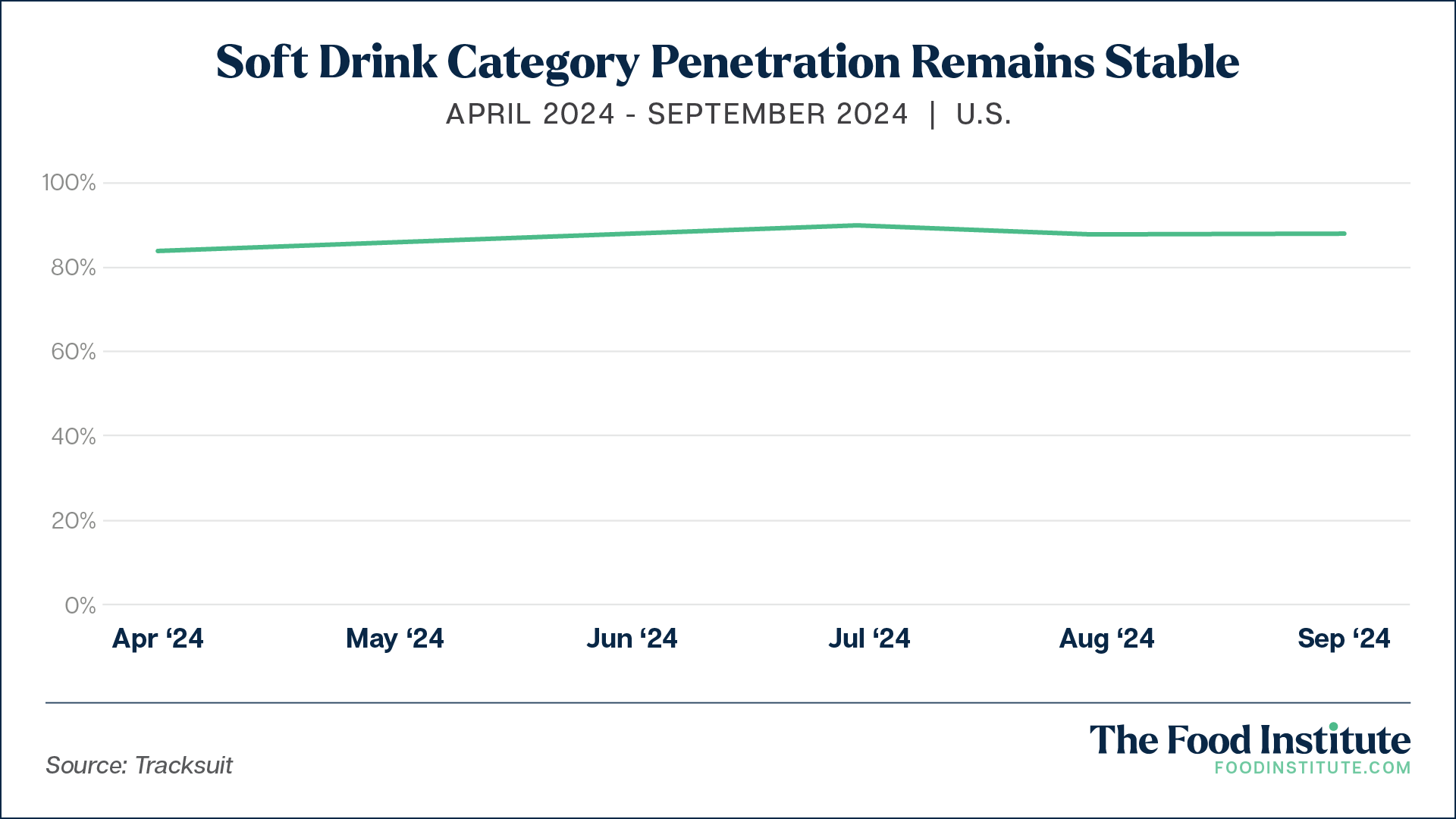

According to a recent Tracksuit survey, at a nationally representative level, the soft drinks category penetration as a whole has remained stable over the past six months. Among consumers aged 18 to 24 years, soft drink category penetration has increased by 4%; among 18 to 34-year-olds category penetration has increased by 5%.

A Lesson Learned from Dr Pepper

Coca-Cola remains the soft drink market leader. The venerable brand is trusted and often sparks nostalgia among consumers. But Coke and longtime rival Pepsi are receiving noteworthy competition of late from the likes of Dr Pepper and even fledgling better-for-you brands like Olipop and Poppi. Dr Pepper, for example, recently overtook Pepsi for second place in market share in the U.S.

“Look at Dr Pepper. … They’ve been around for 139 years,” Herbert noted. “But Dr Pepper has continued to maintain relevance and uniqueness about their position in the market, and they’re leveraging channels like TikTok that resonate.

“It’s knowing what makes the brand distinctive, what makes the brand resonate with the target consumers, and really leaning into that – and Dr Pepper is doing it.”

Where Soda Consumers Reside in Modern Times

According to Tracksuit data, media consumption among consumers in the soft drinks category is, predictably, shifting online and to social media. Between April 2024 and October 2024, media consumption among soft-drink customers was as follows:

- Facebook 65%

- YouTube 63%

- Paid streaming platforms 59%

- TV 57%

- Instagram 45%

- Radio 38%

- TikTok 32%

Among coveted 18 to 24-year-old soft-drink consumers, media consumption has looked like this in 2024:

- YouTube 71%

- Instagram 65%

- Paid streaming platforms 62%

- TikTok 61%

- Snapchat 51%

- Facebook 46%

- TV 40%

Advice for Drink Manufacturers

Analysts like Herbert have little doubt that brands like Coca-Cola and Pepsi will fare just fine in the years ahead. The tradition-rich soda brands simply need to lean into the trust they have long established with their customers, said the Tracksuit exec.

“They’ve been around a long time, and I expect them to be around for a long time,” Herbert said. “Tying the brand promise to the products that they’re delivering … will see them in a strong position.”

That said, consumer behaviors are, in some ways, evolving. As a result, brands must present their messaging where consumers tend to spend time in order to continue building familiarity. In 2024, that entails advertising on YouTube, streaming services, and social media.

Herbert feels major soda manufacturers need to leverage their brand history, yet also stand out through innovative advertising that resonates with younger audiences in an authentic manner.

“Authenticity is really key for this younger age group who are valuing transparency and engagement and aligning the products to what the brands are saying (and) doing,” Herbert said. “Authenticity, relatability, and showing up in a way that’s distinctive from competitors, that’s what’s really building trust, familiarity, and closeness – and ultimately driving purchasing.”

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.