With what seems like a new plant-based development each week, it’s no surprise that meat alternatives are now a $14 billion market, according to Tastewise’s new Q3 Market Report: Alternative Proteins.

The Food Institute reviewed the report and took a closer look into some of the most eye-opening stats:

MENUS TAP INTO PLANT-BASED

U.S. menus have significantly tapped into the alternative meat market, with a +1,320% increase in menu mentions since pre-pandemic. Notably, from May-July 2020, there was a 158% spike in menu mentions of vegan meat across the country. This was largely due to Starbucks’ June 2020 addition of the Impossible Breakfast Sandwich.

The addition prompted further growth in the category and other companies soon followed suit. Beyond Meat signed partnerships with fast-food giants McDonald’s and Yum Brands in early 2021, while Good Catch’s plant-based seafood landed itself on the menu at Bareburger, and Jack in the Box unveiled the Unchicken Sandwich.

These are just a handful of the many new plant-based additions over the past year or so. However, Dunkin’, which was the first major restaurant chain to offer Beyond Meat’s sausage alternative, pulled the Beyond Sausage breakfast sandwich off its U.S. menu in June. The item did not sell as well as the chain expected.

When it comes to where plant-based has the most menu penetration, New York City holds the top spot, followed by Los Angeles and Portland, Oregon.

TRENDS TO WATCH

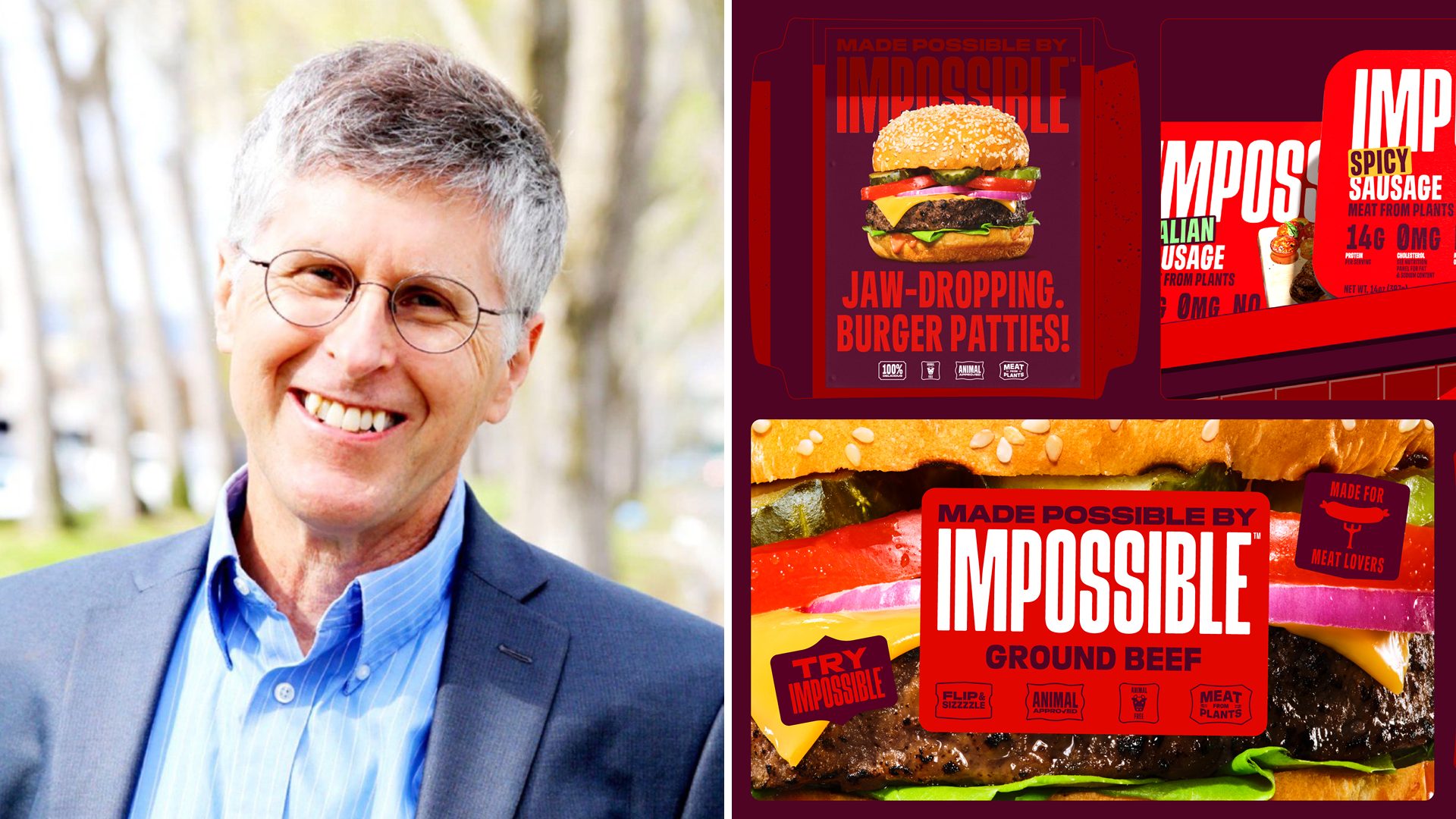

Sausage is the top meat that consumers are trying to replicate with plant-based products, at 34%. Soy is the primary ingredient for sausage replication, but walnut chorizo is an up-and-coming ingredient to watch for sausage replication. There was a 72% increase in interest in walnut-based sausage over the last three months, with 82% being in the form of chorizo.

Sausage was followed by chicken (23%), bacon (10%), and beef (8%), while more niche meats, like lamb, salami, and jerky appear to be items to keep an eye on.

Jerky is especially seeing trending whitespace opportunity. One brand to watch in this category would be Country Archer Provisions, which recently launched a plant-based jerky line. The line uses oyster mushrooms for its products, which the report notes is an emerging ingredient. Mushroom jerky was up 14.6% year-over-year.

TOP MOTIVATORS FOR EATING PLANT-BASED

The report found that health and sustainability are the top two reasons for eating alternative meat. Though health is the number one reason, sustainability is rising faster in interest, up 58% year-over-year.

Specific health-related reasons people choose alt meats for include protein, fiber, as well as saturated fat, cholesterol, and anti-aging.

Interestingly, animal rights declined as a motivator for alt meat (-14% year-over-year), while climate change concerns have stepped up (+83%).

Many consumers don’t want to give up the sensory and social experience of eating animal meat once they’ve decided to eat alternative meats, revealing a market for products that replicate the experience authentically.