U.S. consumers love fast food and those who adhere to plant-forward diet are no exception. Which quick service restaurants (QSRs) are plant-based consumers seeking out this year?

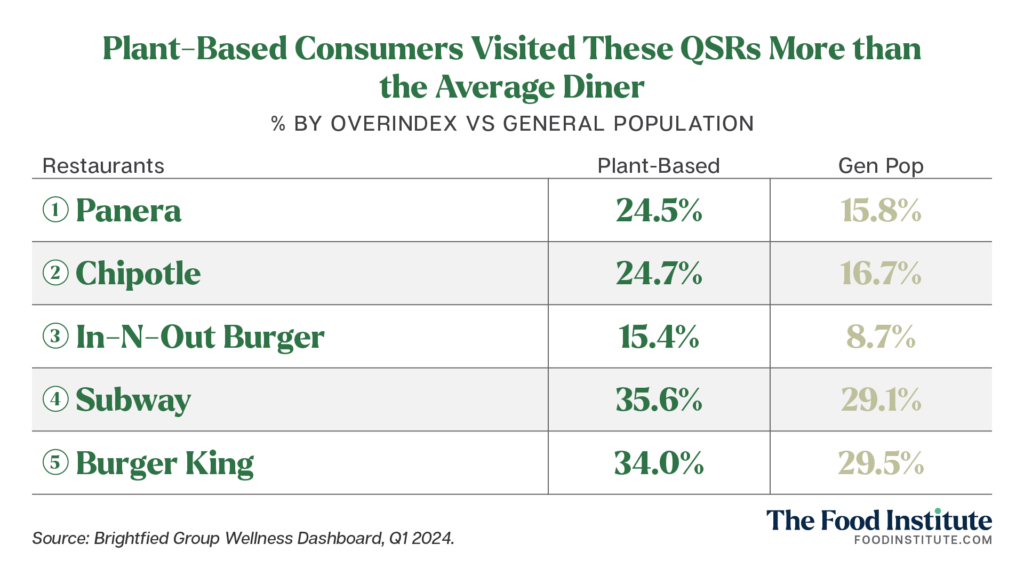

Brightfield Group survey data from Q1 2024 indicate a strong preference towards these five chains.

Commonalities include menu variety, ease of modifications, and fresh ingredients. Accessibility and affordability also come into play.

Premium Rules: Panera Bread and Chipotle

Panera Bread held the highest over-index among the QSRs plant-based consumers have visited over the past three months — 8.7% above the overall average.

Chipotle was a close second, over-indexing by 8.0%.

Panera has experienced quite a growth spurt with monthly visits over the past year consistently exceeding 2022-23 levels. Its April 2024 menu overhaul renewed focus on chicken, bacon, steak, cheese, and other animal products, and stirred concerns related to the chains’ sustainability goals.

Meanwhile, Chipotle has invested in automation to reduce service times, increase consistency, and improve overall turnaround time.

Both chains highlight vegetarian and vegan menu options along with significant flexibility to customize dishes and swap out animal-based ingredients. They have also been known to prioritize values related to freshness, quality ingredients, and environmental impact.

Leveraging Dietary Values with Accessibility

Many of these values are also reflected at In-N-Out Burger, which ranked third among preferred QSRs with a 6.7% response over-index. This fast-food darling of the west coast is known for its strong local partnerships and strict policy of not using freezers or microwaves at any point of distribution.

As Yahoo Finance reports, the privately owned chain does not follow a franchise model and is cautious about over-expansion as it remains focused on keeping prices lower than its competitors.

Subway and Burger King round out the top five. With significantly broader footprints throughout the U.S., both QSRs hit closer to mainstream fast food with their offerings but stand out with focus on fresh, plant-forward, modifiable menu items.

Both chains are also plant-based leaders on the international stage. According to an August 2023 report by ProVeg International, Burger King was the best performer among the fast-food chains—offering 30 plant-based main dishes out of 307 across nine countries—followed by Subway.

Burger King has also pledged to make its menus 50% plant-based by 2030, reported Food Ingredients First.

The Inflation Equation

With ongoing economic pressure impacting fast-food purchases, affordability is also an important consideration for some plant-based consumers.

For instance, in a recent report unpacking fast-food inflation over the past ten years, both Subway and Burger King received honorable mention for having kept price increases in line with inflation.

However, 84% of plant-based respondents told Brightfield that high quality is worth extra money compared to the average response of 66.3%.

“Chipotle, Panera, Burger King, and In-N-Out are all committed to fresh, health(ier) foods, including many plant-based options,” said Jason Voiovich, author and fractional CMO . “The surprising interest in premium fast-food chains like Chipotle speaks to something deeper that’s happening to consumers right now.”

For example, the price for a side of guacamole at Chipotle increased by 26% between 2019 and 2024. But paradoxically, the increase has been good for the chain.

“When budgets are stressed, consumers are forced to pay closer attention to their choices,” Voiovich told FI. “Consumers clearly value Chipotle.”

But this period of consumer introspection won’t treat every QSR equally, he added, citing Red Lobster’s recent bankruptcy filing.

“Others will follow. If QSRs are trying to catch this plant-based trend as a get-out-of-bankruptcy-free card, they should instead focus on what makes them ‘worth it’ for cash-strapped consumers,” Voiovich concluded. “Consumers are paying closer attention than ever and won’t be fooled by opportunistic marketing.”

The Food Institute Podcast

Funding sources are drying up and inflation is making it harder and harder for higher-priced food brands to compete – what’s an early-stage food company to do? Dr. James Richardson, owner of Premium Growth Solutions and author of Ramping Your Brand, joined The Food Institute Podcast to discuss what types of food companies are succeeding under current industry dynamics.