Vegetarianism is growing slowly in the United States and Europe as residents become more sensitive to climate change and aware of the impact of food on health. The World Economic Forum and Statista reported, however, that the plant-based category is declining in less developed and emerging economies as meat becomes more available and affordable.

About 6% of the U.S. population now describes itself as vegan, up from 1% in 2014, and the market is expected to grow according to Statista. In 2021, some $5 billion was invested in alternative proteins, up 60% from 2020, the Good Food Institute noted, but scaling production still is faced by supply chain hurdles.

The EY Future Consumer Index indicates the bloom may be off the rose for alternative proteins. Food companies may need to reimagine the food system and nimbly adapt to changes.

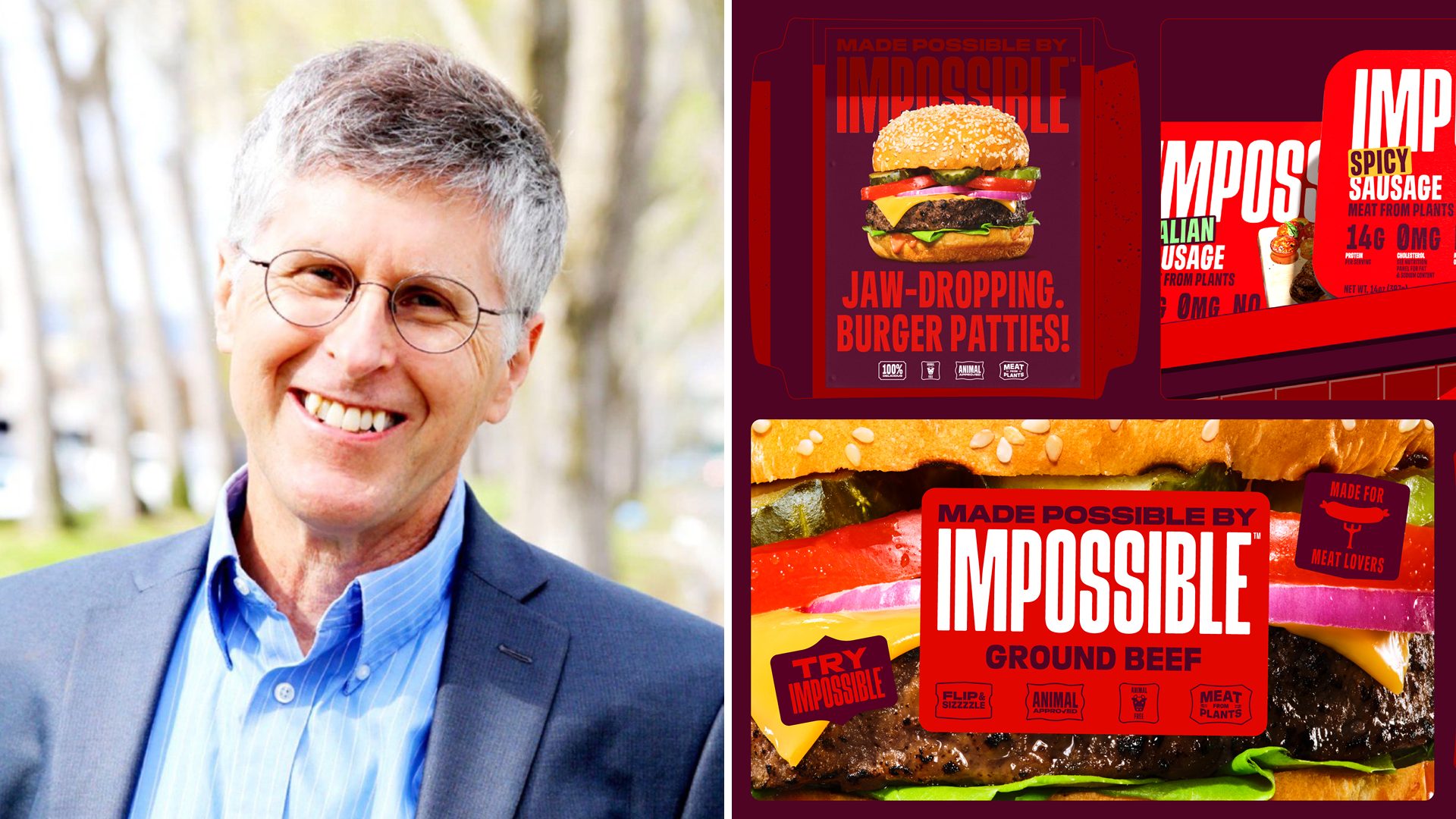

Rob Dongoski, EY’s agribusiness leader, talked with The Food Institute about the future of alternative proteins and whether consumers have moved on.

This Q&A has been edited for length and clarity.

TFI: What are some factors that are shaping opportunities in the alternative protein category?

Dongoski: Consumer preferences are a large factor in creating opportunities for the alternative protein category. For plant-based protein, the value proposition is about healthier-for-you and healthier-for-the-planet and garners a market premium. Many argue both claims, but the stable target is the non-meat eater looking for a meat-like experience. In contrast, lab-grown protein claims to be exactly like its traditional counterpart so market premiums will not be available in markets with traditional meat availability. Fermentation uses an age-old, tried-and-true production technique to create a ‘protein additive’ in a time when most mainstream diets are calling for more protein consumption.

Companies that can innovate to come closer to traditional protein parity and meet shifting consumer diets, palates, and environmentally conscious attitudes will find a growing consumer base as inflation pressures wane in time.

Technology and innovation are also driving opportunities in the space. Larger players may find opportunities for partnership and collaboration, as well as capability- or technology-led M&A activity that may be accelerated in a time when private equity or venture capital sources may be less accessible or more expensive.

TFI: Conversely, what are some of the biggest challenges facing the alternative protein industry?

Dongoski: The challenge continues to be consumer adoption where they have, and will continue, to heavily weigh two primary buying criteria: taste and affordability. Other factors like ‘planet-friendliness,’ ‘social reasoning,’ and even ‘better-for-you’ will compete for the No. 3 buyer criterion, but not override taste and affordability.

Private investors are more closely scrutinizing alternative protein investment opportunities, and the economic downturn is driving up the price of capital. In addition, consumers continue to feel the pressure of inflation, and may be less willing to purchase alternative proteins if they cost more than traditional protein options.

Protein production facilities are currently geared more for traditional processing, which poses an additional challenge for the alternative protein industry.

TFI: Why are consumers souring on the idea?

Dongoski: Taste (including texture) and affordability of plant-based protein continue to be paramount for consumers, and this is not likely to change anytime soon.

Despite philosophical alignment, consumer interest in Gen 1 plant-based products is fading while acceptance is a current barrier to Gen 2 products.

Alternative protein remains twice to four times as expensive as conventional protein. In a period of inflation and added price pressure, this makes purchasing alternative proteins unattainable for many consumers.

TFI: What steps do you feel alternative protein food manufacturers will have to take to capture significant market share in 2023 and beyond?

Dongoski: Consumers are favoring brands that have stated ESG targets and are producing foods with less environmental impact and more sustainable production models. In addition, we’re seeing increased interest from investors in ESG transparency and more reporting requirements. As a result, alternative protein manufacturers and organizations that can capitalize on consumer interest, the regulatory landscape, and the potential for ESG-focused funding could be well-positioned to build market share ahead of an economic uptick post-recession.

Producers need to determine if they want to compete or collaborate with traditional meat suppliers. Reflecting on the dairy situation, there is an ‘us-versus-them’ scenario. The rise of alternatives broadly is real – dairy, meat, sugars, flours – and a short look back at dairy may provide some insights for producers.

TFI: Are there any recent sales stats you feel are a sign of where the alternative protein category is heading?

Dongoski: Various plant-based meat producers reported lower-than-expected financial results in the last quarter of 2022 and the first of 2023. In addition, the price of food for at-home consumption increased 11.3%, according to the latest Consumer Price Index.

EY research estimates the overall protein market will be somewhere in excess of $150 billion as soon as 2030. Even with the challenges of today’s market, alternative protein production is entering a new era, which is defined by new criteria for success, including consumer preferences, technological innovation, manufacturing capacity, and the ESG agenda.

TFI: Which specific types of alternative protein products do you think have the most potential to be well-received by consumers moving forward?

Dongoski: There will likely be a time-and-place scenario for three different alternative protein formats and traditional protein to coexist at scale. The maturity cycle of the plant-based market is likely going to require some repositioning, innovation and next level market structuring. The cultivated market shows promise, if the price point can get to at least parity with traditional meat.

Consumer acceptance is still a real unknown at this point. In markets where traditional meat is costly due to lack of local resources, cultivated protein could become a popular alternative if scale can lower unit costs significantly. Fermentation could eventually emerge as a large opportunity without a tremendous amount of current market hype.

TFI: What else is on the horizon?

Dongoski: In addition to the disruption of the alternative proteins industry, the food system overall is fundamentally changing from a commodity-driven supply chain focused on scale to a personalized and value-added food and agriculture ecosystem. Recent world events, changing consumer dynamics, and technological advancements are disrupting the food system. The food system is being reimagined, shaped by a focus on the consumer, the planet, and connections.