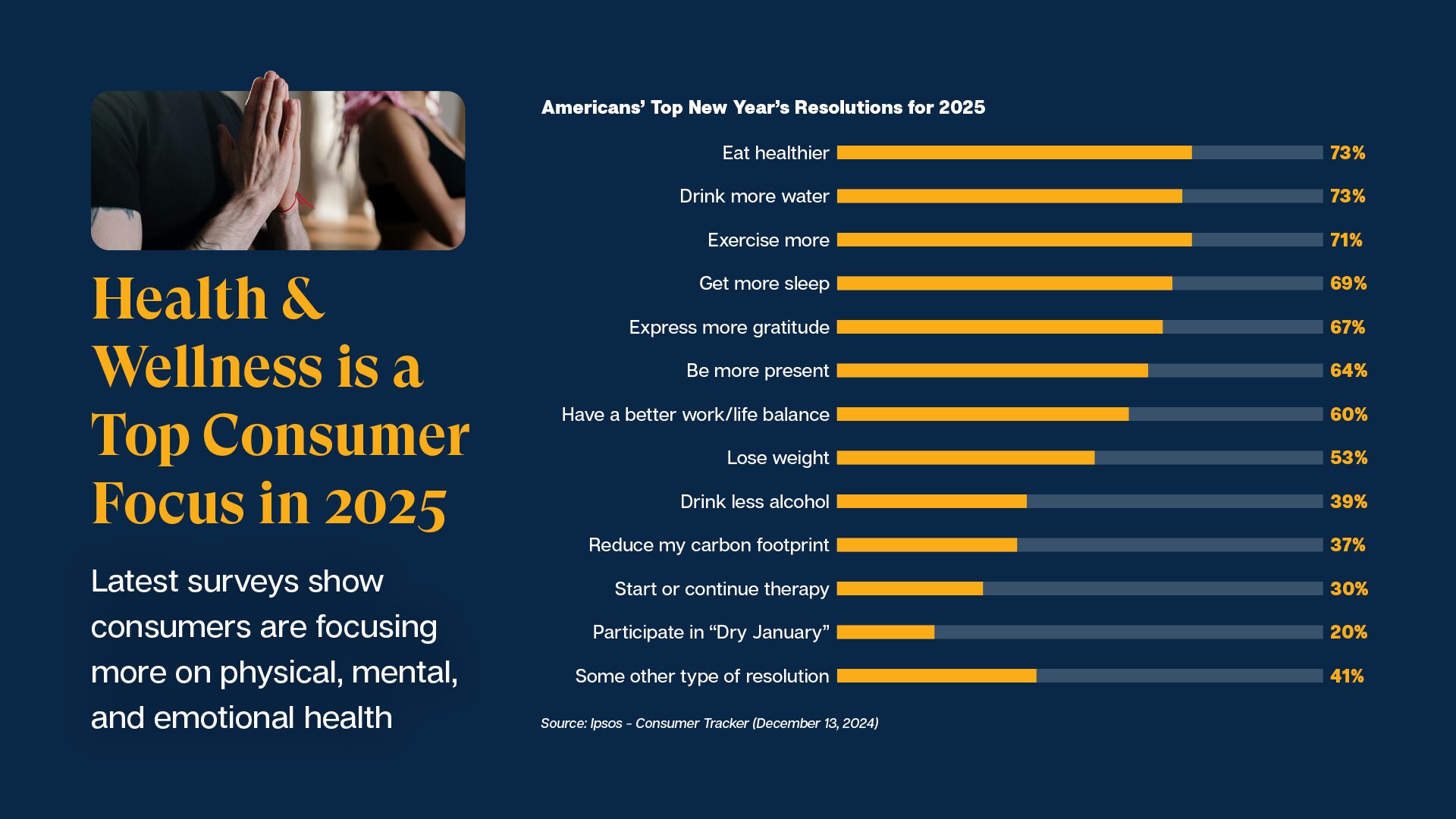

Americans’ top New Year’s resolutions for 2025, according to Ipsos included “eat healthier” (73%), “drink more water” (73%), and “exercise more” (71%).

“Non-GMO, clean label, and organic have all become buzzwords that aren’t just found in health food stores anymore. We’re seeing the entire food and beverage industry moving in this direction,” noted Melissa Nasits, a beverage innovation director at Monin Americas.

Another eye-opening stat related to health and wellness: 50% of Gen Zers feel pressure to eat a certain way to “show” they’re healthy, according to research by Ketchum.

Many consumers, it appears, are focused on what some in the industry refer to as “health & wellness 3.0.” That – along with increased interest in premium products, global flavors, and value – is a major point of focus for consumers heading into the new year, as noted in a new report produced by The Food Institute in conjunction with MenuData and the Specialty Food Association.

By highlighting healthier-for-you items, retailers can make it easier for customers to shop with confidence. That may entail having dedicated wellness sections, for example. Restaurants, on the other hand, will need to offer customized menus moving forward – offering dishes with lighter ingredients, or options that are sodium free – to appeal to health-conscious consumers. CPG brands will need to offer transparent product labeling.

“For a long time, health and wellness centered on sugar-free offerings,” noted Carrie Gillespie, another beverage innovation director with Monin Americas. “Today’s consumer has shifted their focus to seeking products made with more premium ingredients, like pure cane sugar.

“Consumers are more informed about what they’re putting in their bodies, and all natural, no artificial flavors, colors, or preservatives aren’t just fads – they’ve become industry standards consumers expect.”

Premiumization

Premiumization goes beyond price – it’s about creating tangible product improvements, experiences, and emotional connections. Experts note that, while premium ingredients play a key role, the real driver of perceived value is often how well brands communicate their product’s benefits.

In the CPG sector, premiumization hinges on clear messaging about ingredient quality and functional benefits. Consumers are willing to pay more for products that solve a problem or enhance their lifestyles, such as granola marketed for gut health. Retailers must focus on effectively communicating why a product is worth the premium through storytelling.

In foodservice, premiumization often involves offering unique experiences, such as craft cocktails with locally sourced ingredients. Restaurants that successfully blend quality, presentation, and immersive experiences tend to command higher prices.

The growing consumer preference for artisanal food and drink highlights the importance of delivering value beyond just taste – through aesthetics, sustainability, and personalization.

Global Flavors

Americans are increasingly drawn to bold, sensory food experiences, driving demand for global flavors. A recent Civic Sciences study found that two-thirds of respondents enjoy spicy food, reflecting a shift toward more adventurous palates. Industry leaders attribute this trend to globalization and social media, which have made diverse cuisines more accessible.

Restaurants are capitalizing on this shift by offering authentic dining experiences. At Choolaah, for example, customers watch naan being baked in tandoor ovens, reinforcing a connection to North Indian culinary heritage.

“Authenticity is the key word for 2025,” said Maricel Gentile, chef at Maricel’s Kitchen in East Brunswick, New Jersey.

F&B business leaders stress the importance of staying true to traditional recipes while making them approachable for new audiences.

Value

In 2025, consumers’ spending decisions are shaped by more than just price – they often seek unique experiences. Industry analysts noted that consumers want to feel engaged with their food, whether through storytelling, premium ingredients, or Instagrammable moments. Restaurants can meet these expectations by offering thoughtfully crafted menu items.

CPG brands are adapting to shifting perceptions of value by focusing on transparency, sustainability, and versatility. Products that serve multiple occasions or come with added benefits, like free recipe guides, help shoppers feel they’re maximizing their purchases.

While making promotions readily available is important for consumers’ pocketbook, retailers must take other careful steps, too.

“The retailer has to focus on their assortment; Are they offering all the right brands the consumer is looking for?” said Acosta Group executive Kathy Risch.

Bundled deals, in-store demos, and fresh, ready-to-eat meal options can also enhance perceived value while catering to modern shopping preferences, as noted in the new report. Ultimately, today’s value equation is about more than affordability – it’s about the emotional and experiential benefits food provides.

The Food Institute Podcast

When it comes to data in the food-away-from home sector, what are the major challenges and opportunities companies are facing today? Tibersoft’s Chris Hart joined The Food Institute Podcast to discuss how collaboration and data interoperability will be a key theme for the foodservice sector in the years to come.