Online grocery shopping has surged during the COVID-19 pandemic. Before COVID-19, online accounted for less than 10% of food sales, according to Ernst & Young LLP (EY). By June, 45% of food sales were online.

“The one big thing we’re seeing now is that digital retail is a must-have channel for grocery shoppers,” said Jeff Orschell, retail and global account leader, EY Americas. The company’s research for its Future Consumer Index found 44% of consumers plan to do more grocery shopping online coming out of the COVID-19 pandemic.

At the Tipping Point

EY considers 2020 a true tipping point for grocery, where staying competitive requires redefining digital strategies, with technology at the forefront.

Grocery retail has been slow to enter e-commerce for reasons such as product assortment, delivery times, delivering perishables, and the high cost of operating an online channel. But with 44% of consumers saying they will do more grocery shopping online, EY believes now is the time for retailers of all sizes to double down on at-home delivery services that are seamless, intuitive, and tech-first.

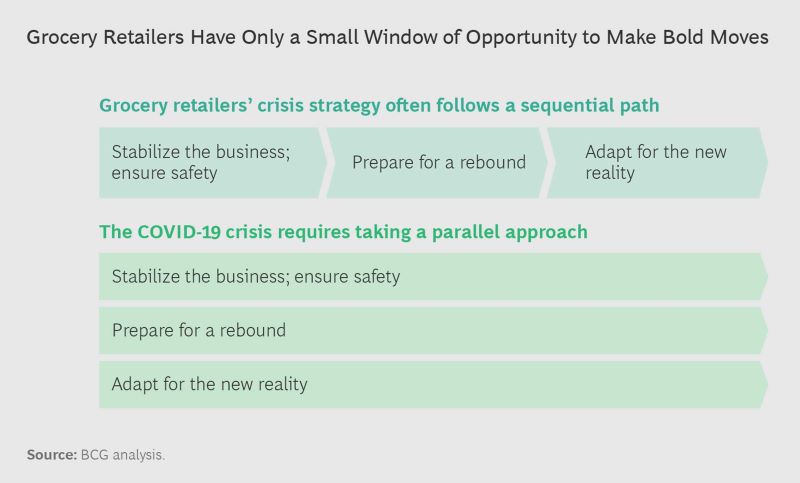

The Boston Consulting Group (BCG) agrees and suggests grocers create an “attractive e-commerce model that can operate at scale.” Grocers should also expect online sales to become 10% to 15% of revenue, compared with the low single-digit share before the pandemic.

BCG also suggests retailers need a strategic, well-thought-out plan for a compelling online presence and offering based on an operating model that will deliver profits and growth. “The plan must include a high-quality website or app, dependable logistics, fine-tuned inventory management (to ensure availability), and reliable multichannel convenience. Shortcuts for the sake of speed could backfire and result in consumer dissatisfaction,” the organization wrote in a recent post.

Meeting the Challenges of E-Commerce

Because e-commerce is less profitable than in-store sales, retailers need to make efforts to increase basket size. It may help these efforts that EY research found 60% of consumers say they will consolidate their shopping trips into fewer trips with larger purchases. Making the online channel cost-advantageous will require building flexibility into the supply chain in ways to lower costs, according to EY.

An important piece of the online shopping puzzle is curbside pickup. EY’s research found 48% of consumers want to buy online and pick up at store. “Many pickup and staging areas are located off to the side of the store, in areas that are not always aesthetically pleasing or consumer friendly,” pointed out Mark Mechelse, VP of insights and communications at Retail Tomorrow—a GMDC initiative, and Andrew McQuilkin, retail leader at BHDP Architecture, in Supermarket News (June 15). To improve customer experience, they recommend stores reevaluate onsite pickup so it feels less like an afterthought and more like a comfortable and clean intentional design.

The demand for online shopping, pickup, and delivery also presents logistical challenges. According to Mike Eardley, president and CEO of IDDBA, in Winsight Grocery Business (June 15), retailers need to consider the following factors:

- Staffing — Have enough staff assigned to handle online orders and also have adequate IT staff to properly manage and support a robust online grocery program. Is the best choice an in-store staffed delivery service or a partnership with a third-party delivery service?

- Inventory management — Make sure products are in stock and consumers receive what they order. Orschell noted many retailers struggle with inventory and may need to compensate by having more safety stock in the supply chain.

- A user-friendly and reliable program — Create an exceptional online customer experience. Orschell emphasized the need for grocers to know their consumers and create an online experience tailored toward an individual’s shopping habits.

Orschell also emphasized the value of a shorter supply chain to get consumers closer to their food. He pointed out consumers want honest and clear labeling, authenticity of what is on the label, and transparency into the origin of products and how they were manufactured or processed and put on the shelf.

Grocery retailers can capitalize on this desire with their private label brands. These sales often account for a significant part of a store’s sales and have increased during COVID.

Meeting the e-commerce challenge and creating a seamless online shopper journey requires consumer trust—in the experience, in the retailer, in price, in the safety of the products and services, and in sourcing. “Trust is now the new currency,” said Orschell.

By Carol Wiley, freelance writer and editor based in Seattle, WA. Reach her at carol@carolwiley.com