The April figures for wholesale and retail inflation will be published May 9 and May 10, respectively, with the commodity expected to garner the most attention being pork.

If you follow the futures markets, you already know that the price of pork recently exploded. African swine fever has spread to all parts of China, ravaging their hog supply, resulting in prices skyrocketing. Cash hog prices rose nearly 56% since the beginning of March, and the April futures contracts for hogs rose the greatest percentage in recorded history. Because of this, you may think that consumers were feeling the sting of higher pork prices.

However, according to the consumer price index (CPI) from the Bureau of Labor Statistics, that hasn’t been the case. The CPI for pork in March only rose 1.5% and actually declined 0.6% annually. The producer price index (PPI) for pork makes even less sense with wholesale pork prices declining 12% annually in March. So what gives? Where is the huge price increase that logic dictates?

In reality, inflation defined in this sense, a general increase in prices and a decrease in the purchasing value of money is not spontaneously occurring across all sectors of the value chain or the economy. Simply put, the high cost of inputs (in this case live hogs) has yet to reach the production and retail segments. The cost pull inflation is lagged, and is felt at different stages of production; first as a commodity (cash prices), then in production (PPI) and lastly in retail (CPI).

Knowing this, you may be wondering how long does it take for inflation to be felt at the checkout register? There is not a straight forward answer as inflation in the current period is influenced by past levels of inflation. In a sense, the effects of past inflation are constantly being felt at a diminishing rate, so expect the recent surge in hog prices to have an impact on grocery store prices at some point, just not an immediately.

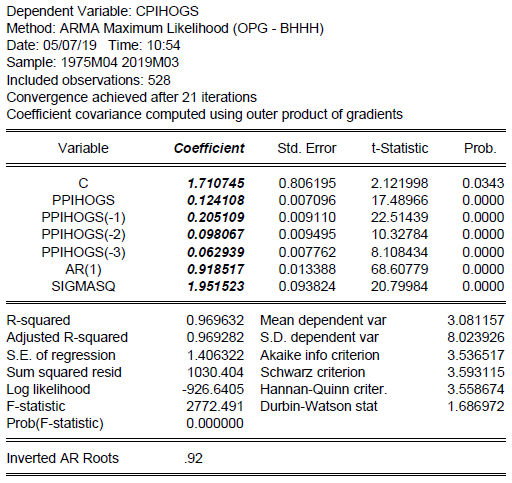

The rough model below illustrates the strength of effects of past wholesale hog inflation has on retail hog inflation. The complexity of this model may be difficult to understand, but for the purpose of this article all you really need to understand is what the coefficients mean*. The model shows that retail inflation in the current month is caused by several months of prior wholesale inflation not just one month.

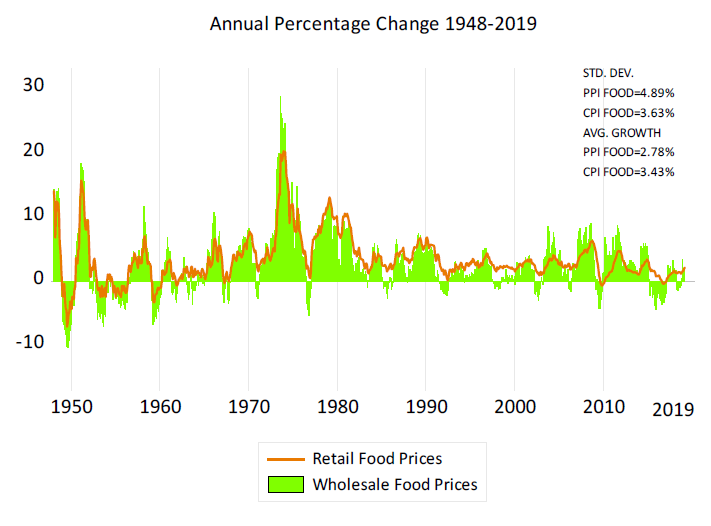

Besides the lag between wholesale and retail prices, there is the tendency for retail prices to be than less volatile than wholesale prices, e.g. retail prices are more “sticky” than wholesale prices. Overall, retail prices have risen faster than wholesale prices over the last 70 years; however retail prices have seen less variability in price changes as demonstrated by having a lower standard deviation. Why are retail prices “stickier” than wholesale prices?

The main reason for this at least in the foodservice industry is because of menu costs. There is a greater cost incurred for retailers constantly adjusting their prices than wholesalers. Just think about a seafood restaurant: the cost of lobster on the wholesale market is always changing. But if the restaurant wanted to change its prices every time the wholesale price of lobster changed, it would have to reprint its menus every day, which would likely be too expensive. So instead, most retailers just set a general price level and adjust prices infrequently.

So when looking at the wholesale and retail prices, don’t necessarily expect them to move in predictably in tandem but do expect the increase in pork prices to be felt at a the grocery store in the coming months.

* The coefficients measure what a 1% increase the independent would have on the dependent variable. For example, the coefficient PPIHogs(-1) means that a 1% increase in the rate of wholesale inflation for the prior month will on average cause retail inflation to rise by 0.2%. The independent variable in this model is annual percentage change for pork CPI. The dependent variable of C,Ar(1), and SIGMASQ are important to the creation of the model but irrelevelant to explaining the effects that wholesale prices have on retail prices.