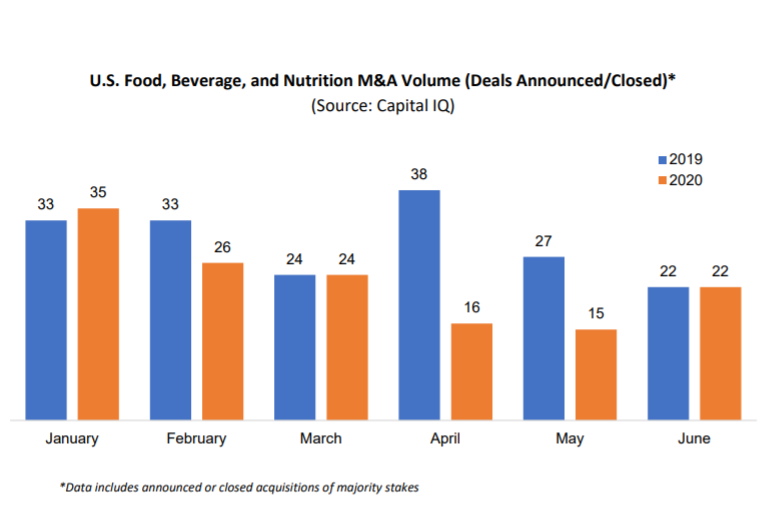

The global outbreak of COVID-19 has had a significant negative impact on our daily lives. It has also had a meaningful impact on transaction activity in the U.S. M&A market. What was shaping up to be another record year of M&A volume through February has devolved into an inefficient market with ever-changing conditions that caused a slowdown in deal activity. Despite the disruption, M&A and investing activity in the food and beverage industry experienced less of a slowdown than other sectors as strategic buyers generated cash, private equity funds sought safe categories, and venture capital investors refined their target sub-categories.

Rebound in Packaged Food and Beverage M&A Activity

Operators in the packaged food, beverage, and nutrition category have dealt with new challenges in recent months, such as maintaining their supply chains, ensuring employees are healthy and safe, building working capital, and having adequate access to capital. This chaos led many business owners to accelerate their liquidity timelines and pursue sale transactions this year. This option is available for businesses that held up or grown during the pandemic, many of which primarily sell into the retail and direct-to-consumer channels.

Additional deal flow should come from auction processes that were put on hold in March due to COVID-19 related disruptions. Most buyers at that point became distracted; strategics were focused on managing their businesses, private equity funds prioritized supporting their portfolio companies, and lenders became more conservative. These pressures have subsided as we move further away from the onset of the pandemic and the uncertainty around its impact starts to subside.

Normalized EBITDA, and any adjustments for COVID-19 that can be supported, should become a key topic of negotiation among buyers, sellers, and lenders. Strategic and financial buyers are likely to place higher valuations on businesses in categories that are expected to grow in the coming years, which include private label, center store staples, produce, and other healthy foods, immunity supplements, and plantbased products.

Uptick in Restaurant Bankruptcies

The foodservice channel has continued to struggle as consumers remain hesitant about returning to dining out en masse. Recent increases in infection rates have delayed the recovery of most restaurant operators and foodservice suppliers. A recent survey by Acosta Inc. found that 12% of consumers plan to dine in a restaurant immediately and almost 70% plan to wait a month or longer.

At the onset of the pandemic, most lenders, landlords, and vendors to restaurant companies were supportive of restaurants’ inability to service their obligations. Many of these creditors have now not been paid in full for several months and are not willing to negotiate payment plans with restaurants. This could lead to more restaurant operators and foodservice suppliers seeking bankruptcy protection to gain leverage in these negotiations.

While many debtors emerge from bankruptcy cases with restructured obligations, certain businesses pursue sale transactions as part of their cases to provide creditors with maximum recovery. This may create acquisition opportunities for strategics and distressed financial buyers at attractive prices.

Stronger Venture Capital Interest

Small brands in the packaged food, beverage, and nutrition category have navigated the pandemic with difficulty. Many struggled with delayed launches for new products, massive supply chain disruptions, and challenges in supporting online sales, leading companies to require a greater amount of capital to make up for lost sales and increased expenses.

Fortunately, many of these companies were able to take advantage of the Paycheck Protection Program and other temporary government assistance programs to weather the storm over the past few months.

However, some of these funds must be paid back and additional capital will be required to drive growth. This could lead to the completion of a growing number of venture capital and growth equity rounds later this year. Investors have been closely monitoring changes in consumer behavior through the pandemic and refined their investment around several categories, including online grocery, plantbased foods, novel ingredients, agriculture technology, and immunity supplements. Companies in these categories are likely to see robust valuations.

Unlike in pre-COVID-19 periods, investor diligence will have an increased focus on supply chain strength, direct-to-consumer presence or capabilities, sell-through data over the past few months, and profitability.

Corporate venture funds should be active participants in investment rounds, particularly for direct-to-consumer concepts, as a result of cash they harvested over the past few months.

By Farzad Mukhi, CFA, investment banking director at Duff & Phelps Securities. Reach him at farzad.mukhi@duffandphelps.com.

Not a member? Click here to join and get access to more exclusive content.