Mr. Peanut may have been replaced by Baby Nut during 2020’s Big Game, but the industry remains full grown. Planters first teased the demise of its 104-year old icon in January before unveiling its new miniaturized mascot in the ad.

Much like Planters, USDA is seeking new blood for the Peanut Standards Board to serve three-year terms starting July 1 through June 30, 2023. The nomination deadline is April 9.

The board has 18 members who represent peanut producers and industry representatives in three regions: Southeast (Alabama, Florida, and Georgia), Southwest (New Mexico, Oklahoma, and Texas), and Virginia/Carolinas (Virginia, North Carolina, and South Carolina).

Each region has three producer and three industry representative seats with staggered three-year terms. U.S. Secretary of Agriculture Sonny Perdue will select individuals from the nominations submitted and appoint one producer and one industry representative from each region to succeed members whose terms expire on June 30, 2020.

Members of the board will be tasked with helping to oversee a growing industry. Peanut production has been on the rise over the last decade, jumping to 7.2 billion-lbs. on an in-shell basis in 2017, according to the latest USDA data. The total soared nearly 97% compared to the 3.7 billion-lbs. reported in 2007.

Combined with imports (125 million-lbs.) and beginning stocks (1.4 billion-lbs.), total peanut holdings in 2017 totaled about 8.8 billion-lbs. This number was up 67% compared to 2007’s 5.3 billion-lbs. Per capita availability increased from 6.3 lbs. per person to 7.4 lbs. per person during the time period.

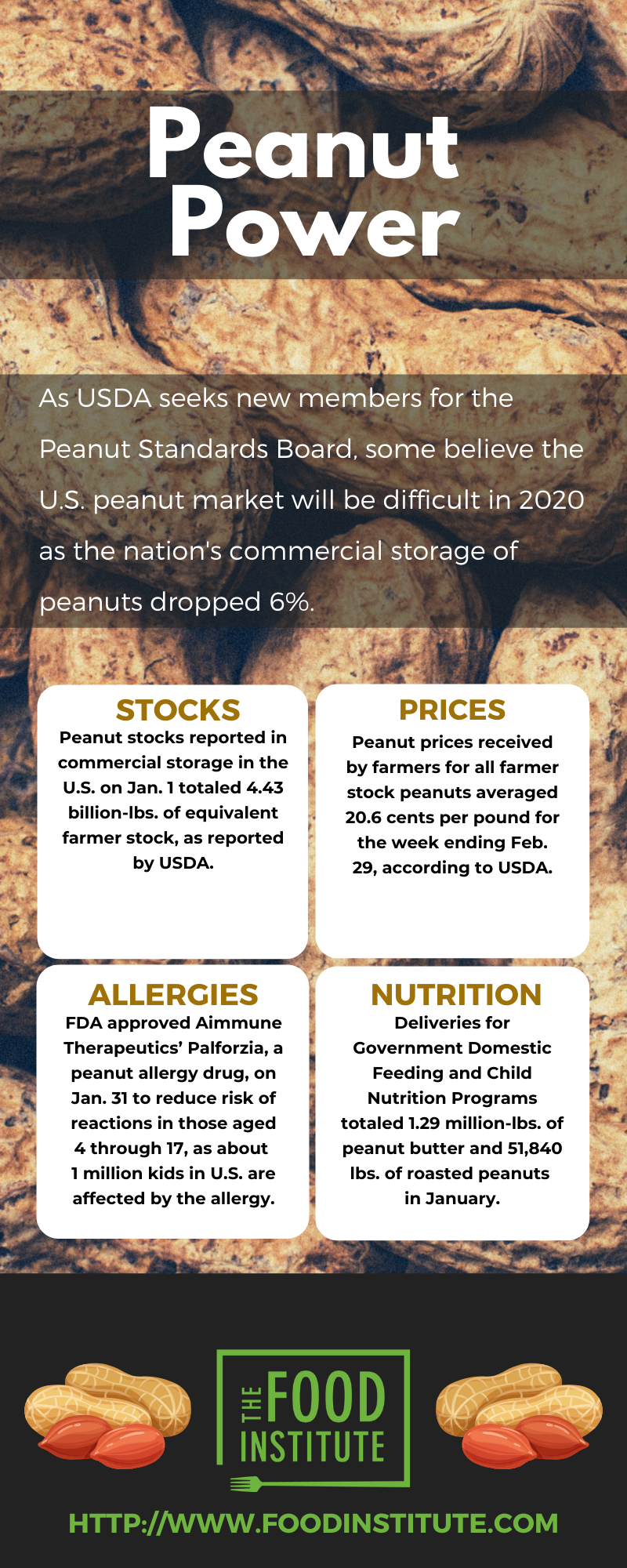

Regarding the current U.S. supply, peanut stocks reported in commercial storage on Jan. 1 totaled 4.43 billion-lbs. of equivalent farmer stock, down 6% from the 4.73 billion-lbs. USDA stated Jan. 1, 2019. The agency noted the total included 3.69 billion-lbs. of actual farmer stock.

Shelled peanuts on hand totaled 712 million-lbs. of farmer stock equivalent, according to the agency, which also reported roasting stock totaled 27.9 million-lbs. Shelled peanut stocks amounted to 536 million-lbs., with 505 million-lbs. of the total edible grades and 30.3 million-lbs. oil stocks. Edible grade stocks by type included 87.8 million-lbs. of Virginias and Valencias, 381 million-lbs. of Runners, and 36.8 million-lbs. of Spanish.

USDA reported that millings in January totaled 273 million-lbs., including 62.2 million-lbs. of Virginias and Valencias, 207 million-lbs. of Runners, and 3.42 million-lbs. of Spanish.

Commercial processors utilized 198 million-lbs. of shelled edible grade peanuts during January. By type, 118 million-lbs. was for all peanut butter products, 33.6 million-lbs. for peanut candy, and 40.5 million-lbs. for peanut snacks. Crushing for oil and cake and meal totaled 47.7 million-lbs. during the month.

Deliveries under the Government Domestic Feeding and Child Nutrition Programs amounted to 1.29 million-lbs. of peanut butter and 51,840 lbs. of roasted peanuts during January. Stocks of treated seed on hand Jan. 31 totaled 1.18 million-lbs., compared with 203,000 lbs. on Dec. 31, 2019. Of the January total, 163,000 lbs. were Runners. December stocks of treated seed included 133,000 lbs. of Runners.

In regard to peanut prices received by farmers, all farmer stock peanuts averaged 20.6 cents per lb. for the week ending Feb. 29, up 0.8 cents from the previous week, according to USDA. Marketings of all farmer stock peanuts for the week ending Feb. 29 totaled 76.7 million-lbs., down 7.36 million-lbs. from the previous week.

USDA reported Runner-type peanut prices averaged 19.5 cents per lb. for the week ending Feb. 29, up 0.1 cent from the previous week. Marketings of runner-type peanuts totaled 50.5 million-lbs., down 15 million-lbs. from prior week.

Comparatively, the 2019 average price was 20.1 cent per lb. in 2019, according to USDA. Average prices in 2018 and 2017 totaled 21.5 cents per lb. and 22.9 cents per lb., respectively.

Some believe the U.S. peanut market will be difficult in 2020 as producers are awaiting signals to determine peanut acreage for 2020. Additionally, shellers are struggling to meet deliveries of current contracts, with little interest in selling more until current contractors are filled, reported Peanut Grower (March 1).

The report noted cotton prices were in the upper 60 cents per lb. range, making it difficult for shellers getting too aggressive in contracting 2020 crop peanuts. Additionally, the Phase 1 trade deal with China did not yet lead to a boost in cotton prices, giving producers few options beyond peanut production.

Meanwhile, scientists believe they’ve finally determined what causes peanut allergies. A study published March 6 in Science argues the gut is the home of the allergy-causing antibodies connected to the condition. Researchers scoured tissue samples from 19 people suffering with peanut allergies and found a hotbed of immunoglobulin E (IgE) antibodies in the gut.

The researchers believe the body typically produces harmless antibodies called immunoglobin G in response to food antigens, including peanuts. However, those with a peanut allergy start producing IgE antibodies that can lead to life-threatening situations.

Deciphering the details of this process, known as Class With Recombination, could be key to ending peanut allergies for good.

This is not the only advancement in the peanut allergy front. FDA on Jan. 31 approved Palforzia, a peanut allergy drug developed by Aimmune Therapeutics Inc. The drug is the first of its kind and is intended for individuals aged 4 through 17 to mitigate allergic reactions, including anaphylaxis, that may occur with accidental exposure to peanuts. For more information on Palforzia, see the Feb. 17 edition of The Food Institute Report.